- United States

- /

- Aerospace & Defense

- /

- NYSE:NOC

Northrop Grumman (NOC): Valuation Check After New European Defense Deals and Global Demand Outlook

Reviewed by Simply Wall St

Northrop Grumman (NOC) is back in the spotlight after deepening its European defense ties, teaming up with Rheinmetall on F-35 fuselages and MBDA on air and missile defense as countries quietly rebuild arsenals.

See our latest analysis for Northrop Grumman.

Those Europe focused deals come after a Q3 earnings beat and a recent dividend affirmation. While the 30 day share price return of minus 6.25 percent shows some cooling momentum, the year to date share price return of 16.87 percent and a 5 year total shareholder return of 96.69 percent still point to a solid longer term trajectory.

If Northrop Grumman's renewed defense demand has your attention, this could be a good moment to explore other potential winners across aerospace and defense stocks.

With earnings beating expectations, a firm dividend, and new long term contracts in Europe and beyond, is Northrop Grumman still trading below its true potential, or is the market already pricing in years of growth ahead?

Most Popular Narrative Narrative: 18% Undervalued

Compared to the last close at $546.97, the most popular narrative sees Northrop Grumman’s fair value materially higher, implying meaningful upside if its assumptions play out.

The ramp up of advanced autonomous and integrated systems such as Beacon and IBCS, combined with ongoing investments in solid rocket motor capacity (targeting a near doubling by 2029), positions the company to capitalize on high growth, higher margin market segments, thereby enhancing future operating margins and underlying cash flow.

Want to see what is behind that bullish cash flow story? The narrative quietly leans on modest growth, steady margins, and a richer future earnings multiple. Curious how those moving parts add up to the projected upside?

Result: Fair Value of $667.21 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat scenario could quickly unwind if flagship programs like B 21 or Sentinel face political pushback, budget cuts, or significant execution setbacks.

Find out about the key risks to this Northrop Grumman narrative.

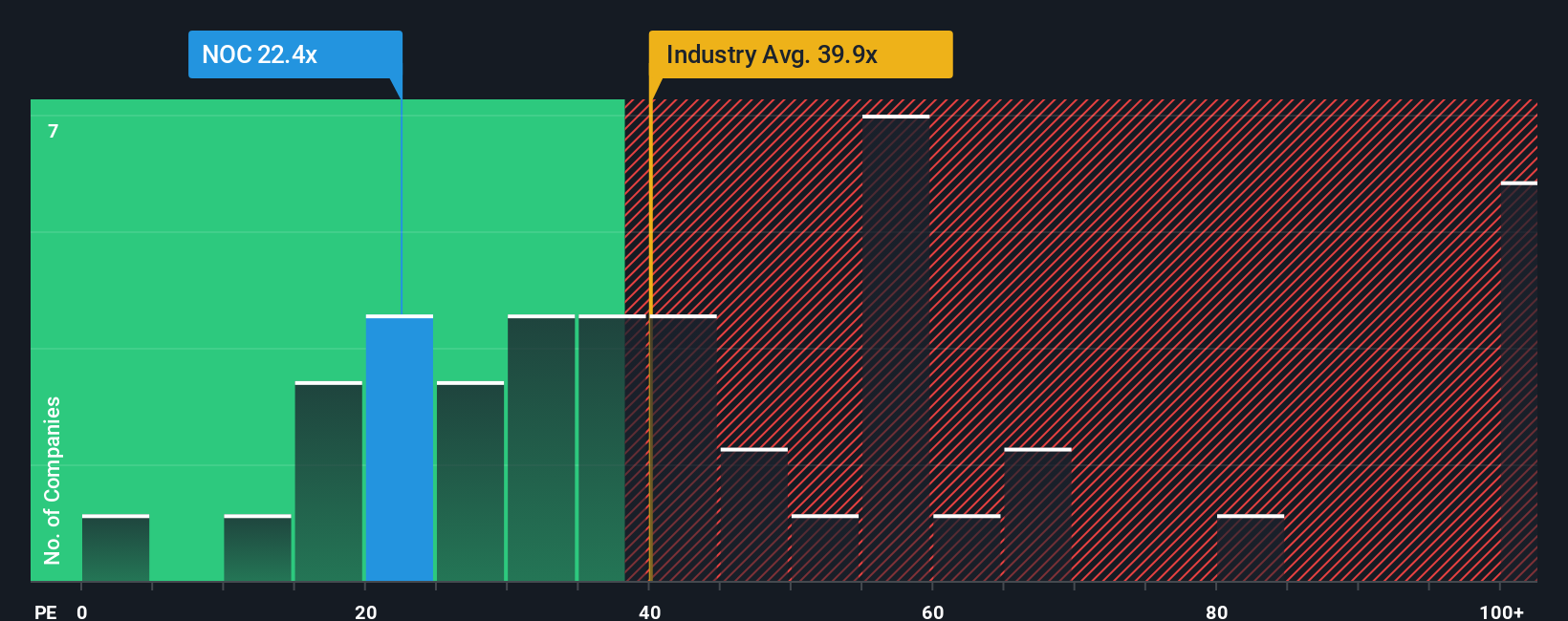

Another View: Market Ratio Signals

While the narrative points to upside, the market’s own numbers sound a more cautious note. Northrop Grumman trades on a 19.4 times earnings ratio, well below its 27 times fair ratio estimate and far under the 37.8 times industry average. This suggests room for rerating, but also the risk that it is cheap for a reason.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Northrop Grumman for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 935 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Northrop Grumman Narrative

If you see the story differently, or want to test your own assumptions against the numbers, you can build a custom view in minutes: Do it your way.

A great starting point for your Northrop Grumman research is our analysis highlighting 6 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Do not stop with a single stock when you can quickly scan fresh opportunities that fit your style, goals, and appetite for intelligent risk using our screeners.

- Position your portfolio for potential mispriced upside by targeting these 935 undervalued stocks based on cash flows that strong cash flow trends suggest the market is overlooking.

- Capture growth at the intersection of medicine and algorithms by focusing on these 30 healthcare AI stocks reshaping diagnostics, treatment pathways, and hospital efficiency.

- Lock in recurring income streams by zeroing in on these 14 dividend stocks with yields > 3% that can support long term wealth building through consistent cash payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northrop Grumman might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NOC

Northrop Grumman

Operates as an aerospace and defense technology company in the United States, the Asia/Pacific, Europe, and internationally.

Solid track record established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026