- United States

- /

- Aerospace & Defense

- /

- NYSE:LHX

L3Harris (LHX): Is Expanding Missile and Satellite Production Shaping Its Competitive Edge?

Reviewed by Simply Wall St

- In recent news, L3Harris Technologies was awarded a contract worth up to US$292 million to continue producing propulsion for the Javelin weapon system, and the company opened a new 92,000 square foot spacecraft manufacturing facility with The Austin Company to support next-generation satellite manufacturing.

- This marks L3Harris's largest propulsion production contract to date and highlights its growing investment in digital manufacturing workflows and advanced aerospace capabilities.

- We'll now explore how L3Harris's expanded role in missile propulsion production could influence its future investment narrative and outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

L3Harris Technologies Investment Narrative Recap

At its core, the investment case for L3Harris Technologies rests on the company's ability to win significant defense contracts and deliver advanced technology that supports sustained revenue and earnings growth. The recent US$292 million Javelin propulsion contract supports the company's expanding footprint in high-demand defense segments, potentially reinforcing vital near-term catalysts like increased missile and space system production, though risks remain around its dependence on key subcontractor performance and government budget cycles.

The opening of the new 92,000 square foot spacecraft manufacturing facility stands out as a highly relevant announcement. This launch underpins L3Harris’s efforts to enhance its production scale and technological capabilities in satellite and hypersonic missile defense, areas closely tied to crucial future growth catalysts in aerospace and defense systems.

However, investors should not overlook that, despite recent contract wins, ongoing reliance on other contractors could create timing or efficiency risks that...

Read the full narrative on L3Harris Technologies (it's free!)

L3Harris Technologies is projected to reach $24.9 billion in revenue and $2.7 billion in earnings by 2028. This outlook assumes a 5.2% annual revenue growth and a $1.0 billion increase in earnings from the current $1.7 billion.

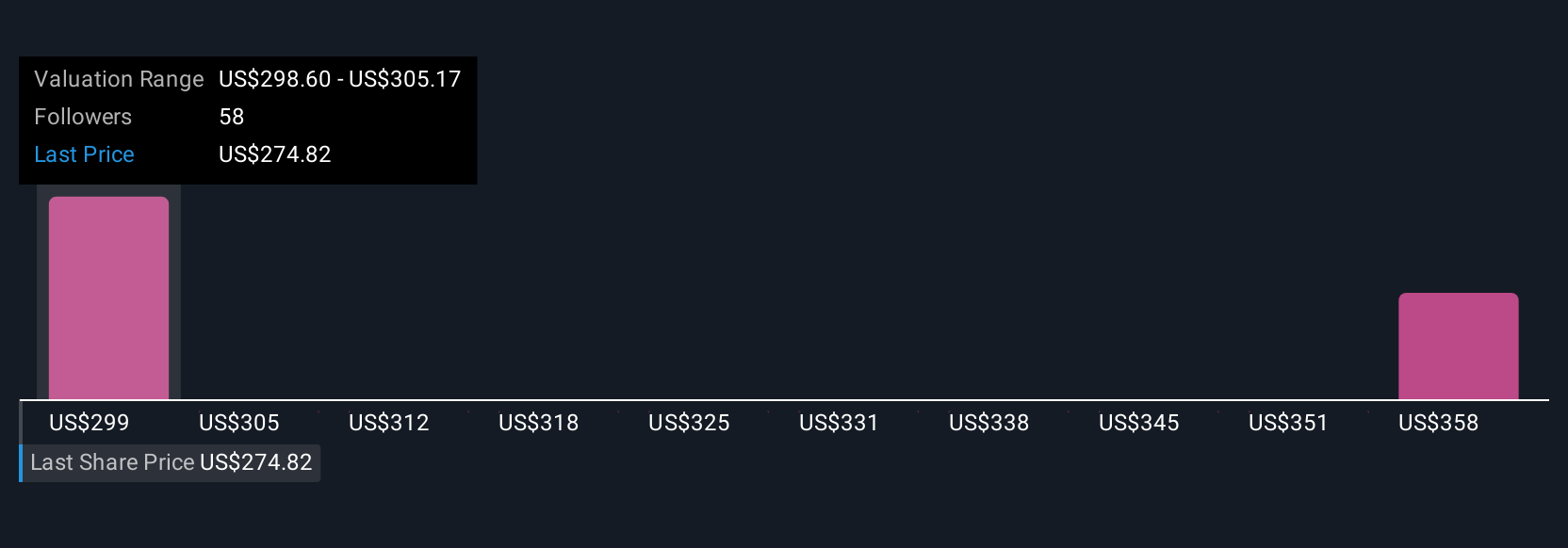

Uncover how L3Harris Technologies' forecasts yield a $302.58 fair value, a 6% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community’s two fair value estimates for L3Harris range from US$302.58 to US$330.75 per share. While many see upside from recent contract momentum, dependency risks may impact results differently, so consider several viewpoints before making your next decision.

Explore 2 other fair value estimates on L3Harris Technologies - why the stock might be worth just $302.58!

Build Your Own L3Harris Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your L3Harris Technologies research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free L3Harris Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate L3Harris Technologies' overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LHX

L3Harris Technologies

Provides mission-critical solutions for government and commercial customers worldwide.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives