- United States

- /

- Aerospace & Defense

- /

- NYSE:LMT

Lockheed Martin (NYSE:LMT) Declares US$3.30 Q2 Dividend for 2025

Reviewed by Simply Wall St

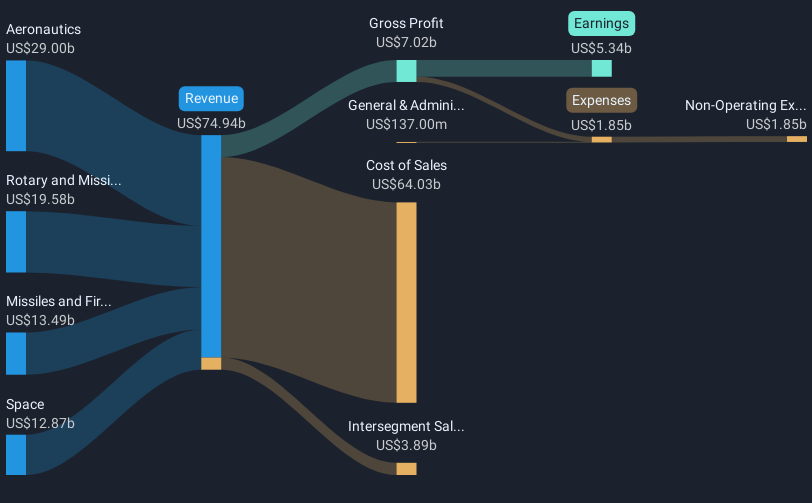

Lockheed Martin (NYSE:LMT) has recently announced a second-quarter 2025 dividend of $3.30 per share, adding positive momentum to its shares, which saw a 7% increase over the last quarter. During this period, the company also reported strong Q1 earnings, with revenue and net income outperforming the previous year. Alongside the dividend, an active share buyback program likely supported its share price. These factors collectively complemented broader market trends, which have risen by 8% over 12 months, underscoring Lockheed Martin's concurrent success amidst flat recent market performance.

You should learn about the 2 risks we've spotted with Lockheed Martin.

The recent dividend announcement of $3.30 per share by Lockheed Martin adds another layer to its short-term positive performance, highlighted by a 7% increase in share price over the last quarter. This news could enhance investor confidence in the company's ability to generate consistent returns, aligning with Lockheed's strategic integration of AI, 5G, and cloud technologies, potentially boosting revenue and earnings forecasts. Despite this short-term momentum, the company's shares have risen 50.35% over the past five years, reflecting a robust long-term growth trajectory.

In contrast to its longer-term performance, over the past year, Lockheed Martin underperformed both its industry and the broader market, as the US Aerospace & Defense industry returned 21.2%, and the US market gained 8%. The current share price of $468.21 still lags behind the analyst consensus price target of $523.53 by about 10.6%, suggesting a potential upside if the company's operational enhancements and market conditions align as anticipated. The continuation and expansion of successful projects such as the Golden Dome and missile systems could further influence revenue growth and market positioning.

Understand Lockheed Martin's track record by examining our performance history report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Lockheed Martin, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LMT

Lockheed Martin

An aerospace and defense company, engages in the research, design, development, manufacture, integration, and sustainment of technology systems, products, and services worldwide.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives