- United States

- /

- Machinery

- /

- NYSE:IR

Ingersoll Rand (NYSE:IR) Stock Jumps 16% Over The Past Month

Reviewed by Simply Wall St

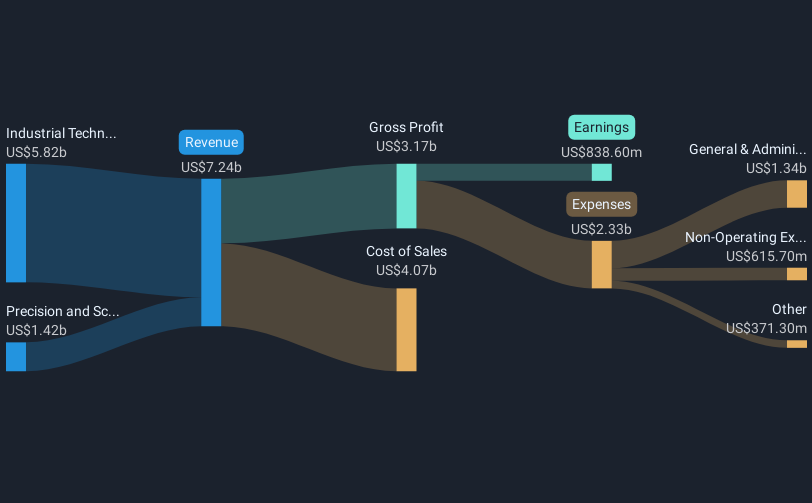

Ingersoll Rand (NYSE:IR) recently reported its Q1 2025 earnings, showcasing increased sales despite a dip in net income. Their commitment to shareholder value is emphasized through the ongoing dividend distribution and substantial expansion of their buyback program. Over the past month, Ingersoll Rand's stock price rose 16%, outperforming the broader market's 4% increase. The company's strategic moves in capital allocation, especially the increased buyback authorization, likely added weight to its upward price movement, aligning with the positive broader market momentum. As earnings expectations remain robust, these developments strengthen investor confidence in the company's growth trajectory.

The recent uptick in Ingersoll Rand's stock price, influenced by strong Q1 earnings and an enlarged buyback program, aligns with analysts' forecasts for revenue and earnings growth. Their strategy of strategic acquisitions and cost efficiencies underpins the robust order growth and margin improvements. Such initiatives may continue to bolster revenue predictions, even as the company encounters potential challenges from pricing strategies and macroeconomic uncertainties. Potential risks could temper these expectations, affecting projected profit margins and earnings targets.

Over the past five years, Ingersoll Rand's total shareholder return, which includes dividends and share price appreciation, soared to 198%, reflecting effective capital allocation and operational resilience. This impressive performance contrasts with its recent underperformance relative to the broader US market and Machinery industry, both of which posted stronger gains over the past year.

In context of valuation, the current share price decrease from the consensus price target of US$91.48, equivalent to a 17% gap, suggests room for further price growth, contingent on meeting revenue and earnings forecasts. Investors should weigh the potential of Ingersoll Rand's strategic ventures against inherent risks, considering both the company's historical success and its alignment with market expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Ingersoll Rand, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IR

Ingersoll Rand

Provides various mission-critical air, fluid, energy, and medical technologies services and solutions worldwide.

Adequate balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives