- United States

- /

- Machinery

- /

- NYSE:JBTM

JBT Marel (JBTM): Reassessing Valuation After Fed Rate Cut Fuels Latest Share Price Pop

Reviewed by Simply Wall St

The latest pop in JBT Marel (JBTM) came right after the Federal Reserve trimmed rates and leaned dovish, a backdrop that pushed industrial names higher and sharpened investor focus on JBTM’s longer term trajectory.

See our latest analysis for JBT Marel.

That surge slots into an already impressive run, with the share price now at $153.8 and a year to date share price return of 22.73 percent alongside a 3 year total shareholder return of 71.98 percent. This signals that momentum is clearly building rather than fading.

If this rate driven move in JBT Marel has you thinking about what else could rerate next, it might be worth exploring aerospace and defense stocks as another pocket of cyclical industrial opportunity.

With the stock now brushing its price target, a modest intrinsic discount hinted at by valuation models, and earnings still catching up, is JBT Marel a quietly mispriced compounder, or has the market already banked the next leg of growth?

Most Popular Narrative Narrative: 0.9% Undervalued

With JBT Marel last closing at $153.8 against a narrative fair value near $155.25, the story leans toward slight upside rather than euphoria.

The JBT Marel merger is already realizing synergy benefits, enabling margin expansion through cost savings, portfolio breadth, increased cross selling, and a deeper customer relationship via integrated system sales, which management expects to continue driving net margin improvement into 2027.

Want to see what turns a current loss maker into a high margin cash engine? The narrative quietly bakes in surging growth, expanding profitability, and a future earnings multiple that would surprise most industrial investors. Curious which specific financial milestones have to fall into place?

Result: Fair Value of $155.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stubborn tariff pressures and slower than expected merger integration could easily cap margin expansion. This may challenge the upbeat earnings and valuation path embedded in today’s narrative.

Find out about the key risks to this JBT Marel narrative.

Another Lens on Value

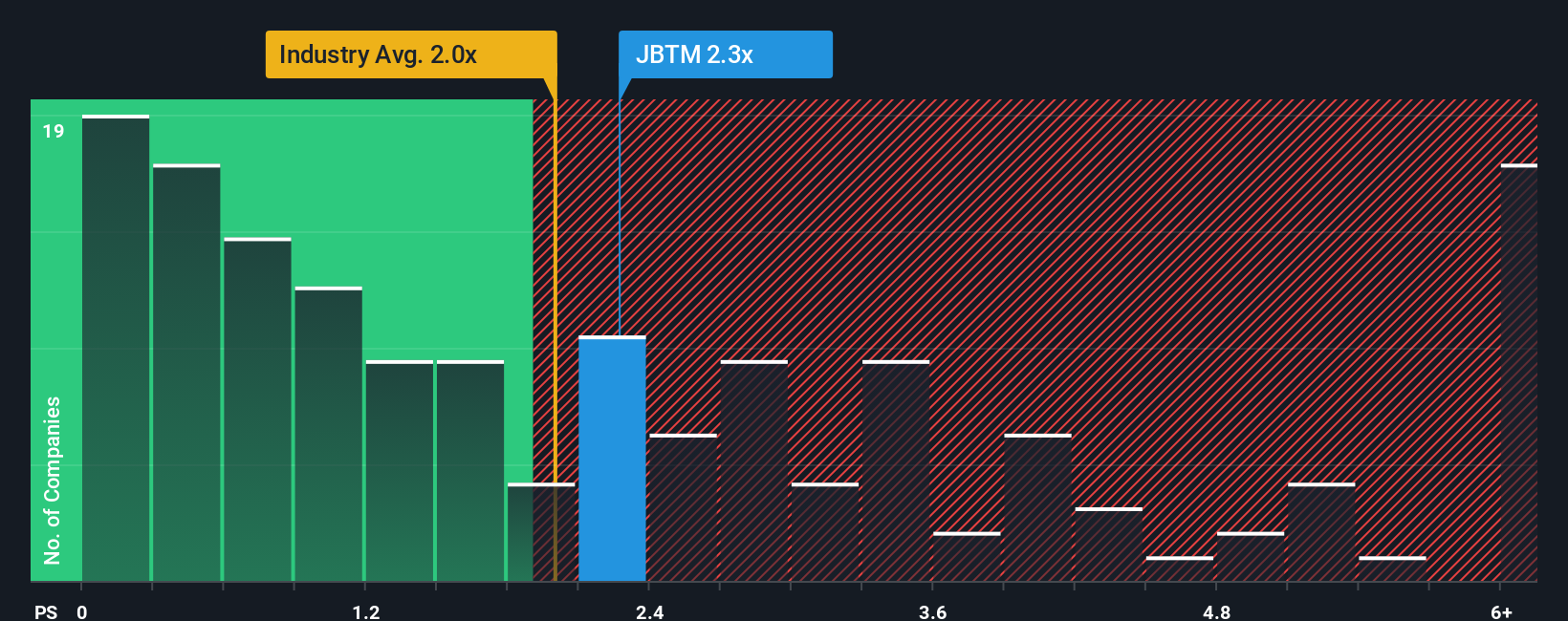

On sales based metrics, JBT Marel looks slightly stretched, trading at a 2.5 times price to sales ratio against a 2.4 times fair ratio and a 2 times industry average. That leaves less margin for error if growth stumbles, so is the recent momentum already pricing in the good news?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own JBT Marel Narrative

If you see the story differently, or would rather dig into the numbers yourself, you can build a fresh view in under three minutes with Do it your way.

A great starting point for your JBT Marel research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop at JBT Marel. Sharpen your edge by using the Simply Wall Street Screener to uncover fresh, data backed opportunities before the crowd notices.

- Secure stronger income potential by reviewing these 12 dividend stocks with yields > 3% that aim to balance reliable payouts with solid business quality.

- Capitalize on structural growth trends by assessing these 30 healthcare AI stocks transforming how medicine, diagnostics, and patient care are delivered.

- Amplify your upside prospects by targeting these 904 undervalued stocks based on cash flows where market prices still lag underlying cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JBTM

JBT Marel

Provides technology solutions to food and beverage industry in North America, Europe, the Middle East, Africa, the Asia Pacific, and Central and South America.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)