- United States

- /

- Building

- /

- NYSE:LII

Lennox International’s Valuation in Focus Following AI Launches and DOE Validation of Heat Pump Innovation

Reviewed by Simply Wall St

If you have been watching Lennox International (LII) lately, you might have noticed a flurry of developments making waves, especially among investors evaluating their next move. The company recently rolled out two new AI-powered support agents that are already helping thousands of HVAC technicians and homeowners troubleshoot and maintain Lennox systems. On top of that, the commercial heat pump rooftop unit was just validated by the U.S. Department of Energy for exceeding strict lab performance standards. These milestones reflect Lennox’s push toward digital transformation and high-efficiency solutions, both pivotal themes in the evolving HVAC industry.

Despite these advances, Lennox shares have drifted about 7% lower over the past year, with some short-term ups and downs along the way. Longer term, returns have been much more impressive, suggesting real growth for investors who held on through the cycles. With momentum from these product launches and industry recognition, the company appears to be working to reshape its story and potentially change how the market values its future pipeline.

Now, with stock performance lagging in the short term but innovation and engagement on the rise, investors may be considering whether this is a rare buying opportunity for the long term or if the market is already factoring in all of Lennox’s potential future growth.

Most Popular Narrative: 16.3% Undervalued

According to the most widely followed narrative, Lennox International is currently undervalued, with its fair value estimated to be well above the latest share price. The valuation builds on a foundation of steady profit and revenue growth, strong digital transformation momentum, and multi-year expansion in margins.

Strategic partnerships with Samsung (mini splits/VRF with smart tech integration) and Ariston (heat pump water heaters) will expand Lennox's advanced, energy-efficient product offerings. This will enhance its access to segments benefiting from regulatory and consumer demand for sustainability, with significant revenue growth expected from 2026 and 2027 onward.

Is this fair value target just wishful thinking, or is there a hidden logic you are missing? Behind this analyst view lie bold growth assumptions for revenue, margins and profit, plus a big bet on premium pricing and industry disruption. Curious what kind of financial leap is required for Lennox shares to hit this target? The numbers just might surprise you.

Result: Fair Value of $650.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent supply chain challenges or a shift in consumer spending could put pressure on Lennox’s growth story and future valuation.

Find out about the key risks to this Lennox International narrative.Another View: What Does Our DCF Model Say?

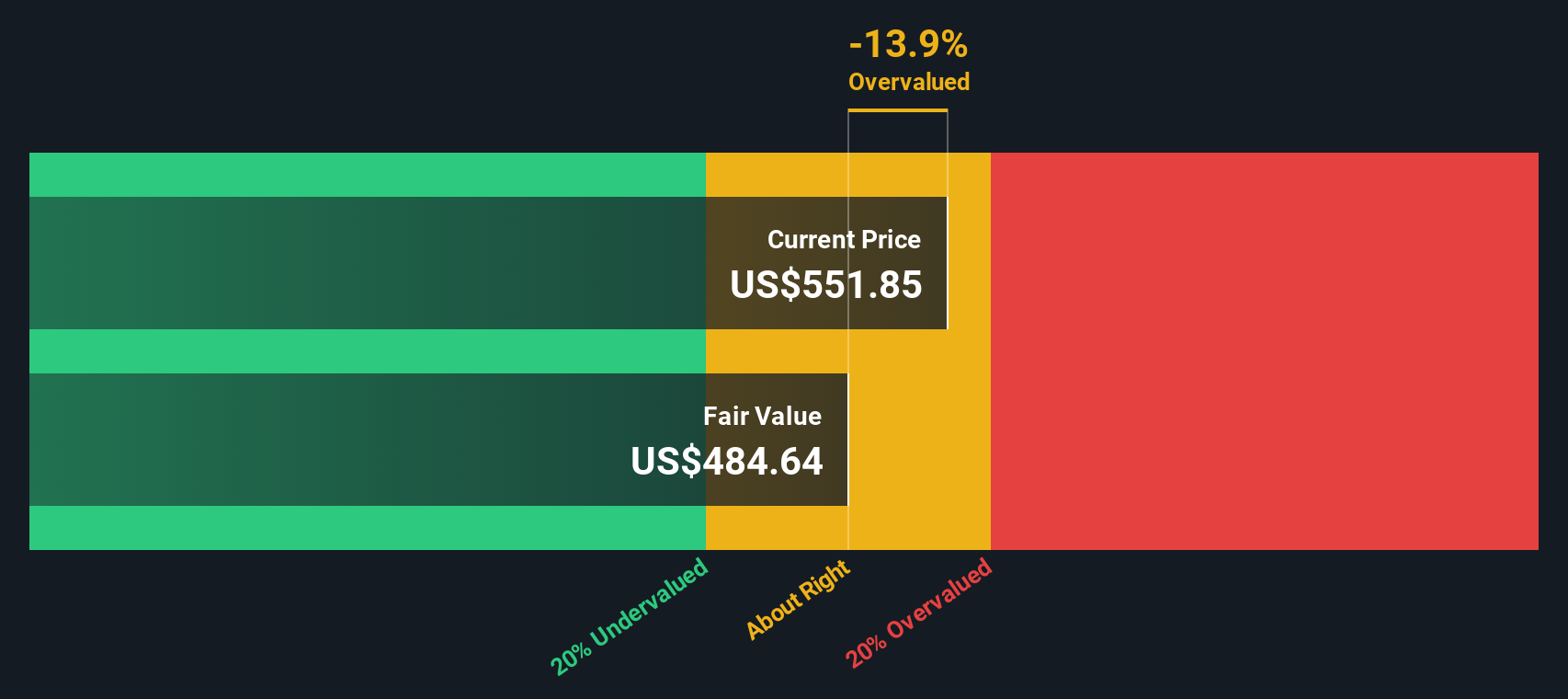

Taking a different approach, our SWS DCF model applies cash flow forecasts and discount rates to assess Lennox International’s value. This method currently offers a more cautious perspective. It suggests the stock may actually be overvalued. Could this fundamental view signal a hidden risk, or does it overlook Lennox’s growth runway?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Lennox International for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Lennox International Narrative

If our models or analyst assumptions are not quite what you see in the numbers, you can dive in and form your own perspective in just a few minutes. Do it your way

A great starting point for your Lennox International research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for one opportunity. Broaden your portfolio’s potential by tapping unique stock themes trusted by seasoned market-watchers and trendsetters. Don’t let the next big win slip by while you’re on the sidelines.

- Capitalize on tiny companies with major upside by starting with penny stocks with strong financials for stocks boasting strong fundamentals before they hit everyone’s radar.

- Ride the surge in artificial intelligence breakthroughs by unlocking a shortlist of promising innovators via our AI penny stocks curated for big potential in the AI revolution.

- Boost your income by targeting top performers with robust yields in the dividend stocks with yields > 3% universe. This approach is ideal for investors seeking consistent cash flow and security.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LII

Lennox International

Designs, manufactures, and markets products for the heating, ventilation, air conditioning, and refrigeration markets in the United States, Canada, and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives