- United States

- /

- Electrical

- /

- NYSE:NVT

Should nVent Electric’s (NVT) Data Center Enclosure Expansion Prompt a Fresh Look From Investors?

Reviewed by Sasha Jovanovic

- nVent Electric recently expanded its Eleanor, West Virginia facility by 117,000 square feet, aiming to meet rising demand for large outdoor enclosures used in the data center industry, and plans to add over 100 new manufacturing jobs within eight months.

- This move accelerates nVent’s push into the fast-growing AI and data center infrastructure market, leveraging acquisitions and capacity increases to strengthen its position.

- We'll explore how the added manufacturing capacity for data center enclosures influences nVent Electric's investment narrative and future outlook.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

nVent Electric Investment Narrative Recap

To invest in nVent Electric, you need to believe that global demand for data center infrastructure and electrical protection solutions will continue to fuel multi-year sales growth and margin expansion. The Eleanor, West Virginia expansion directly addresses near-term demand, reinforcing nVent’s ability to deliver on its largest growth catalyst, AI and digitalization spending, while also amplifying the risk tied to any sudden slowdown in AI or data center investments in the short term.

Among nVent’s recent moves, the September 3 announcement of a 117,000-square-foot facility lease in Blaine, Minnesota stands out as highly relevant. Like the West Virginia expansion, this new Minnesota facility is aimed at scaling up production of data center solutions, sharpening nVent’s focus on capacity as a growth driver while linking future results increasingly closely to data center market trends.

However, against this growth, investors should also be aware that a sharp downturn in AI capital expenditure could...

Read the full narrative on nVent Electric (it's free!)

nVent Electric's outlook anticipates $4.5 billion in revenue and $651.5 million in earnings by 2028. This scenario hinges on a 10.4% annual revenue growth rate and a $395.4 million increase in earnings from the current $256.1 million.

Uncover how nVent Electric's forecasts yield a $100.59 fair value, in line with its current price.

Exploring Other Perspectives

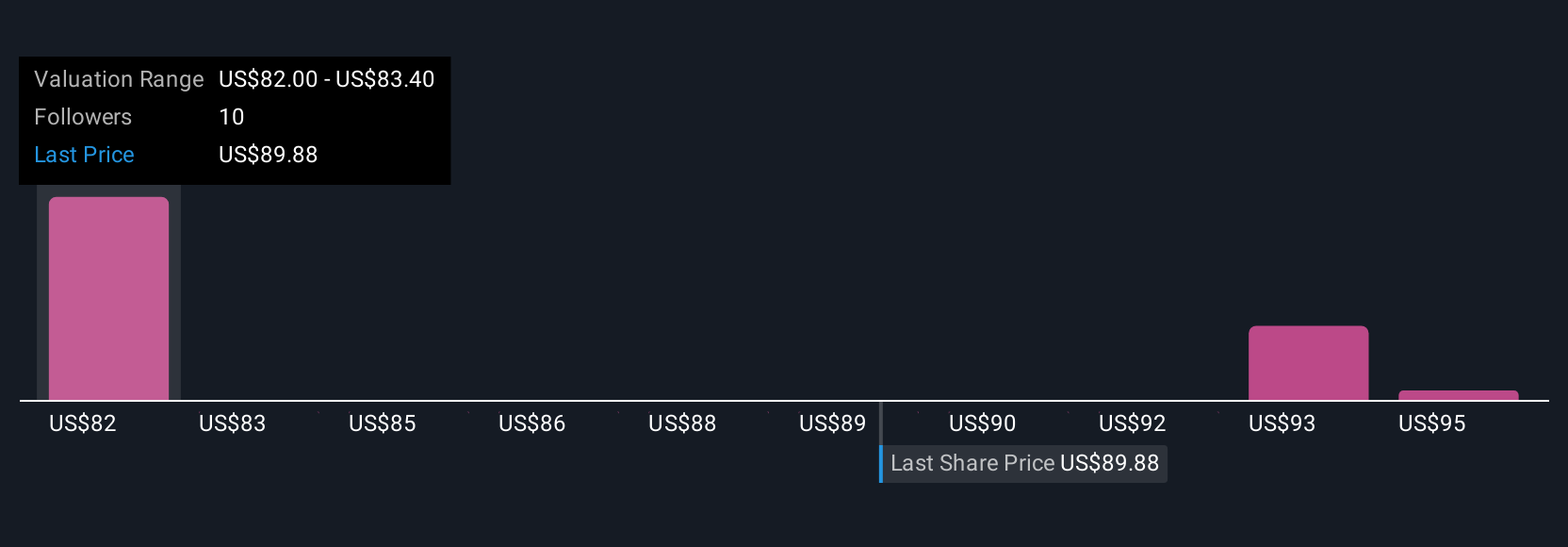

Simply Wall St Community members have set fair value estimates for nVent Electric between US$73.37 and US$105 across four analyses. Opinions are split, and as nVent’s outsized exposure to data center demand grows, the stakes of any slowdown in AI investment matter even more, explore diverse viewpoints to inform your decision.

Explore 4 other fair value estimates on nVent Electric - why the stock might be worth as much as 6% more than the current price!

Build Your Own nVent Electric Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your nVent Electric research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free nVent Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate nVent Electric's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NVT

nVent Electric

Designs, manufactures, markets, installs, and services electrical connection and protection solutions in North America, Europe, the Middle East, Africa, the Asia Pacific, and internationally.

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives