- United States

- /

- Aerospace & Defense

- /

- NYSE:NOC

How New Long-Term Munitions and Propulsion Contracts At Northrop Grumman (NOC) Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Recently, Northrop Grumman secured multiple long-term U.S. defense contracts worth over US$300,000,000, including a firm-fixed-price, IDIQ SiAW support deal running through 2034 and a major XM1211 proximity-fuzed ammunition award, while also showcasing rapid innovation in solid rocket motor manufacturing through its collaboration with Titomic.

- At the same time, new positive analyst coverage and Northrop Grumman’s heavy investment in next-generation munitions and propulsion capacity highlight how contract wins are intersecting with technology advances to shape expectations about its role in future defense programs.

- Now we’ll examine how the new multi-year U.S. Army XM1211 contract could influence Northrop Grumman’s existing investment narrative and outlook.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Northrop Grumman Investment Narrative Recap

To own Northrop Grumman, you need to be comfortable with a thesis built on sustained U.S. and allied defense spending, long-cycle programs, and steady contract awards. The recent XM1211 and SiAW wins reinforce near term revenue visibility, but do not meaningfully change the key catalyst, which is execution on major programs like B 21 and Sentinel, or the main risk around cost control and fixed price contract exposure if large investments or ramp ups do not go to plan.

The new U.S. Army XM1211 proximity fuzed ammunition contract, worth over US$200,000,000, is especially relevant because it links directly to Northrop Grumman’s heavy investment in next generation munitions capacity. Together with its over US$1,000,000,000 in solid rocket motor spending and the SiAW support deal running through 2034, it underlines how future growth expectations depend on converting these capital intensive bets into profitable production at scale.

Yet, while these wins may look reassuring, investors should also be aware of the growing execution and cost overrun risk if fixed price programs...

Read the full narrative on Northrop Grumman (it's free!)

Northrop Grumman's narrative projects $47.5 billion revenue and $4.4 billion earnings by 2028. This requires 5.5% yearly revenue growth and roughly a $0.5 billion earnings increase from $3.9 billion today.

Uncover how Northrop Grumman's forecasts yield a $667.21 fair value, a 21% upside to its current price.

Exploring Other Perspectives

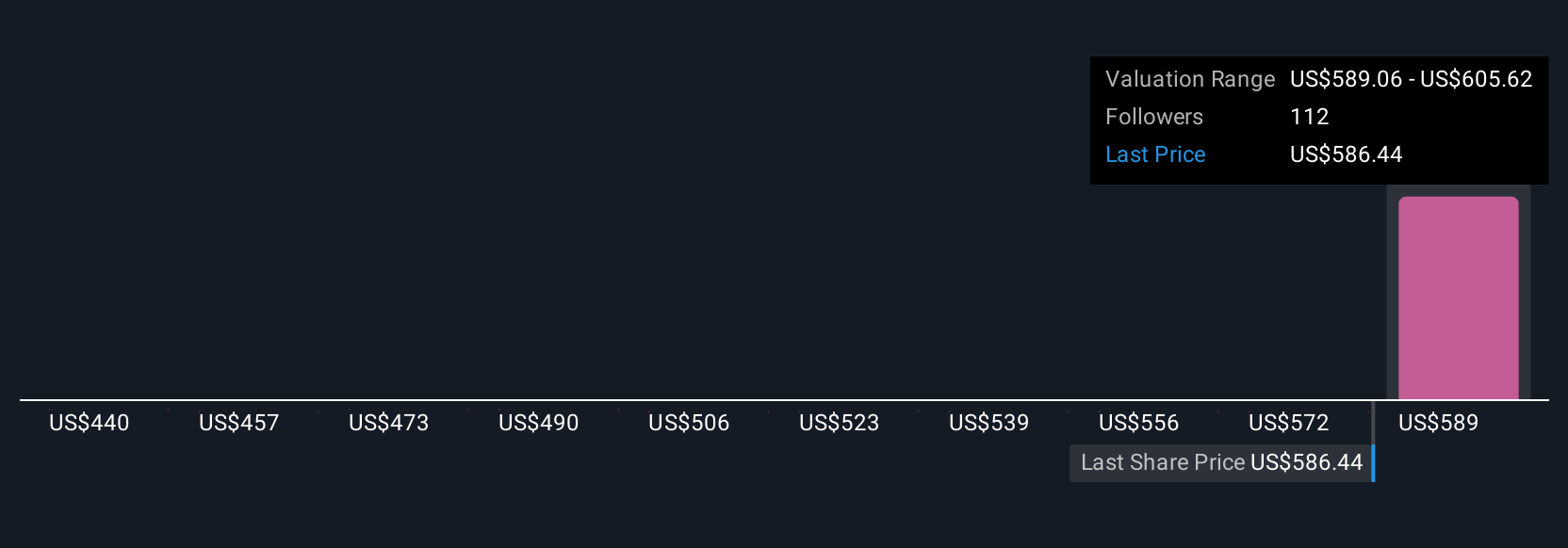

Three fair value estimates from the Simply Wall St Community span roughly US$499 to US$667, underlining how far apart individual views can be. When you weigh those against Northrop Grumman’s reliance on large U.S. defense programs as a core catalyst, it becomes even more important to compare several different scenarios for its future performance.

Explore 3 other fair value estimates on Northrop Grumman - why the stock might be worth as much as 21% more than the current price!

Build Your Own Northrop Grumman Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Northrop Grumman research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Northrop Grumman research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Northrop Grumman's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northrop Grumman might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NOC

Northrop Grumman

Operates as an aerospace and defense technology company in the United States, the Asia/Pacific, Europe, and internationally.

Solid track record established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026