- United States

- /

- Machinery

- /

- NYSE:ITT

How ITT’s (ITT) New Chair Appointment Shapes Its Governance and Investment Narrative

Reviewed by Sasha Jovanovic

- ITT Inc. recently announced that its Board has appointed director Nazzic S. Keene to succeed Timothy H. Powers as non-executive Board Chair following his retirement, with the transition expected after her election at the May 2026 Annual Meeting of Shareholders.

- Keene’s background as former CEO of Science Applications International Corporation and her current board roles at Automatic Data Processing Inc. and Caterpillar Inc. adds deeper information technology and M&A integration expertise to ITT’s boardroom.

- We’ll now look at how Keene’s appointment as incoming Board Chair could influence ITT’s investment narrative and long-term governance profile.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

ITT Investment Narrative Recap

To own ITT, you need to believe in its ability to convert a large, project-heavy backlog into consistent earnings while managing cyclicality in energy and industrial markets. Keene’s appointment as future Board Chair is a governance update rather than a near term catalyst, and it does not materially alter the key risk around execution on complex projects and acquisitions that could affect revenue visibility and margin stability.

The most relevant recent announcement alongside this board change is ITT’s completion of the second phase of its US$25 million expansion of the Industrial Process facility in Dammam, Saudi Arabia, which doubles capacity. That expansion ties directly into the company’s backlog driven growth catalyst, but it also raises the stakes on managing project-based revenue concentration, execution risk, and integration discipline across newer, higher growth markets.

Yet behind ITT’s growing project footprint, investors should be aware of how much earnings now hinge on avoiding delays, cost overruns, or cancellations in...

Read the full narrative on ITT (it's free!)

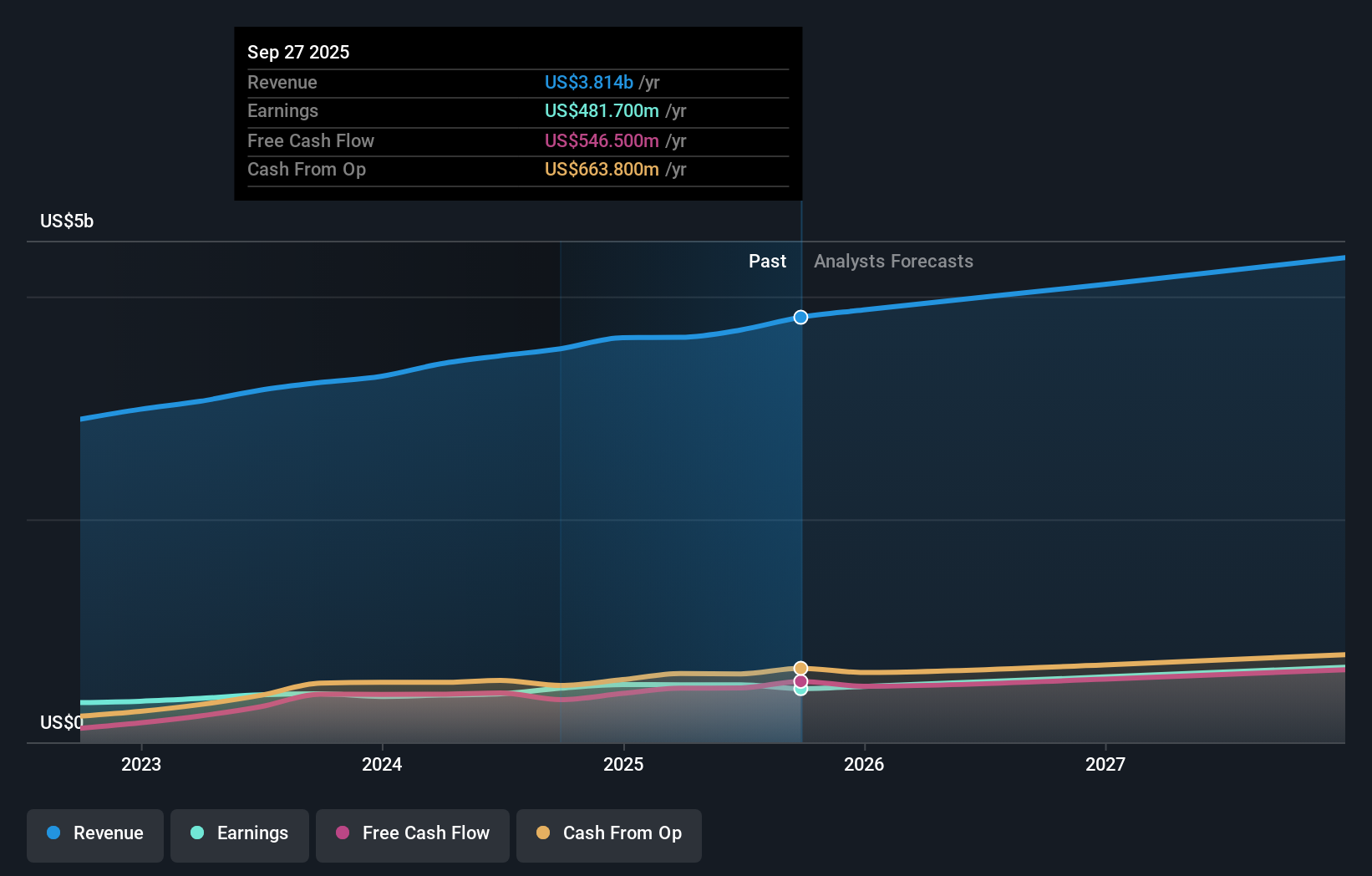

ITT's narrative projects $4.4 billion revenue and $651.2 million earnings by 2028. This requires 6.3% yearly revenue growth and about a $134.7 million earnings increase from $516.5 million today.

Uncover how ITT's forecasts yield a $208.91 fair value, a 16% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community’s 3 fair value estimates for ITT range widely, from US$59.46 up to US$208.91, showing very different views on upside. You can set those against the company’s growing exposure to project based revenue and M&A integration risk, which could influence how reliably ITT converts its backlog and acquisitions into future earnings, and decide which scenarios you find most convincing.

Explore 3 other fair value estimates on ITT - why the stock might be worth less than half the current price!

Build Your Own ITT Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ITT research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free ITT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ITT's overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ITT

ITT

Manufactures and sells engineered critical components and customized technology solutions for the transportation, industrial, and energy markets.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026