- United States

- /

- Machinery

- /

- NYSE:KAI

Results: Kadant Inc. Beat Earnings Expectations And Analysts Now Have New Forecasts

It's been a good week for Kadant Inc. (NYSE:KAI) shareholders, because the company has just released its latest quarterly results, and the shares gained 5.2% to US$333. It looks like a credible result overall - although revenues of US$272m were in line with what the analysts predicted, Kadant surprised by delivering a statutory profit of US$2.68 per share, a notable 11% above expectations. This is an important time for investors, as they can track a company's performance in its report, look at what experts are forecasting for next year, and see if there has been any change to expectations for the business. Readers will be glad to know we've aggregated the latest statutory forecasts to see whether the analysts have changed their mind on Kadant after the latest results.

See our latest analysis for Kadant

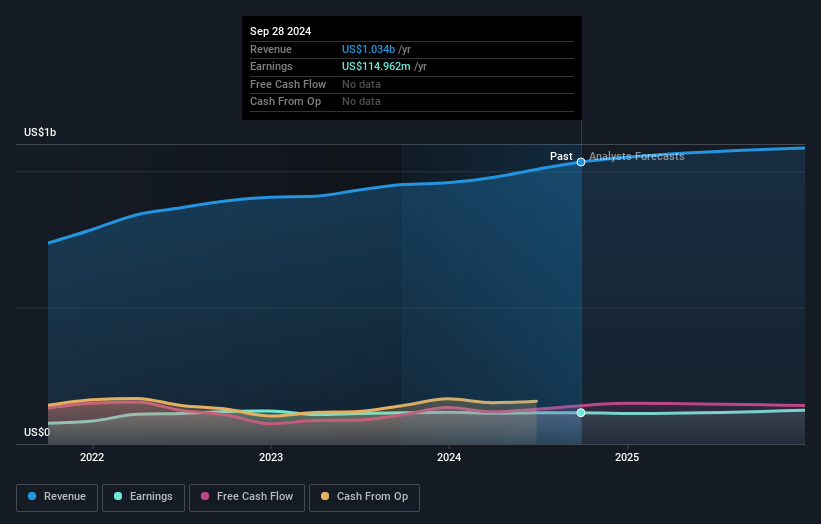

Taking into account the latest results, the consensus forecast from Kadant's three analysts is for revenues of US$1.09b in 2025. This reflects a reasonable 5.0% improvement in revenue compared to the last 12 months. Per-share earnings are expected to rise 7.0% to US$10.47. In the lead-up to this report, the analysts had been modelling revenues of US$1.10b and earnings per share (EPS) of US$10.70 in 2025. The analysts seem to have become a little more negative on the business after the latest results, given the minor downgrade to their earnings per share numbers for next year.

The consensus price target held steady at US$325, with the analysts seemingly voting that their lower forecast earnings are not expected to lead to a lower stock price in the foreseeable future. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. The most optimistic Kadant analyst has a price target of US$360 per share, while the most pessimistic values it at US$300. With such a narrow range of valuations, the analysts apparently share similar views on what they think the business is worth.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Kadant's past performance and to peers in the same industry. We would highlight that Kadant's revenue growth is expected to slow, with the forecast 4.0% annualised growth rate until the end of 2025 being well below the historical 10% p.a. growth over the last five years. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 3.0% annually. Even after the forecast slowdown in growth, it seems obvious that Kadant is also expected to grow faster than the wider industry.

The Bottom Line

The biggest concern is that the analysts reduced their earnings per share estimates, suggesting business headwinds could lay ahead for Kadant. Happily, there were no major changes to revenue forecasts, with the business still expected to grow faster than the wider industry. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

With that in mind, we wouldn't be too quick to come to a conclusion on Kadant. Long-term earnings power is much more important than next year's profits. At Simply Wall St, we have a full range of analyst estimates for Kadant going out to 2025, and you can see them free on our platform here..

It is also worth noting that we have found 1 warning sign for Kadant that you need to take into consideration.

Valuation is complex, but we're here to simplify it.

Discover if Kadant might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:KAI

Flawless balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives