- United States

- /

- Building

- /

- NYSE:MBC

Is the New U.S. Cabinet Tariff Policy Altering the Investment Case for MasterBrand (MBC)?

Reviewed by Sasha Jovanovic

- Earlier this week, the U.S. government imposed new tariffs on imported kitchen cabinets, bathroom vanities, and upholstered furniture, aiming to protect domestic manufacturers.

- This policy shift could reshape the competitive landscape for companies like MasterBrand by reducing the influx of foreign products into the U.S. market.

- We'll explore how added tariff protections could strengthen MasterBrand's position within the domestic cabinetry industry.

Find companies with promising cash flow potential yet trading below their fair value.

What Is MasterBrand's Investment Narrative?

To be a MasterBrand shareholder right now, you'd want to see the company capitalize on changes in trade policy and regain footing after a tough stretch for earnings and margins. The new U.S. tariffs on imported cabinets and furniture look likely to be a meaningful short-term catalyst, giving domestic producers like MasterBrand potential pricing power and reducing foreign competition, an important shift not factored into recent earnings or analyst targets. The market’s initial reaction, including a sharp move in peer stocks, signals expectations for improved conditions, especially as MasterBrand’s recent results have shown stagnant sales and compressed profits. While that tariff boost may help, it also introduces risk if higher input costs or changes in demand patterns offset the benefits. With ongoing high debt levels, low return on equity, and a still-fresh board, execution risk is not trivial, especially if the anticipated boost from tariffs is short-lived or lost to cost inflation or supply chain pressures.

But if the boost from tariffs fades, higher debt could put pressure on returns. MasterBrand's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

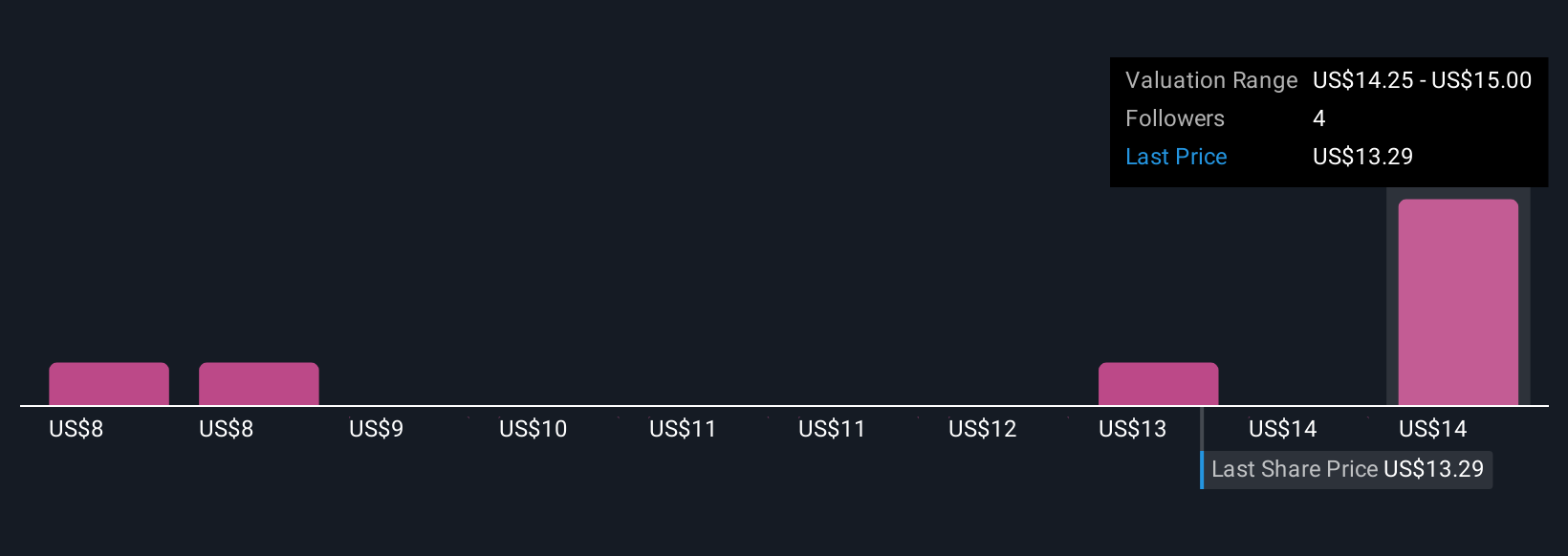

Explore 4 other fair value estimates on MasterBrand - why the stock might be worth 45% less than the current price!

Build Your Own MasterBrand Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MasterBrand research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free MasterBrand research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MasterBrand's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 31 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MBC

MasterBrand

Engages in the manufacture and sale of residential cabinets in the United States and Canada.

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives