- United States

- /

- Building

- /

- NYSE:MBC

Does MasterBrand’s (MBC) Push for Custom Cabinetry Reveal a New Competitive Playbook?

Reviewed by Sasha Jovanovic

- StarMark Cabinetry, a MasterBrand brand, recently announced a major product line expansion featuring 15 new door styles, eight finishes, and enhanced customization options as part of a broader two-year brand refresh initiative.

- This product expansion and updated brand identity highlight MasterBrand's ongoing commitment to aligning with changing homeowner and designer tastes through innovation and tailored offerings.

- We'll consider how MasterBrand's efforts to boost customization in cabinetry may influence the company's broader investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is MasterBrand's Investment Narrative?

For someone considering MasterBrand as an investment, the big picture hinges on belief in the company’s ability to revitalize growth and profitability despite industry headwinds and a track record of declining earnings. The new StarMark Cabinetry product expansion sends a timely signal that MasterBrand is prioritizing innovation and customization, aiming to win over changing homeowner and designer preferences. While this brand refresh is an encouraging step that might create near-term excitement and boost engagement, it is unlikely to quickly alter the main catalysts or risks: ongoing pressure from weaker cabinet demand, slim profit margins, leadership turnover, and a board that lacks long-term experience. The recent news could provide some support if it translates to real sales traction, but with sales and net income still trending down and the share price lingering below analyst fair value estimates, investors have to weigh whether these strategic moves can offset larger structural challenges. Still, many will want to see measurable financial impact before rethinking the existing cautious outlook.

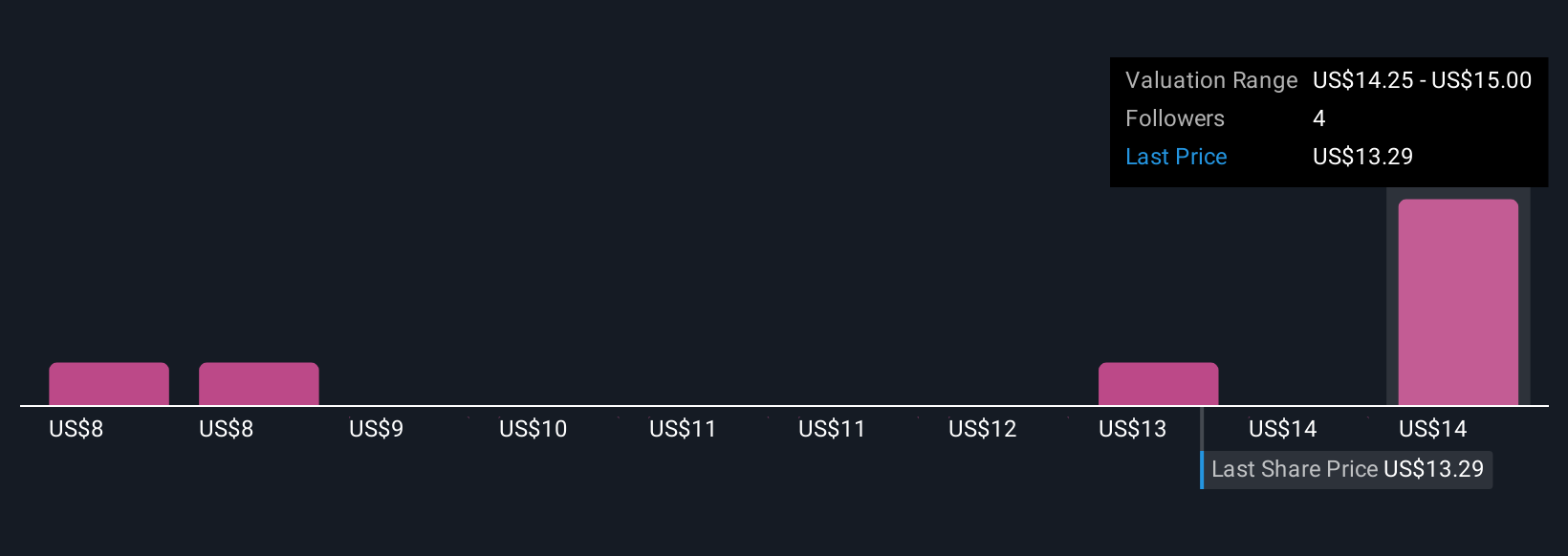

But keep in mind the company’s board has seen significant turnover, which could influence long-term stability. Despite retreating, MasterBrand's shares might still be trading 5% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 4 other fair value estimates on MasterBrand - why the stock might be worth 41% less than the current price!

Build Your Own MasterBrand Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MasterBrand research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free MasterBrand research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MasterBrand's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MBC

MasterBrand

Engages in the manufacture and sale of residential cabinets in the United States and Canada.

Slight risk and fair value.

Similar Companies

Market Insights

Community Narratives