- United States

- /

- Building

- /

- NYSE:JCI

Johnson Controls International (NYSE:JCI) Declares US$0.37 Quarterly Dividend for April 2025

Reviewed by Simply Wall St

Johnson Controls International (NYSE:JCI) recently affirmed its commitment to shareholder returns by approving a quarterly dividend of $0.37 per share. Despite this stable dividend announcement, the company's stock price fell by 4.83% over the past week. This decline contrasts with broader market trends that saw a more modest decline of 3.7%, despite encouraging economic data such as the Consumer Price Index report. While tech stocks rebounded amid hopes of future Federal Reserve rate cuts, JCI's performance diverged from these broader sector gains. The dividend affirmation suggests a robust financial standing, but recent market volatility, driven by economic uncertainty and broader declines in the industrial sector, might overshadow such positive signals. Nonetheless, Johnson Controls continues to emphasize its commitment to returning value to shareholders through consistent dividend payouts, which can be a significant consideration for investors during periods of market instability.

Understand Johnson Controls International's earnings outlook by examining our growth report.

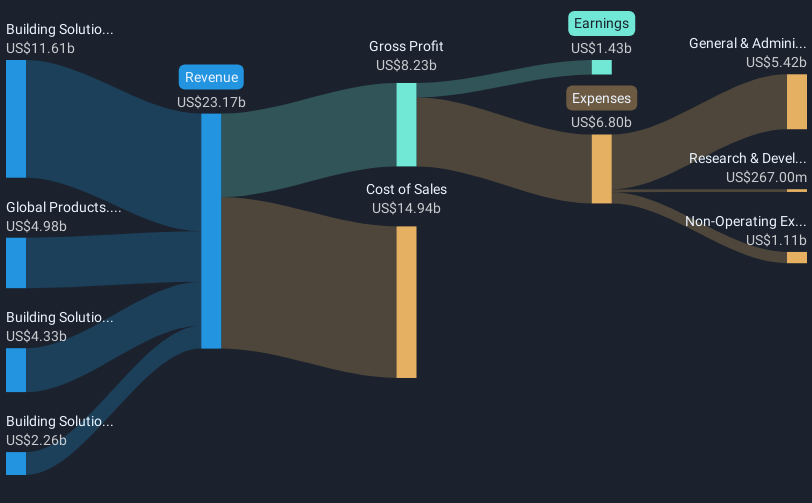

Over the past five years, Johnson Controls International's total shareholder returns reached an impressive 190.18%. This period witnessed significant earnings growth at an annual rate of 9.6%, while recent earnings for Q3 2023 showed substantial improvements with net income climbing to US$1.05 billion from US$379 million the previous year. The company's robust earnings announcements may have positively influenced its longer-term share performance. Additionally, Johnson Controls completed a massive buyback program in February 2025, repurchasing 388.1 million shares for essentially US$17.52 billion, highlighting shareholder value emphasis.

In the last year, JCI outperformed both the US market and the building industry by achieving returns above their respective benchmarks, adding further context to its five-year performance. Despite the company's strong historical returns, challenges such as higher price-to-earnings ratios compared to industry averages and a decline in net profit margin from 8.3% to 6.2% were noted. Recent executive changes, like Joakim Weidemanis' appointment as CEO, also mark strategic shifts potentially impacting future performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JCI

Johnson Controls International

Engages in engineering, manufacturing, commissioning, and retrofitting building products and systems in the United States, Europe, the Asia Pacific, and internationally.

Average dividend payer slight.

Similar Companies

Market Insights

Community Narratives