- United States

- /

- Industrials

- /

- NYSE:MMM

What Does 3M's Recent Settlement Mean for Its Share Price in 2025?

Reviewed by Bailey Pemberton

If you have been keeping an eye on 3M stock lately, you are not alone. Whether you are debating holding, buying, or just staying curious, the company’s share price has kept investors guessing. Over the past year, 3M has returned 14.6% to shareholders, and a striking 17.6% so far this year. Still, those recent gains have not come without bumps along the way. In the past seven days, the stock slipped 1.8%, and over the last 30 days it is down 3.4%. This mix of solid long-term growth and shorter-term swings has made 3M a fascinating watch as the broader market digests shifting interest rates and industrial demand trends.

With a last close at $152.53 and a five-year gain of 28.9%, there is plenty to unpack when it comes to the stock’s value. On our core value checks, 3M scores a 3 out of 6, meaning it appears undervalued in three distinct ways but not across the board. For investors seeking confidence in a clear buy or sell decision, that might seem inconclusive at first. But numbers only tell part of the story.

So, what do these six valuation checks say about 3M, and how should you interpret this score? Let’s dive into the details of each approach. Stay with me, because there is one way to look at valuation that could bring everything into sharper focus by the end.

Approach 1: 3M Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its free cash flows well into the future, then discounting those cash flows back to today’s value. This approach gives a comprehensive picture of a business’s intrinsic worth, based on how much cash it is expected to generate for shareholders over time.

For 3M, the current Free Cash Flow is negative, at $-2.3 Billion. However, analysts project a significant turnaround, with Free Cash Flow expected to reach $4.7 Billion by 2029. Looking even further, estimates extend out to $6.2 Billion by 2035, with projections for steady growth each year. The first five years of these numbers are taken from direct analyst estimates. The latter years are extrapolated.

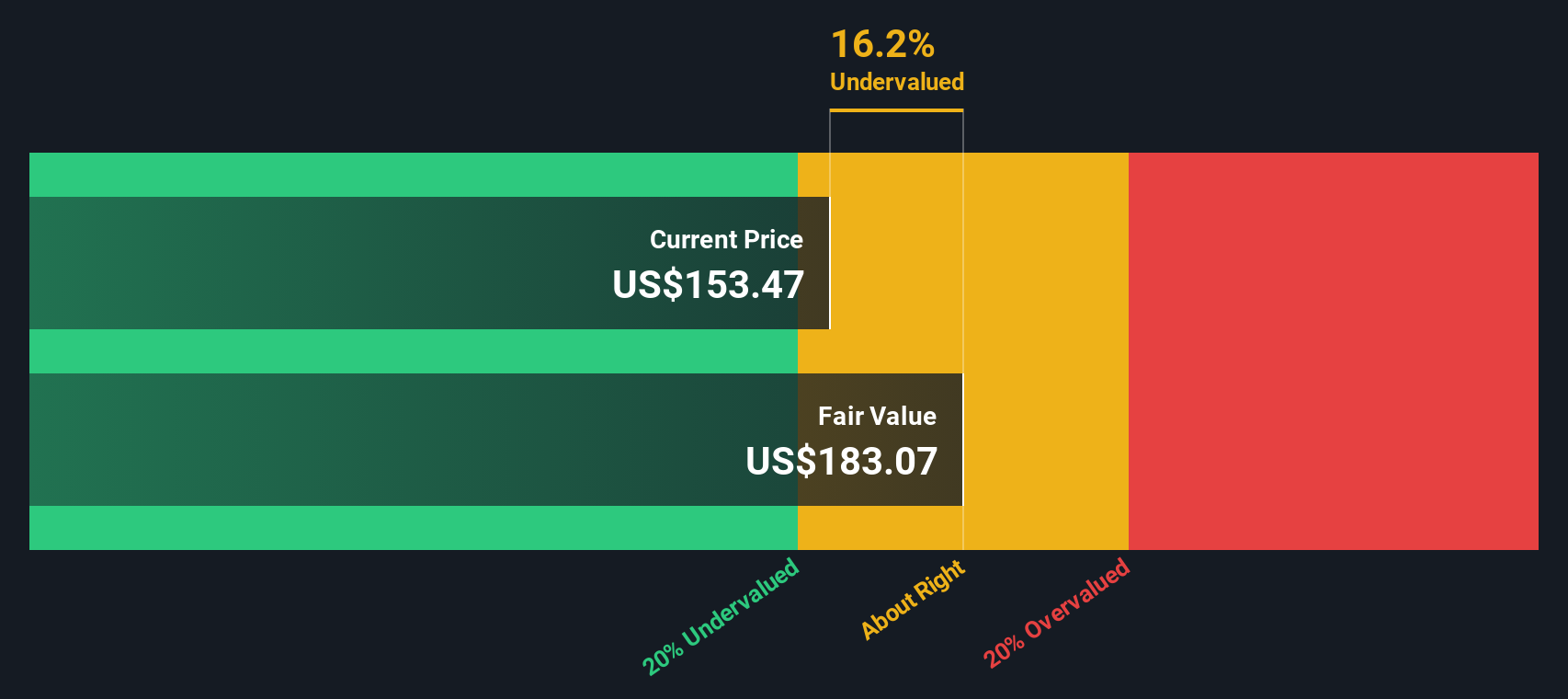

After calculating all of those future cash flows and bringing them to the present, the DCF model puts 3M’s intrinsic value at $188.26 per share. Compared to the recent share price of $152.53, this suggests the stock is currently 19.0% undervalued based on its long-term cash flow potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests 3M is undervalued by 19.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: 3M Price vs Earnings (PE Ratio)

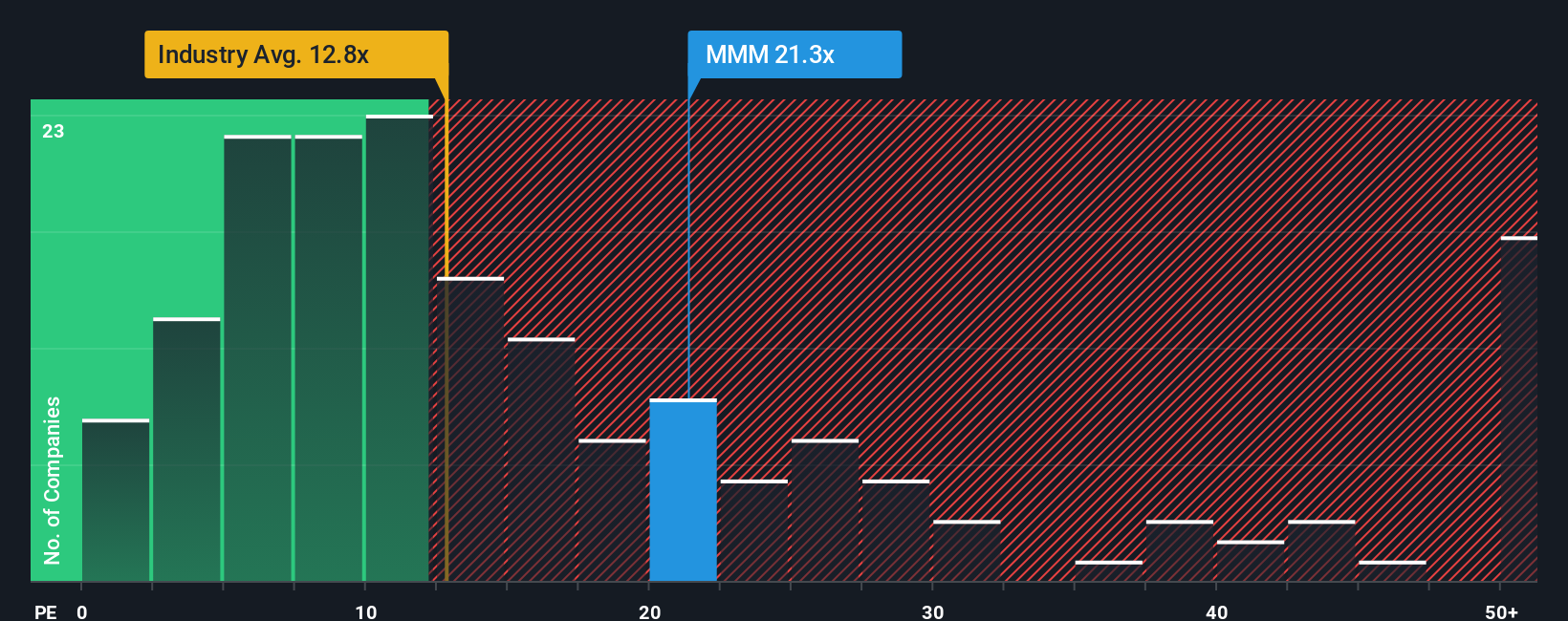

The price-to-earnings, or PE ratio, is a go-to valuation metric for most profitable companies. It gives investors a quick sense of how much they are paying for every dollar of the company's earnings. This makes it especially useful for stable, mature businesses like 3M that consistently generate profits.

What makes a "fair" PE ratio can vary widely depending on expectations for future growth, the amount of risk involved, and how confident investors are in those earnings. Higher growth and lower risk usually support a higher PE ratio, while slow growth or uncertainty put downward pressure on what the market is willing to pay.

Right now, 3M trades at a PE ratio of 20.6x. This is just below the Industrials sector average of 12.7x and is a little under the peer average of 21.0x. Instead of relying solely on industry or peer comparisons, it makes sense to look at the "Fair Ratio" calculated by Simply Wall St. This proprietary metric considers not just growth rates but also how risky the business is, its profit margins, market cap, and other relevant company factors to give a more holistic benchmark. For 3M, the Fair Ratio is currently 27.9x.

Compared to this Fair Ratio, 3M's current PE ratio suggests there could be room for upside, as it trades at a discount versus what would be expected given its financial profile.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your 3M Narrative

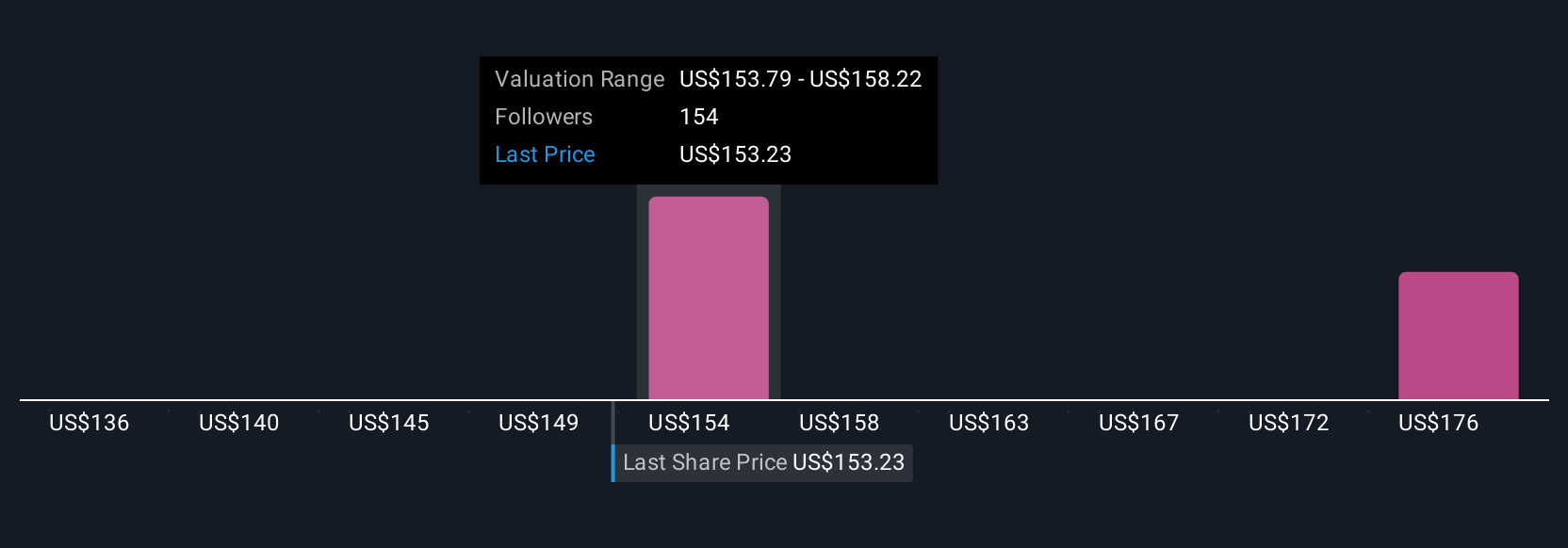

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story about a company, capturing your view of what will drive its future, whether that’s innovation, risks, or operational changes, and connecting those beliefs to financial forecasts like revenue, earnings, and margins.

Instead of treating stocks as just numbers, Narratives on Simply Wall St help you link 3M’s real-world developments to what you believe those events mean for its fair value. Narratives are easy to use and available on the Community page, where millions of investors turn company news, earnings, and unique perspectives into live, dynamic forecasts that automatically update when new information comes in.

If you think 3M’s upcoming product launches and supply chain improvements can boost revenue and margins, your Narrative might lead you to a higher fair value. For example, this could be close to the $187 price target some analysts expect. Alternatively, if you’re worried that ongoing litigation or weak global demand will dampen earnings, your Narrative could see fair value much lower, aligning with bearish estimates like $101 and suggesting caution.

By comparing the fair value set by your Narrative to the current share price, you gain a simple, actionable signal on whether to act, all tailored to your own outlook and always responsive to the latest updates in the market.

Do you think there's more to the story for 3M? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if 3M might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MMM

3M

Provides diversified technology services in the Americas, the Asia Pacific, Europe, the Middle East, Africa, and internationally.

Fair value with acceptable track record.

Similar Companies

Market Insights

Community Narratives