- United States

- /

- Building

- /

- NYSE:JBI

Janus International Group, Inc. (NYSE:JBI) Not Doing Enough For Some Investors As Its Shares Slump 28%

To the annoyance of some shareholders, Janus International Group, Inc. (NYSE:JBI) shares are down a considerable 28% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 29% share price drop.

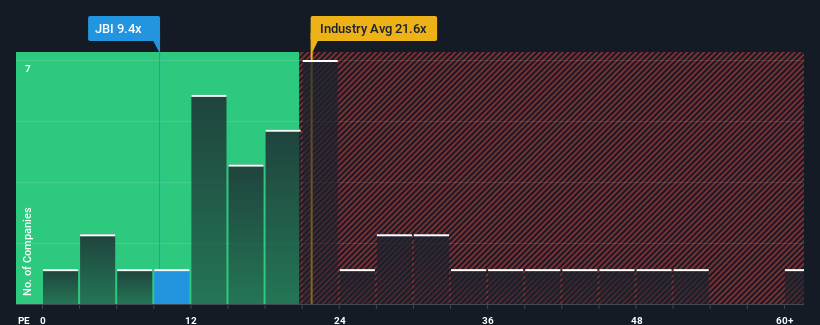

Following the heavy fall in price, Janus International Group may be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 9.4x, since almost half of all companies in the United States have P/E ratios greater than 18x and even P/E's higher than 34x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times haven't been advantageous for Janus International Group as its earnings have been falling quicker than most other companies. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for Janus International Group

Is There Any Growth For Janus International Group?

The only time you'd be truly comfortable seeing a P/E as low as Janus International Group's is when the company's growth is on track to lag the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 20%. Still, the latest three year period has seen an excellent 51% overall rise in EPS, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Turning to the outlook, the next year should bring diminished returns, with earnings decreasing 38% as estimated by the five analysts watching the company. With the market predicted to deliver 15% growth , that's a disappointing outcome.

In light of this, it's understandable that Janus International Group's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

What We Can Learn From Janus International Group's P/E?

Janus International Group's recently weak share price has pulled its P/E below most other companies. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Janus International Group maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 3 warning signs for Janus International Group you should be aware of, and 1 of them shouldn't be ignored.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:JBI

Janus International Group

Janus International Group, Inc. manufacturers and supplies turn-key self-storage, commercial, and industrial building solutions in North America and internationally.

Moderate growth potential with mediocre balance sheet.

Market Insights

Community Narratives