- United States

- /

- Aerospace & Defense

- /

- NYSE:LOAR

Does Jeremy Halford’s Appointment Signal a New Phase of Operational Focus for Loar Holdings (LOAR)?

Reviewed by Sasha Jovanovic

- Loar Holdings recently announced the appointment of Jeremy Halford as Executive Vice President, who will report directly to CEO & Executive Co-Chairman Dirkson Charles and oversee operations at several key subsidiaries across both the US and UK.

- Halford’s background in operational leadership at major industrial firms may support Loar’s continued focus on strengthening operational efficiency and accelerating growth in specialized aerospace markets.

- We will explore how Halford’s operational expertise may affect Loar’s investment narrative and future growth prospects in the aerospace sector.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Loar Holdings Investment Narrative Recap

For an investor considering Loar Holdings, the core belief centers on the company’s ability to consistently deliver margin expansion and capture new product opportunities within specialized aerospace markets. The appointment of Jeremy Halford as Executive Vice President highlights an effort to reinforce operational execution, which could aid near-term progress but does not immediately shift the primary catalyst: integrating recent bolt-on acquisitions to realize synergy benefits and sustain earnings momentum. The main risk, complex integration and execution across a rapidly expanded footprint, remains materially unchanged by this leadership addition.

Among the company’s recent announcements, the May follow-on equity offering stands out as most relevant. By raising US$750.69 million, Loar has augmented its financial flexibility for acquisitions and working capital, directly supporting the pipeline of bolt-on deals that underpin its growth catalysts. This aligns with a focus on productivity improvements and scaling operations to drive profitability.

However, with rapid expansion and multiple new leaders, there remains the potential for overlooked integration issues that investors should be aware of...

Read the full narrative on Loar Holdings (it's free!)

Loar Holdings' narrative projects $656.1 million revenue and $114.0 million earnings by 2028. This requires 13.2% yearly revenue growth and a $69.6 million earnings increase from $44.4 million today.

Uncover how Loar Holdings' forecasts yield a $97.20 fair value, a 23% upside to its current price.

Exploring Other Perspectives

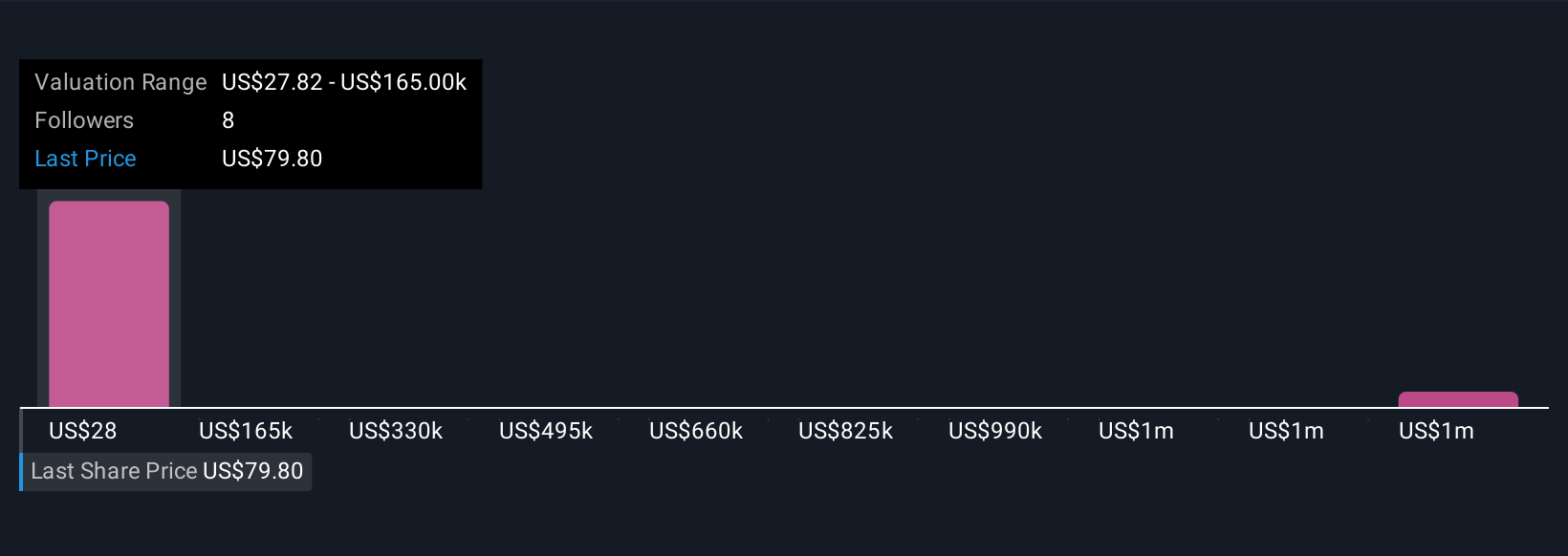

Five members of the Simply Wall St Community provided fair value estimates for Loar Holdings, ranging from US$27.81 to over US$1.6 million. While many see robust growth potential tied to new product introductions, opinions vary widely and reflect different expectations for Loar's success with acquisition integration. Consider how these differing views could shape your own perspective on the company's prospects.

Explore 5 other fair value estimates on Loar Holdings - why the stock might be a potential multi-bagger!

Build Your Own Loar Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Loar Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Loar Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Loar Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LOAR

Loar Holdings

Through its subsidiaries, designs, manufactures, and markets aerospace and defense components for aircraft, and aerospace and defense systems in the United States and internationally.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives