- United States

- /

- Trade Distributors

- /

- NYSE:MRC

MRC Global (MRC): Evaluating Valuation Following Strong Q2 Results and Operational Momentum

Reviewed by Kshitija Bhandaru

MRC Global (MRC) posted a 12% revenue increase and a 50% jump in adjusted EBITDA for the second quarter of 2025, supported by higher project activity across markets and a recovery in its Gas Utilities segment.

See our latest analysis for MRC Global.

MRC Global’s share price recently touched $14.46, reflecting growing confidence after the upbeat quarterly report and continued share repurchases. While the 1-year total shareholder return stands at 15%, the stock’s multi-year track record shows momentum has been building for patient investors.

If MRC Global’s solid rebound has you considering what else could be gaining strength, now is a smart time to discover fast growing stocks with high insider ownership

With shares still trading below analyst targets despite recent gains, the question now is whether MRC Global's recovery is just getting started, or if the current price already reflects the company’s growth prospects.

Most Popular Narrative: 7.7% Undervalued

The narrative assigns a fair value of $15.67 per share, which is higher than the last close of $14.46 and suggests there could still be upside. Here is a key driver behind this outlook.

*The simplification of MRC Global's capital structure by repurchasing convertible preferred shares is expected to be accretive to both cash generation and earnings in 2025 and beyond, positively impacting net margins and EPS. The sale of the Canada business and reinvestment of proceeds to reduce debt should improve profitability and margins, enhancing the company's overall financial health and net earnings.*

Want to know what gives MRC Global this premium? The narrative rests on bold profit margin gains and a major earnings turnaround. However, there is one assumption at the heart of it that could change everything. Don't miss the full narrative if you're curious to see what really supports that valuation.

Result: Fair Value of $15.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as lingering internal control weaknesses and potential sales declines could still upend these optimistic forecasts if not addressed effectively.

Find out about the key risks to this MRC Global narrative.

Another View: Valuation Based on Price-to-Earnings

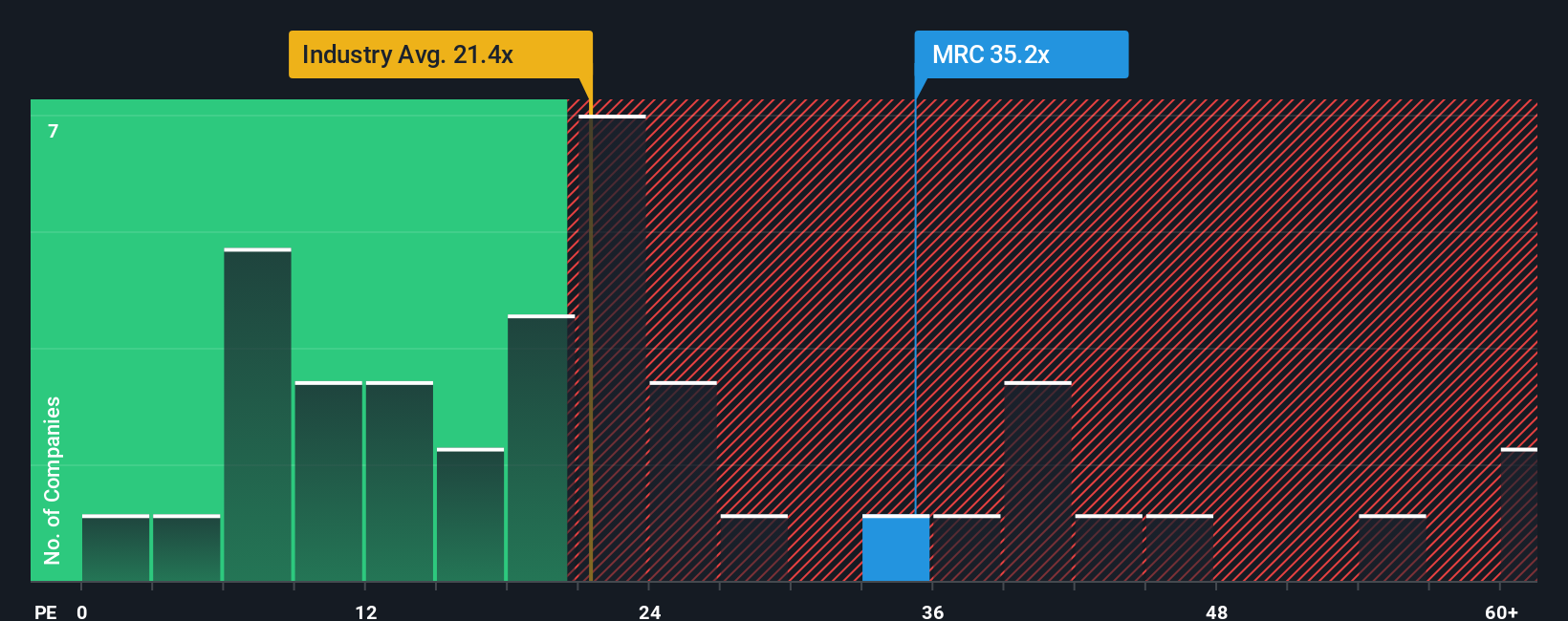

While the fair value estimate sees MRC Global as undervalued, its current price-to-earnings ratio is 38.4x. This is much higher than both the peer average (28.4x), the industry average (23.1x), and even the fair ratio of 29.3x. That gap signals investors are paying a premium for future growth. Does that leave room for upside, or does it expose buyers to risk if expectations fall short?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MRC Global Narrative

If you’d rather see the numbers for yourself or have a different perspective, you can build your own view of MRC Global in just a few minutes with Do it your way.

A great starting point for your MRC Global research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Unlock even more opportunities by using the Simply Wall Street Screener. This tool is designed to help you find under-the-radar stocks before everyone else. Take action now and get ahead of the market:

- Seize the chance for strong payouts by checking out these 19 dividend stocks with yields > 3%, which offers yields above 3% from companies with solid financials.

- Tap into the next wave of healthcare breakthroughs by browsing these 31 healthcare AI stocks, where you can find leaders in medical AI and life sciences innovation.

- Position yourself for the future with these 26 quantum computing stocks, highlighting companies at the forefront of game-changing quantum computing advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MRC

MRC Global

Through its subsidiaries, distributes pipes, valves, fittings, and other infrastructure products and services in the United States and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives