- United States

- /

- Electrical

- /

- NYSE:NVT

Appointment of Utilities Veteran to Board Could Be a Game Changer for nVent Electric (NVT)

Reviewed by Simply Wall St

- In July 2025, nVent Electric plc expanded its board to ten members and appointed Diane Leopold, the former COO of Dominion Energy, to its Board of Directors and Audit and Finance Committee.

- Leopold's addition brings deep industry expertise from more than three decades in the utilities sector, enhancing nVent’s capabilities as it sharpens its focus on electrical infrastructure and data center solutions.

- We'll explore how the appointment of an experienced utility executive could strengthen nVent's investment case and future growth prospects.

nVent Electric Investment Narrative Recap

To be a shareholder in nVent Electric, it’s important to believe in the company’s capacity to capitalize on accelerating demand for electrical infrastructure and data center solutions, particularly as industries modernize. While the appointment of Diane Leopold to the board adds extensive utilities expertise, it does not materially alter the most important near-term driver, which remains execution on data center and utility growth opportunities. The biggest risk continues to be macroeconomic pressures and cost headwinds, which this board refresh does not fundamentally change.

Among recent announcements, nVent’s launch of innovations in liquid cooling for high-performance computing and AI from November 2024 stands out. This initiative is directly relevant to the company’s data solutions catalyst, aiming to support its positioning in sectors with fast-growing demand and provide new avenues for revenue growth.

But on the other hand, investors should keep in mind rising input costs that may not be fully offset by pricing or productivity gains...

Read the full narrative on nVent Electric (it's free!)

nVent Electric's narrative projects $4.2 billion in revenue and $557.6 million in earnings by 2028. This requires 10.9% yearly revenue growth and an increase of $315 million in earnings from the current level of $242.6 million.

Uncover how nVent Electric's forecasts yield a $79.88 fair value, a 4% upside to its current price.

Exploring Other Perspectives

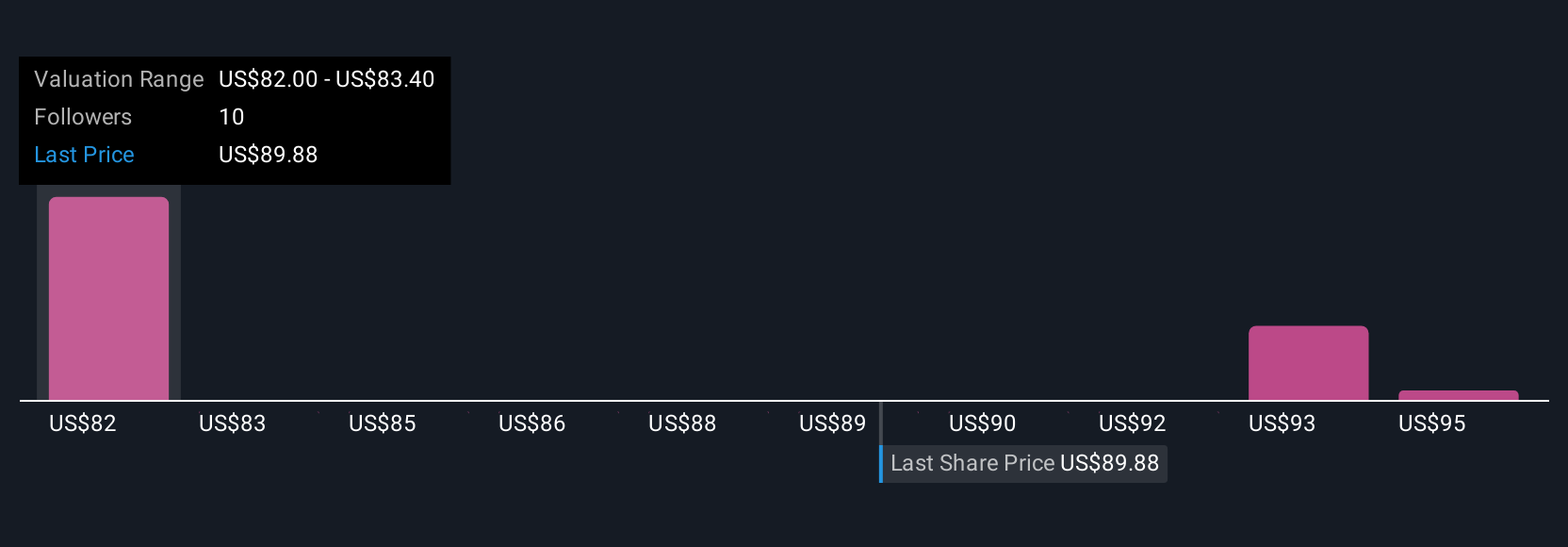

Three fair value estimates from the Simply Wall St Community span US$79.88 to US$96, reflecting varied outlooks. As data solutions remain a crucial growth catalyst, you’ll find wide-ranging opinions on whether growth potential can offset cost pressures and pricing risks.

Explore 3 other fair value estimates on nVent Electric - why the stock might be worth just $79.88!

Build Your Own nVent Electric Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your nVent Electric research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free nVent Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate nVent Electric's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NVT

nVent Electric

Designs, manufactures, markets, installs, and services electrical connection and protection solutions in North America, Europe, the Middle East, Africa, the Asia Pacific, and internationally.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives