- United States

- /

- Machinery

- /

- NYSE:MKFG

Markforged Holding Corporation (NYSE:MKFG) Stock Rockets 25% But Many Are Still Ignoring The Company

Markforged Holding Corporation (NYSE:MKFG) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 11% in the last twelve months.

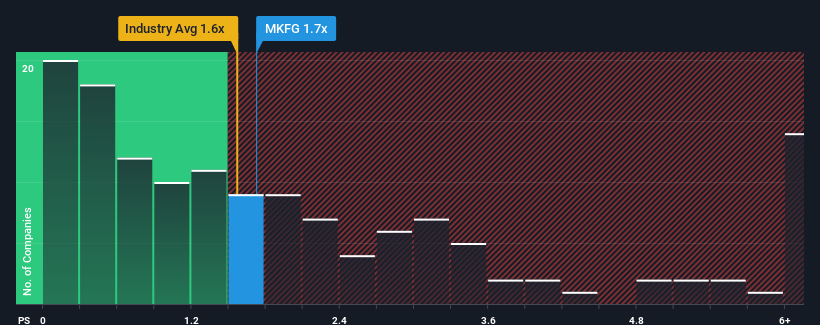

In spite of the firm bounce in price, it's still not a stretch to say that Markforged Holding's price-to-sales (or "P/S") ratio of 1.7x right now seems quite "middle-of-the-road" compared to the Machinery industry in the United States, where the median P/S ratio is around 1.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Markforged Holding

How Has Markforged Holding Performed Recently?

While the industry has experienced revenue growth lately, Markforged Holding's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Markforged Holding will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Markforged Holding?

The only time you'd be comfortable seeing a P/S like Markforged Holding's is when the company's growth is tracking the industry closely.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 7.1%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 31% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 5.2% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 1.5%, which is noticeably less attractive.

In light of this, it's curious that Markforged Holding's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Its shares have lifted substantially and now Markforged Holding's P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite enticing revenue growth figures that outpace the industry, Markforged Holding's P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Plus, you should also learn about these 2 warning signs we've spotted with Markforged Holding.

If these risks are making you reconsider your opinion on Markforged Holding, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:MKFG

Markforged Holding

Produces and sells 3D printers, materials, software, and other related services worldwide.

Adequate balance sheet slight.

Similar Companies

Market Insights

Community Narratives