- United States

- /

- Construction

- /

- NYSE:ORN

Even With A 25% Surge, Cautious Investors Are Not Rewarding Orion Group Holdings, Inc.'s (NYSE:ORN) Performance Completely

Orion Group Holdings, Inc. (NYSE:ORN) shares have continued their recent momentum with a 25% gain in the last month alone. The last month tops off a massive increase of 278% in the last year.

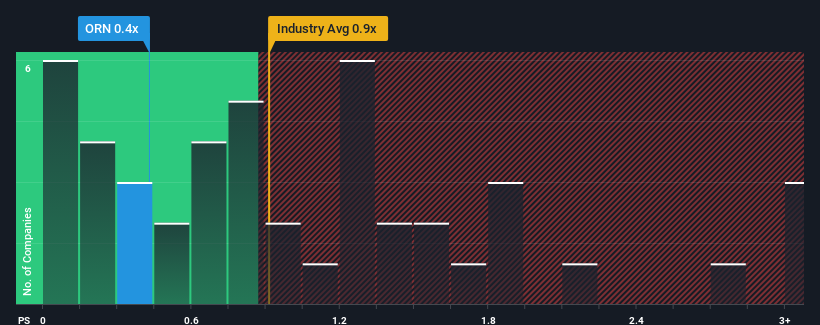

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Orion Group Holdings' P/S ratio of 0.4x, since the median price-to-sales (or "P/S") ratio for the Construction industry in the United States is also close to 0.9x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Orion Group Holdings

How Has Orion Group Holdings Performed Recently?

Orion Group Holdings hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Orion Group Holdings' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Orion Group Holdings would need to produce growth that's similar to the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 2.6%. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 12% per annum over the next three years. That's shaping up to be materially higher than the 8.2% per year growth forecast for the broader industry.

With this in consideration, we find it intriguing that Orion Group Holdings' P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

What Does Orion Group Holdings' P/S Mean For Investors?

Its shares have lifted substantially and now Orion Group Holdings' P/S is back within range of the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Despite enticing revenue growth figures that outpace the industry, Orion Group Holdings' P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

You need to take note of risks, for example - Orion Group Holdings has 4 warning signs (and 1 which can't be ignored) we think you should know about.

If these risks are making you reconsider your opinion on Orion Group Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ORN

Orion Group Holdings

Operates as a specialty construction company in the infrastructure, industrial, and building sectors in the United States, Alaska, Hawaii, Canada, and the Caribbean Basin.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives