- United States

- /

- Semiconductors

- /

- NasdaqGS:PDFS

Top US Growth Companies With High Insider Ownership In February 2025

Reviewed by Simply Wall St

As February 2025 unfolds, U.S. markets have experienced a turbulent period, with the Dow Jones Industrial Average facing its steepest weekly decline since October and major indices like the S&P 500 and Nasdaq Composite entering negative territory for the month. Amidst this volatility, investors are increasingly focused on growth companies with high insider ownership, as these stocks can offer unique insights into potential resilience and alignment of interests between company leaders and shareholders during uncertain times.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 25.4% | 25.6% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 27.6% |

| On Holding (NYSE:ONON) | 19.1% | 30.2% |

| Astera Labs (NasdaqGS:ALAB) | 15.7% | 61.1% |

| BBB Foods (NYSE:TBBB) | 16.5% | 41.1% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.1% |

| Enovix (NasdaqGS:ENVX) | 12.6% | 56.0% |

| Upstart Holdings (NasdaqGS:UPST) | 12.6% | 103.4% |

| Credit Acceptance (NasdaqGS:CACC) | 14.2% | 33.6% |

Underneath we present a selection of stocks filtered out by our screen.

Viemed Healthcare (NasdaqCM:VMD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Viemed Healthcare, Inc. provides home medical equipment and post-acute respiratory healthcare services in the United States, with a market cap of approximately $302.93 million.

Operations: The company's revenue is primarily derived from the Sleep and Respiratory Disorders Sector, amounting to $214.30 million.

Insider Ownership: 13.2%

Earnings Growth Forecast: 32.5% p.a.

Viemed Healthcare's earnings are forecast to grow significantly at 32.5% annually, outpacing the US market's 14.3%. Revenue growth is projected at 12.9% per year, exceeding the broader market's 8.8%, although it remains below the desired 20% threshold for high growth companies. Analysts agree on a potential stock price increase of 65%. Recent insider trading activity shows no substantial buying or selling over the past three months.

- Take a closer look at Viemed Healthcare's potential here in our earnings growth report.

- Our valuation report unveils the possibility Viemed Healthcare's shares may be trading at a premium.

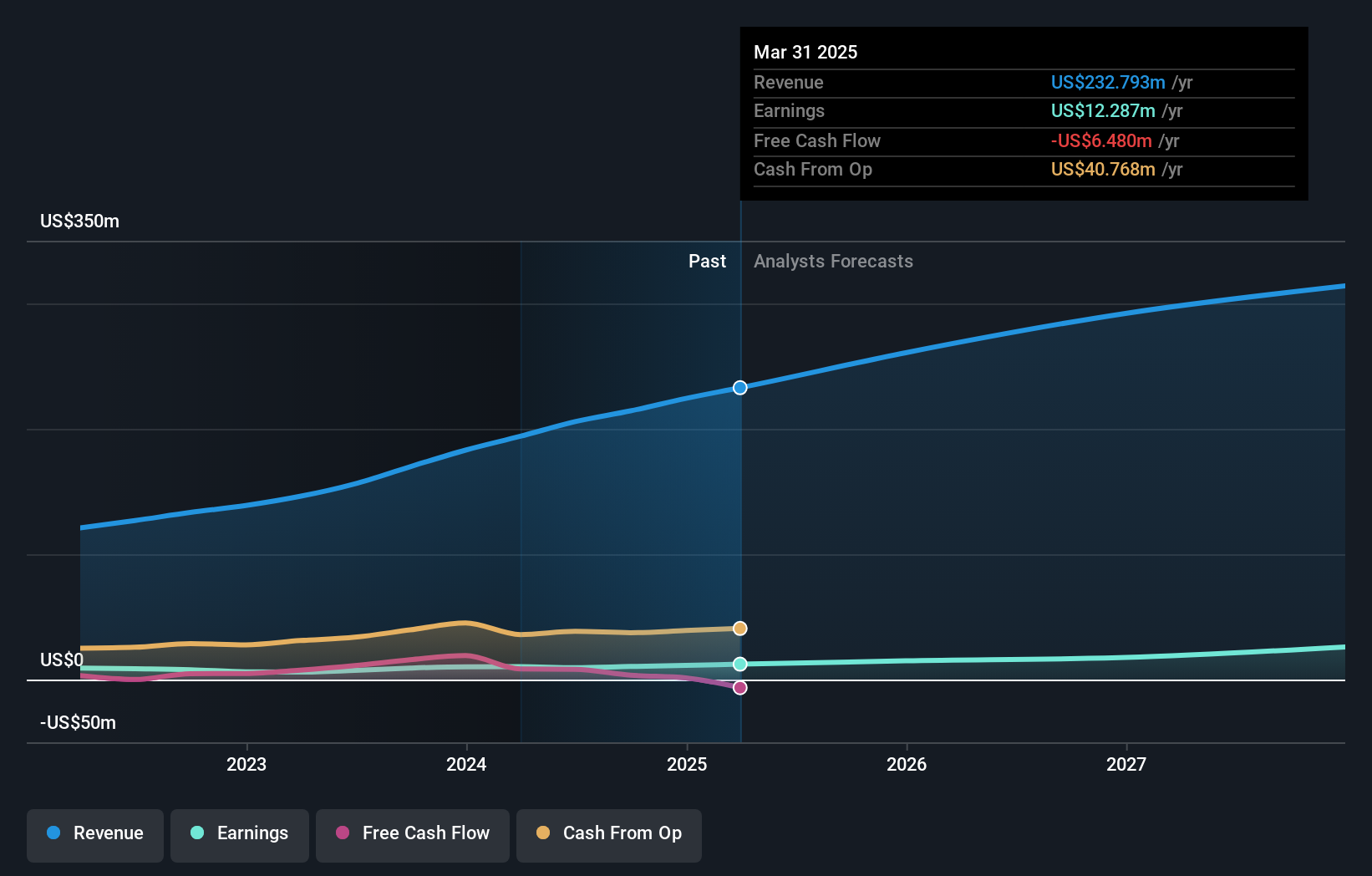

PDF Solutions (NasdaqGS:PDFS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PDF Solutions, Inc. offers proprietary software, physical intellectual property products for integrated circuit designs, electrical measurement hardware tools, methodologies, and professional services globally with a market cap of approximately $892.16 million.

Operations: The company's revenue primarily comes from its Software & Programming segment, which generated $179.47 million.

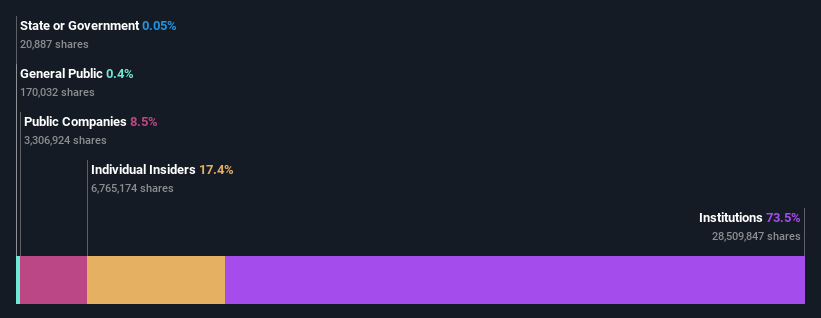

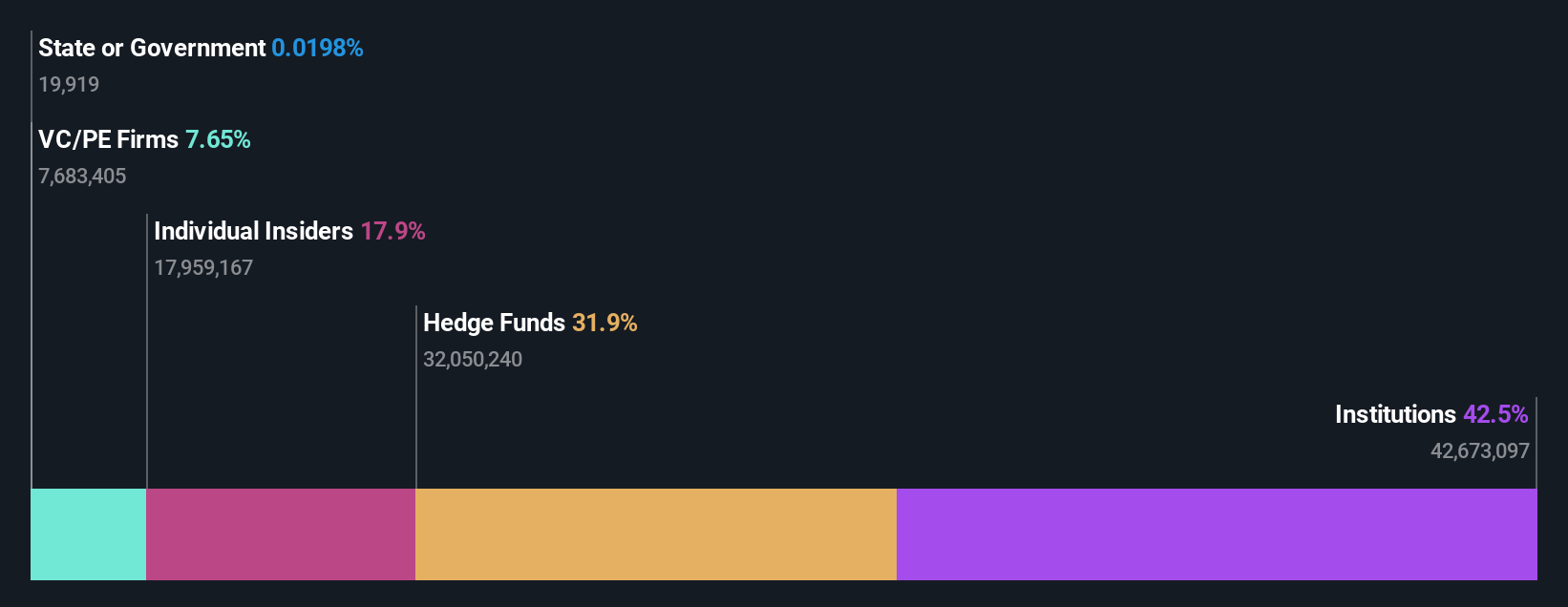

Insider Ownership: 17.4%

Earnings Growth Forecast: 80.1% p.a.

PDF Solutions is poised for substantial growth, with earnings projected to increase significantly at 80.1% annually, surpassing the US market's 14.3%. Revenue is expected to grow by 15.2% per year, also outpacing the broader market. The stock trades at a discount of 11.8% below its estimated fair value and analysts anticipate a price rise of 57.5%. Recent insider activity shows significant selling over the past three months without substantial buying.

- Click here and access our complete growth analysis report to understand the dynamics of PDF Solutions.

- Insights from our recent valuation report point to the potential undervaluation of PDF Solutions shares in the market.

Loar Holdings (NYSE:LOAR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Loar Holdings Inc. operates through its subsidiaries to design, manufacture, and market aerospace and defense components for aircraft and related systems both in the United States and internationally, with a market cap of $6.42 billion.

Operations: The company's revenue is generated from its Aerospace & Defense segment, amounting to $378.81 million.

Insider Ownership: 22%

Earnings Growth Forecast: 51.8% p.a.

Loar Holdings is projected to experience substantial earnings growth of 51.8% annually, exceeding the US market's average. Despite this, revenue growth is forecast at 15.2%, which is slower than the desired high-growth threshold but still above market averages. Recent insider activity reveals significant selling over the past quarter without notable buying. The company raised its earnings guidance for 2025, reflecting optimism in financial performance despite a low future return on equity forecast of 6.9%.

- Dive into the specifics of Loar Holdings here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential overvaluation of Loar Holdings shares in the market.

Seize The Opportunity

- Unlock more gems! Our Fast Growing US Companies With High Insider Ownership screener has unearthed 195 more companies for you to explore.Click here to unveil our expertly curated list of 198 Fast Growing US Companies With High Insider Ownership.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade PDF Solutions, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PDFS

PDF Solutions

Provides proprietary software, physical intellectual property for integrated circuit designs, electrical measurement hardware tools, proven methodologies, and professional services in the United States, Japan, China, Taiwan, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives