- United States

- /

- Building

- /

- NYSE:JCI

Does Alpha Modus' AI Patent Lawsuit Change the Bull Case for Johnson Controls International (JCI)?

Reviewed by Sasha Jovanovic

- In October 2025, Alpha Modus Corp. filed new patent infringement lawsuits against Johnson Controls International and others, alleging unauthorized use of its patented artificial intelligence systems for real-time retail analytics in the U.S. District Court for the Eastern District of Texas.

- This escalation underscores the growing legal risks facing technology providers as AI-driven consumer analytics becomes integral to the global retail ecosystem.

- With these lawsuits spotlighting Johnson Controls' exposure to intellectual property disputes in AI retail analytics, we'll examine how this development may affect its investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

Johnson Controls International Investment Narrative Recap

To be a shareholder in Johnson Controls International, you need to believe that the company’s shift toward customer-focused segments and digital building solutions will drive sustainable revenue and margin gains, even as the global building technology sector evolves. The recent patent infringement lawsuit from Alpha Modus Corp. brings legal complexity to Johnson Controls’ AI retail analytics ambitions, but the near-term business catalyst remains closely tied to execution on operational restructuring rather than litigation outcomes, and the most immediate risk continues to be integration challenges in the new reporting model, unaffected, for now, by this legal action.

Of the latest company moves, the September launch of new AI-driven capabilities in the OpenBlue Enterprise Manager suite stands out, underscoring Johnson Controls’ commitment to innovation and efficiency in digital building management. This is highly relevant given the heightened focus on AI, as both a driver of growth and a source of intellectual property risk, something investors need to weigh as part of the evolving investment argument.

However, the potential for short-term disruption from transitional challenges tied to the company’s new organizational structure could present a risk that investors should be aware of if...

Read the full narrative on Johnson Controls International (it's free!)

Johnson Controls International's outlook anticipates $27.0 billion in revenue and $3.3 billion in earnings by 2028. This projection assumes 4.9% annual revenue growth and a $1.3 billion increase in earnings from $2.0 billion today.

Uncover how Johnson Controls International's forecasts yield a $114.95 fair value, a 7% upside to its current price.

Exploring Other Perspectives

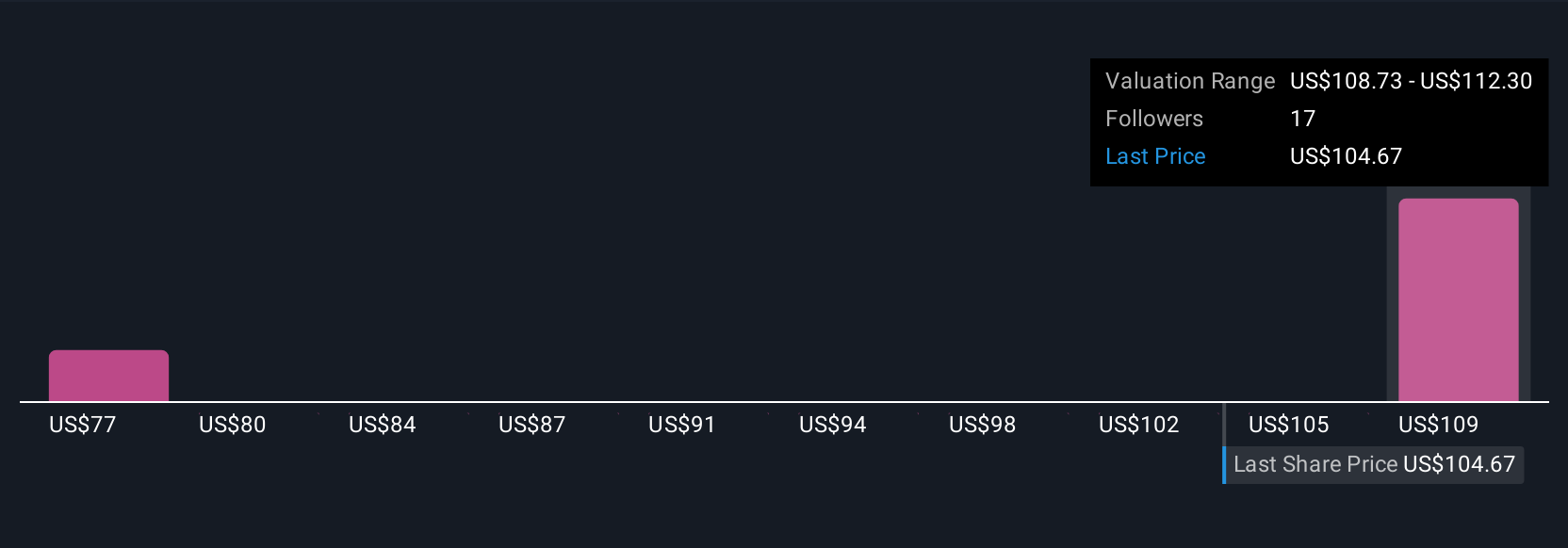

Simply Wall St Community members place Johnson Controls International’s fair value between US$74.47 and US$114.95, across 2 unique estimates. Amid these divergent opinions, integration risks from recent restructuring may remain front of mind for those considering lasting impacts on earnings performance.

Explore 2 other fair value estimates on Johnson Controls International - why the stock might be worth 31% less than the current price!

Build Your Own Johnson Controls International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Johnson Controls International research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Johnson Controls International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Johnson Controls International's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JCI

Johnson Controls International

Engages in engineering, manufacturing, commissioning, and retrofitting building products and systems in the United States, Europe, the Asia Pacific, and internationally.

Proven track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives