- United States

- /

- Building

- /

- NYSE:NX

Quanex (NX) Swings to Net Loss Despite Sales Growth—What Does This Mean for Its Investment Story?

Reviewed by Simply Wall St

- Quanex Building Products Corporation recently reported third quarter and nine-month results, showing sales rising to US$495.27 million and US$1.35 billion, respectively, but recording a net loss of US$276.01 million for the quarter and US$270.38 million for the nine-month period, in contrast to profits in the previous year.

- This shift to a net loss occurred despite substantial sales growth, as the company updated its fiscal 2025 net sales guidance and continued share buybacks and dividend payments.

- We'll explore how Quanex's significant revenue growth, paired with a swing to net loss, may influence its future investment narrative.

Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

Quanex Building Products Investment Narrative Recap

To own Quanex Building Products as a shareholder, you would need confidence that its significant revenue growth, integration of acquisitions, and ongoing operational changes will translate into sustained earnings improvement. The recent report of strong sales but a swing to a large net loss makes near-term profitability the critical catalyst for sentiment, and also elevates concerns about the company’s ability to achieve expected margin recovery, these figures may materially impact perceptions around the most important short-term catalyst and risk right now.

Of the latest company announcements, Quanex’s updated fiscal 2025 net sales guidance to approximately US$1.82 billion stands out. This indicates management's continued expectation for robust top-line performance, but whether these sales gains will flow through to the bottom line amid reported losses remains a key focus for those watching the profitability inflection.

Yet, in contrast to the headline revenue growth, investors should be aware that underlying profitability has come under pressure and the company’s ability to quickly restore margins...

Read the full narrative on Quanex Building Products (it's free!)

Quanex Building Products’ forecast projects $2.2 billion in revenue and $283.5 million in earnings by 2028. This assumes an 11.3% annual revenue growth rate and a $266.4 million increase in earnings from the current $17.1 million.

Uncover how Quanex Building Products' forecasts yield a $33.75 fair value, a 86% upside to its current price.

Exploring Other Perspectives

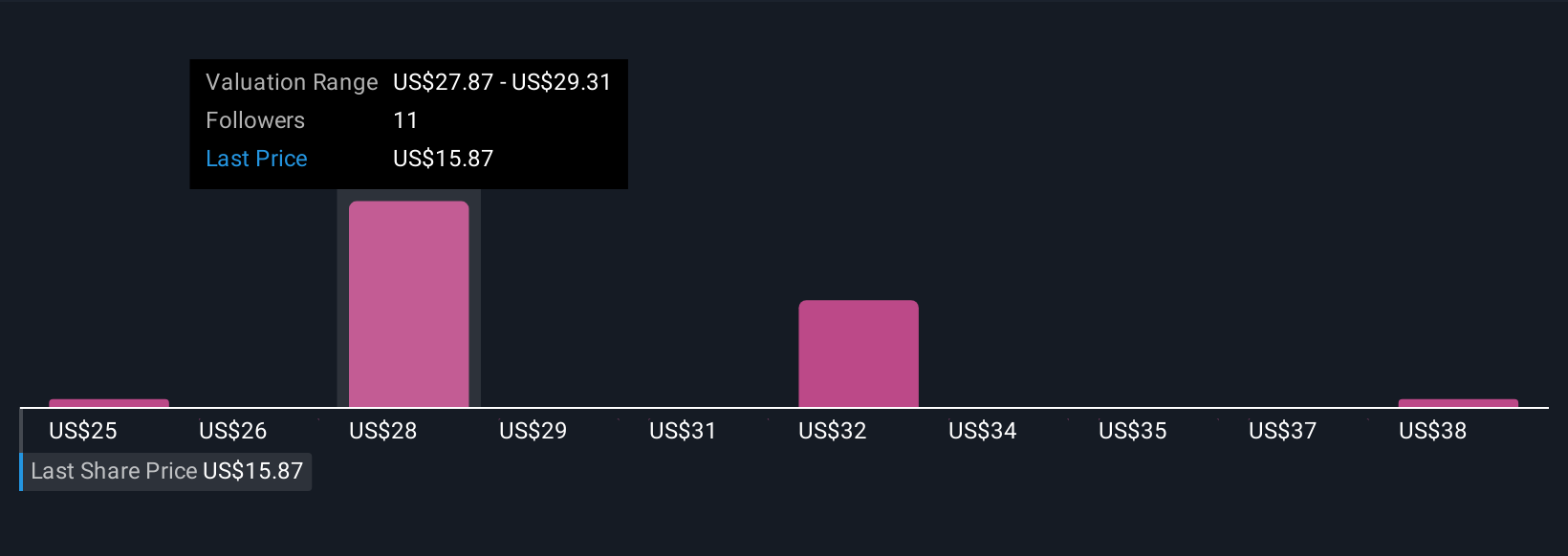

Four recent fair value estimates from the Simply Wall St Community range from US$24.99 to US$39.38 per share. While profit turnaround is seen as the next catalyst, these differing views suggest that your outlook on Quanex’s margin recovery could shape your investment approach.

Explore 4 other fair value estimates on Quanex Building Products - why the stock might be worth just $24.99!

Build Your Own Quanex Building Products Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Quanex Building Products research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Quanex Building Products research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Quanex Building Products' overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Quanex Building Products might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NX

Quanex Building Products

Manufactures and distributes components for original equipment manufacturers (OEM) in the building products industry in the United States, Europe, Canada, Asia, and internationally.

Very undervalued average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion