- United States

- /

- Aerospace & Defense

- /

- NYSE:LMT

Lockheed Martin Corporation's (NYSE:LMT) Price Is Out Of Tune With Earnings

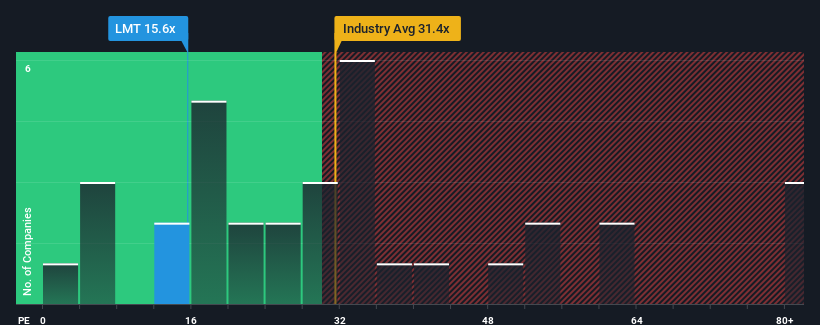

With a median price-to-earnings (or "P/E") ratio of close to 17x in the United States, you could be forgiven for feeling indifferent about Lockheed Martin Corporation's (NYSE:LMT) P/E ratio of 15.6x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Lockheed Martin certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It might be that many expect the strong earnings performance to deteriorate like the rest, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

See our latest analysis for Lockheed Martin

Does Growth Match The P/E?

The only time you'd be comfortable seeing a P/E like Lockheed Martin's is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered an exceptional 27% gain to the company's bottom line. The latest three year period has also seen a 17% overall rise in EPS, aided extensively by its short-term performance. Therefore, it's fair to say the earnings growth recently has been respectable for the company.

Turning to the outlook, the next three years should generate growth of 2.0% per year as estimated by the analysts watching the company. With the market predicted to deliver 11% growth per year, the company is positioned for a weaker earnings result.

In light of this, it's curious that Lockheed Martin's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Bottom Line On Lockheed Martin's P/E

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Lockheed Martin currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

You should always think about risks. Case in point, we've spotted 2 warning signs for Lockheed Martin you should be aware of.

If these risks are making you reconsider your opinion on Lockheed Martin, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:LMT

Lockheed Martin

A security and aerospace company, engages in the research, design, development, manufacture, integration, and sustainment of technology systems, products, and services worldwide.

Very undervalued established dividend payer.