- United States

- /

- Aerospace & Defense

- /

- NYSE:LOAR

Loar Holdings (LOAR): Evaluating Valuation After Expanded Credit Capacity for Future Growth Initiatives

Reviewed by Simply Wall St

Loar Holdings (LOAR) just gave itself more financial firepower by amending its Credit Agreement to lift delayed draw term loan capacity to 275 million and extend availability through late 2026, which indicates it is planning for growth.

See our latest analysis for Loar Holdings.

The move comes after a recent coverage initiation highlighted Loar as an active consolidator in the aerospace aftermarket. However, the stock has lost momentum, with a 1 year total shareholder return of negative 25.6 percent and the share price now at 68.3 dollars.

If this kind of funding firepower has you thinking about where else growth could come from in aerospace and defense, it is worth exploring aerospace and defense stocks next.

So, with fresh credit capacity, double digit earnings growth, and a share price still well below analyst targets, is Loar quietly undervalued here, or is the market already pricing in its next leg of growth?

Most Popular Narrative: 28.4% Undervalued

With the narrative fair value sitting well above the 68.3 dollars last close, the valuation hinges on ambitious growth and margin expansion assumptions.

Ongoing productivity initiatives, adoption of advanced value-based pricing, and continuous improvement in manufacturing processes, including the integration of advanced digital technologies, are facilitating annual margin expansion, a trend that should enhance both operating leverage and net margins as topline scales.

Curious how steady revenue growth, rising profitability, and a premium earnings multiple can still add up to an upside case? The narrative spells out the precise roadmap, including how long margins are expected to climb and what kind of earnings power those assumptions build into Loar’s future valuation.

Result: Fair Value of $95.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if bolt on acquisitions misfire or customer concentration around key aircraft platforms backfires, today’s upbeat margin story could unravel quickly.

Find out about the key risks to this Loar Holdings narrative.

Another View, Rich Multiples Signal Caution

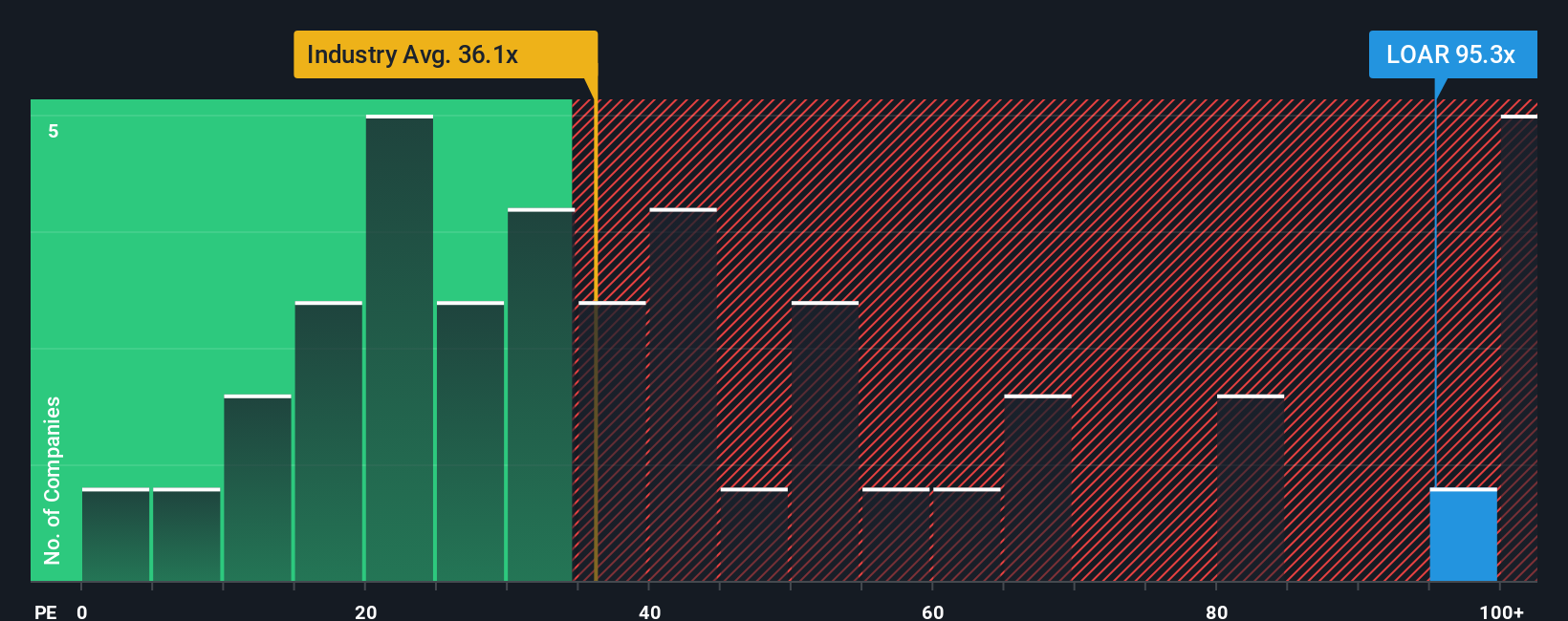

That 28.4 percent upside case clashes with how the market is actually pricing Loar today. On a price to earnings basis of roughly 101 times, the shares sit far above the fair ratio of 30.2 times, the peer average of 58.3 times, and the US Aerospace and Defense industry at 37.6 times. If sentiment cools or execution wobbles, could multiple compression swamp the narrative upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Loar Holdings Narrative

If you see the story differently, or want to dig into the numbers yourself, you can build a custom view in minutes. Do it your way.

A great starting point for your Loar Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Loar might be compelling, but you will kick yourself later if you ignore other powerful ideas emerging from the Simply Wall Street Screener right now.

- Capture potential bargains by targeting companies trading below intrinsic value with these 915 undervalued stocks based on cash flows that still show solid fundamentals and room for sentiment to turn.

- Position ahead of the next tech wave by scanning these 25 AI penny stocks that blend rapid innovation with business models already turning breakthroughs into revenue.

- Lock in potential income streams by reviewing these 14 dividend stocks with yields > 3% that combine attractive yields with balance sheets built to support consistent payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LOAR

Loar Holdings

Through its subsidiaries, designs, manufactures, and markets aerospace and defense components for aircraft, and aerospace and defense systems in the United States and internationally.

Adequate balance sheet with limited growth.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026