- United States

- /

- Construction

- /

- NYSE:MTZ

MasTec (MTZ): Valuation Insights After Record Backlog and Upgraded Growth Outlook

Reviewed by Kshitija Bhandaru

MasTec (MTZ) just posted a record backlog and boosted its outlook for the year, largely thanks to strong demand in telecom, utilities, and clean energy. This shift is drawing fresh attention from investors.

See our latest analysis for MasTec.

MasTec’s record backlog and raised outlook have helped fuel investor optimism, with the share price climbing to its highest level in the past year. The momentum has caught attention after recent analyst upgrades, and while the shares now trade around fair value, long-term total shareholder returns of nearly 0.7% over one year and more than 3.6% over five years illustrate steady compounding along with occasional swings in sentiment.

If you’re interested in finding growth stories backed by insider confidence, now’s a smart time to explore fast growing stocks with high insider ownership.

With MasTec’s shares at 52-week highs and robust growth forecasts, the key question now is whether investors can still find value, or if the market has already fully priced in the company’s future potential.

Most Popular Narrative: 2.6% Undervalued

Compared to its recent close at $215.81, the most popular narrative estimates MasTec's fair value at $221.58. This represents a slight premium that could suggest room to run if current drivers remain in place.

Recent policy developments (including extended tax credits for renewables and regulatory clarity from new federal legislation) have strengthened MasTec's bookings pipeline and provide long-duration tailwinds. These changes reduce policy risk and support visibility on new project awards, which improves future revenue predictability and supports a higher valuation.

Curious about what exactly powers this higher fair value? The underlying calculations hinge on optimistic growth projections, improving profitability, and a future profit multiple that differs from today’s industry norm. Explore which bold assumptions and hidden numbers could be driving MasTec’s narrative valuation.

Result: Fair Value of $221.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a slowdown in project demand or delays in large contracts could put pressure on MasTec’s margins, challenging the positive growth narrative that investors are watching.

Find out about the key risks to this MasTec narrative.

Another View: Is MasTec Actually Overvalued?

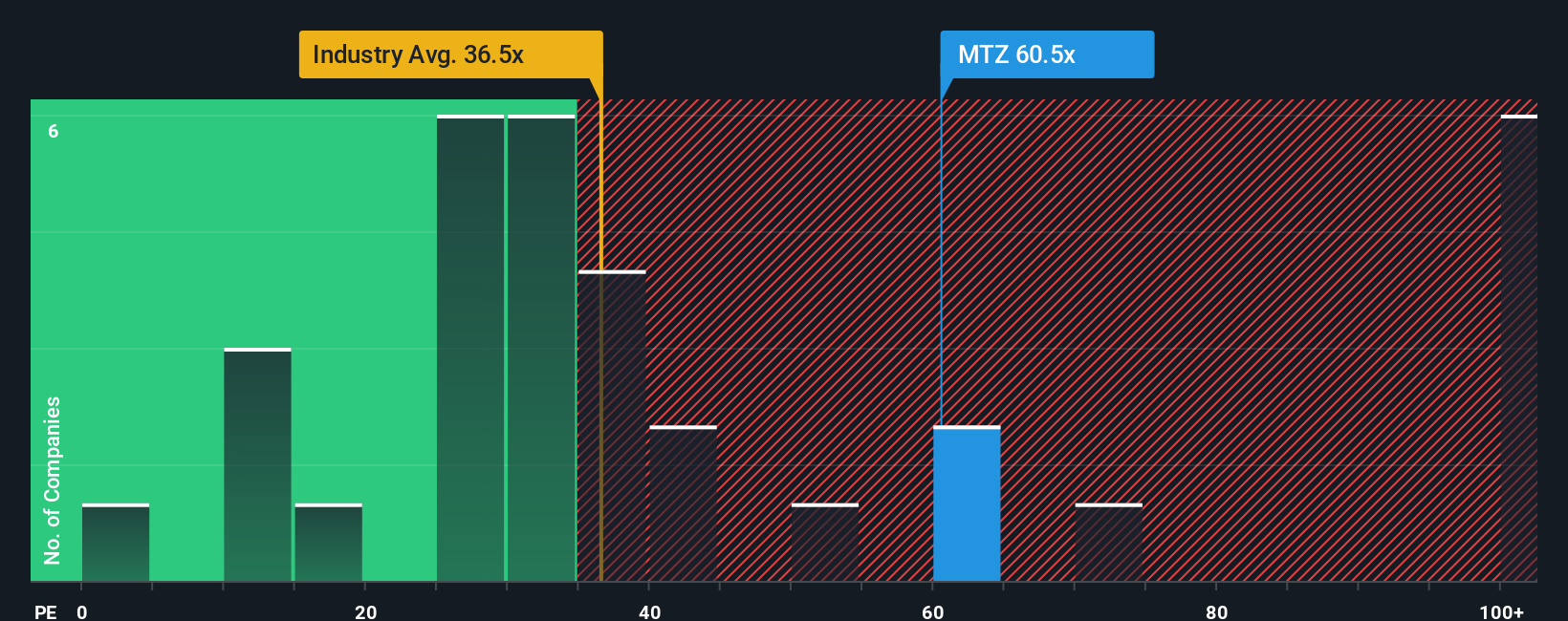

While the narrative model sees a slight undervaluation, a closer look at MasTec’s price-to-earnings ratio offers a different story. Trading at 63x earnings, the shares are priced well above the Construction industry average of 35.6x and the peer average of 47.8x. This premium could limit near-term upside if expectations do not keep rising.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MasTec Narrative

If you have your own perspective or want to dig deeper into the details, you can shape your personal MasTec story in just a few minutes. Do it your way

A great starting point for your MasTec research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let the next wave of opportunity pass you by. Jump in now to find your edge and build a portfolio that stands out with breakthrough picks.

- Tap into stocks generating reliable passive income and compare yields above 3% by checking out these 19 dividend stocks with yields > 3%.

- Gain the first-mover advantage in cutting-edge tech by examining these 24 AI penny stocks reshaping tomorrow’s markets through artificial intelligence.

- Capitalize on stocks trading below their intrinsic value and see which companies have the potential for upside with these 896 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MTZ

MasTec

An infrastructure construction company, provides engineering, building, installation, maintenance, and upgrade services for communications, energy, utility, and other infrastructure primarily in the United States and Canada.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives