- United States

- /

- Industrials

- /

- NYSE:MMM

3M’s (MMM) Advanced Materials Push via JOINT3 Consortium Might Change The Case For Investing

Reviewed by Sasha Jovanovic

- Japan-based Resonac Corporation announced that 3M has joined the JOINT3 consortium, an international collaboration to accelerate the development of panel-level organic interposers for next-generation semiconductor packaging.

- This move highlights 3M's growing emphasis on advanced materials innovation, particularly targeting the expanding markets for AI and autonomous vehicles where efficient, high-performance semiconductors are crucial.

- We'll examine how 3M's push into advanced semiconductor packaging through the JOINT3 consortium may influence its future value proposition.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

3M Investment Narrative Recap

Owning 3M typically requires confidence in its innovation-driven turnaround, operational improvement, and ability to control legal risks, especially as PFAS litigation continues to loom large. While 3M's entry into the JOINT3 semiconductor consortium puts a spotlight on its materials expertise and positions it for relevance in next-gen tech markets, this news is not likely to materially alter the biggest near-term catalyst: ongoing operational improvements and new product launches, nor does it meaningfully reduce the primary risk from outstanding PFAS liabilities.

The most relevant recent event to this development is 3M's showcase at IAA Mobility 2025, which emphasized advancements in materials for electric and autonomous vehicles, directly connecting to the potential growth offered by semiconductor technology collaborations like JOINT3. With management emphasizing margin expansion and accelerated product development, operational execution remains the key catalyst amid structural industry transitions.

However, investors should be aware that despite innovation headlines, unresolved PFAS legal actions could still...

Read the full narrative on 3M (it's free!)

3M's narrative projects $26.1 billion revenue and $4.7 billion earnings by 2028. This requires 2.0% annual revenue growth and a $0.8 billion earnings increase from $3.9 billion today.

Uncover how 3M's forecasts yield a $161.62 fair value, in line with its current price.

Exploring Other Perspectives

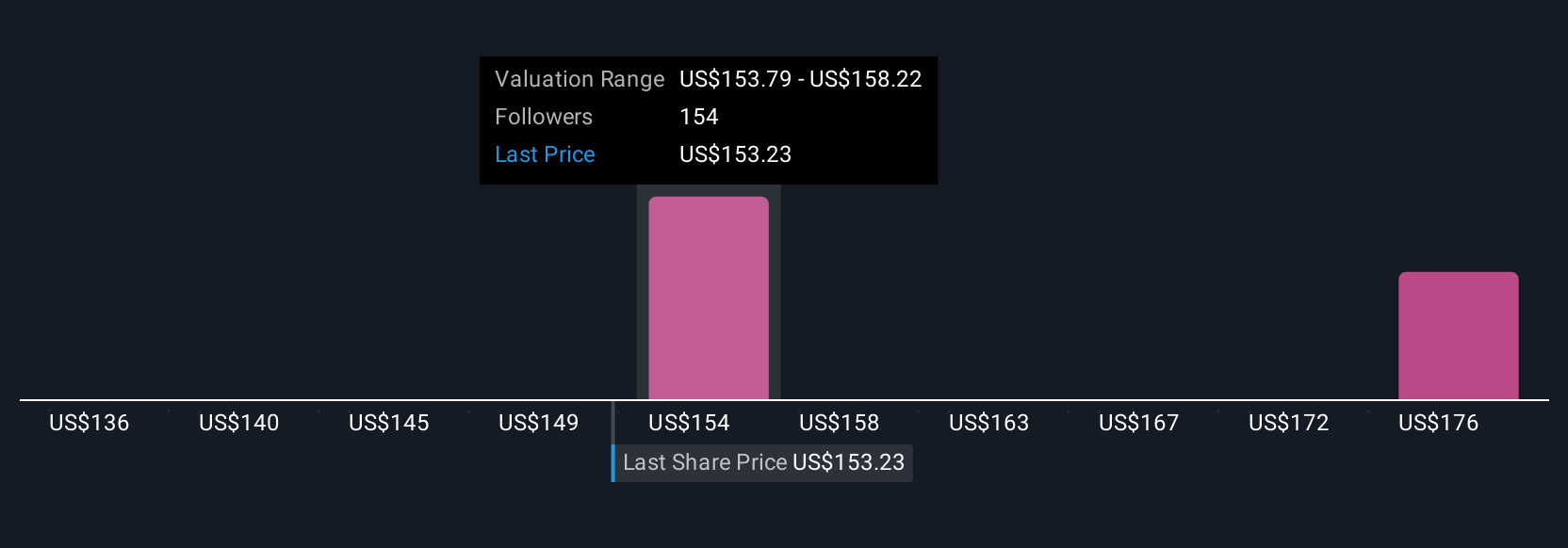

Simply Wall St Community members set 3M’s fair value anywhere from US$114 to US$188, drawing on nine distinct valuation approaches. Yet with the company still facing substantial unresolved PFAS litigation, perspectives on its future prospects truly diverge, explore the range of opinions to see where you stand.

Explore 9 other fair value estimates on 3M - why the stock might be worth as much as 19% more than the current price!

Build Your Own 3M Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your 3M research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free 3M research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate 3M's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if 3M might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MMM

3M

Provides diversified technology services in the Americas, the Asia Pacific, Europe, the Middle East, Africa, and internationally.

Good value with acceptable track record.

Similar Companies

Market Insights

Community Narratives