- United States

- /

- Industrials

- /

- NYSE:MMM

How 3M's (MMM) Role in JOINT3 Could Shape Its Semiconductor Market Ambitions

Reviewed by Simply Wall St

- Resonac Corporation recently announced the formation of ‘JOINT3,’ a consortium of 27 leading companies, including 3M, focused on developing advanced panel-level organic interposer technology for next-generation semiconductor packaging, with a prototype line set to launch at Resonac’s APLIC center in Japan in 2026.

- 3M’s inclusion underscores its ongoing commitment to co-develop cutting-edge materials and collaborate within a global alliance aimed at addressing key manufacturing challenges in the evolving semiconductor supply chain.

- We’ll explore how 3M’s participation in this global semiconductor consortium could influence its positioning in high-growth, innovation-driven markets.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 29 companies in the world exploring or producing it. Find the list for free.

3M Investment Narrative Recap

To invest in 3M, you need to believe that operational improvements and innovation in high-growth sectors can outpace legacy challenges like legal liabilities and margin pressure. While 3M's participation in Resonac's JOINT3 consortium signals fresh relevance in advanced semiconductor materials, this move is unlikely to change the immediate focus on earnings stability, which remains shaped by ongoing PFAS litigation risk and structural growth headwinds. Recent dividend declarations, maintaining a steady payout of US$0.73 per share, reinforce 3M’s intent to deliver predictable shareholder returns amid these uncertain catalysts and risks. However, against the clear drive into high-tech partnerships, investors should also be mindful that...

Read the full narrative on 3M (it's free!)

3M's outlook forecasts $26.2 billion in revenue and $4.7 billion in earnings by 2028. This is based on analysts' assumptions of 2.1% annual revenue growth and a $0.8 billion increase in earnings from the current $3.9 billion.

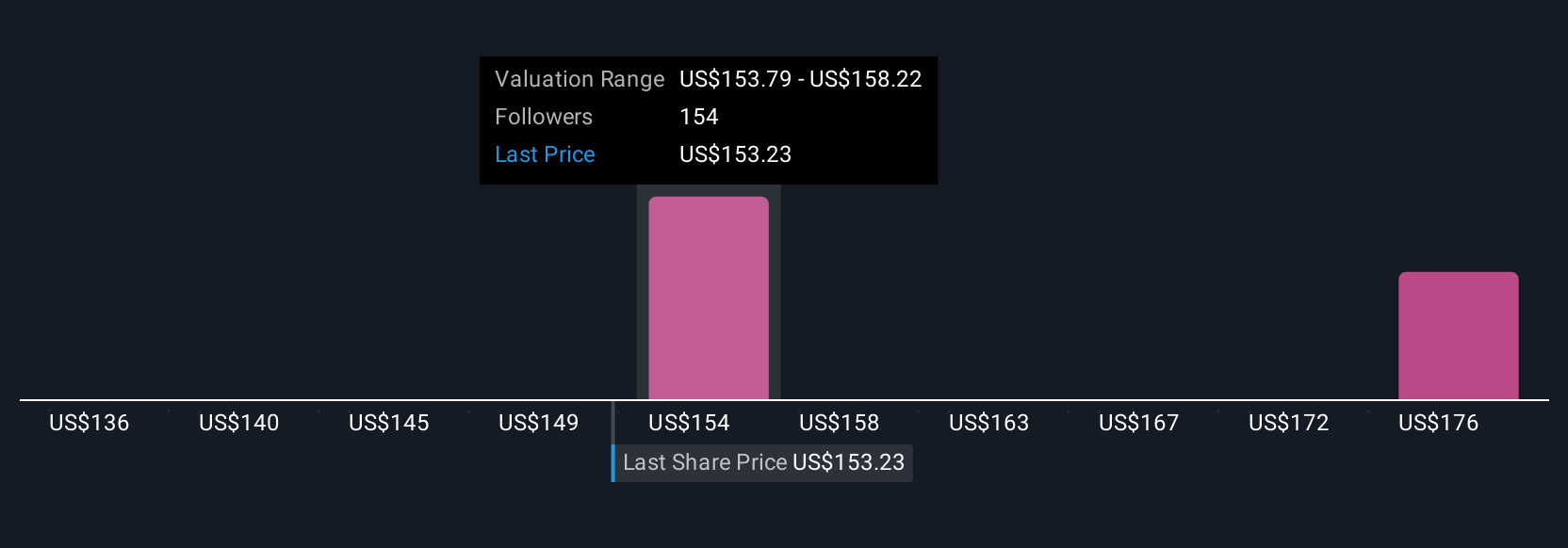

Uncover how 3M's forecasts yield a $161.15 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Eight fair value estimates from the Simply Wall St Community span from US$114.86 to US$169.18, showing how opinions can widely differ. While some focus on growth from innovation partnerships, it’s important to stay aware of unresolved PFAS litigation and its potential to impact long-term performance, explore several viewpoints to inform your decision.

Explore 8 other fair value estimates on 3M - why the stock might be worth as much as 10% more than the current price!

Build Your Own 3M Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your 3M research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free 3M research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate 3M's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if 3M might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MMM

3M

Provides diversified technology services in the Americas, the Asia Pacific, Europe, the Middle East, Africa, and internationally.

Fair value with acceptable track record.

Similar Companies

Market Insights

Community Narratives