- United States

- /

- Aerospace & Defense

- /

- NYSE:HWM

Howmet Aerospace (HWM): Assessing Valuation After U.S.-China Trade Tension Relief Boosts Investor Optimism

Reviewed by Kshitija Bhandaru

Howmet Aerospace (HWM) shares saw a lift after President Trump adopted a more conciliatory approach toward U.S.-China relations, which eased worries about intensifying trade tensions among investors with global interests.

See our latest analysis for Howmet Aerospace.

The market’s upbeat reaction to easing trade war concerns gave Howmet Aerospace another boost, adding to its already strong momentum. After climbing 1.6% in just one day, the share price has now delivered a 3.9% return over the past month and a remarkable year-to-date share price return of 74.2%. Long-term investors have seen even bigger rewards, with a 1-year total shareholder return of 86.3% and an eye-catching 973% total return over five years, providing clear evidence of the company’s ability to capitalize on favorable shifts in sentiment and capture sustained growth.

If the broader upswing in the aerospace sector has you curious, this is a perfect moment to discover other contenders. See the full list for free with See the full list for free..

With Howmet’s shares riding high and trading well above some valuation estimates, investors are left to ponder: does the current price reflect all the company’s future gains, or is there still room to buy in?

Most Popular Narrative: 6.5% Undervalued

Howmet Aerospace's fair value target, guided by the most closely tracked narrative, stands above the recent closing price. The fair value estimate of $206.38 is approximately 6.5% higher than the market's last trade, highlighting optimism about future prospects.

Major capacity expansions in high-margin engine products and industrial gas turbines, backed by customer agreements, are set to ramp in 2026 and 2027. These projects should deliver significant revenue growth and incremental margin expansion as initial launch costs normalize.

Curious what assumptions lead to this premium? The real story centers on projected leaps in revenue, enhanced margins, and a future profit multiple that rivals top growth stocks. See which forecasted milestones drive the narrative’s calculation and discover how bold financial models are shaping this valuation.

Result: Fair Value of $206.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the outlook is not without risks, as slower demand growth or OEM supply chain issues could quickly challenge these bullish long-term assumptions.

Find out about the key risks to this Howmet Aerospace narrative.

Another View: Multiples Tell a Different Story

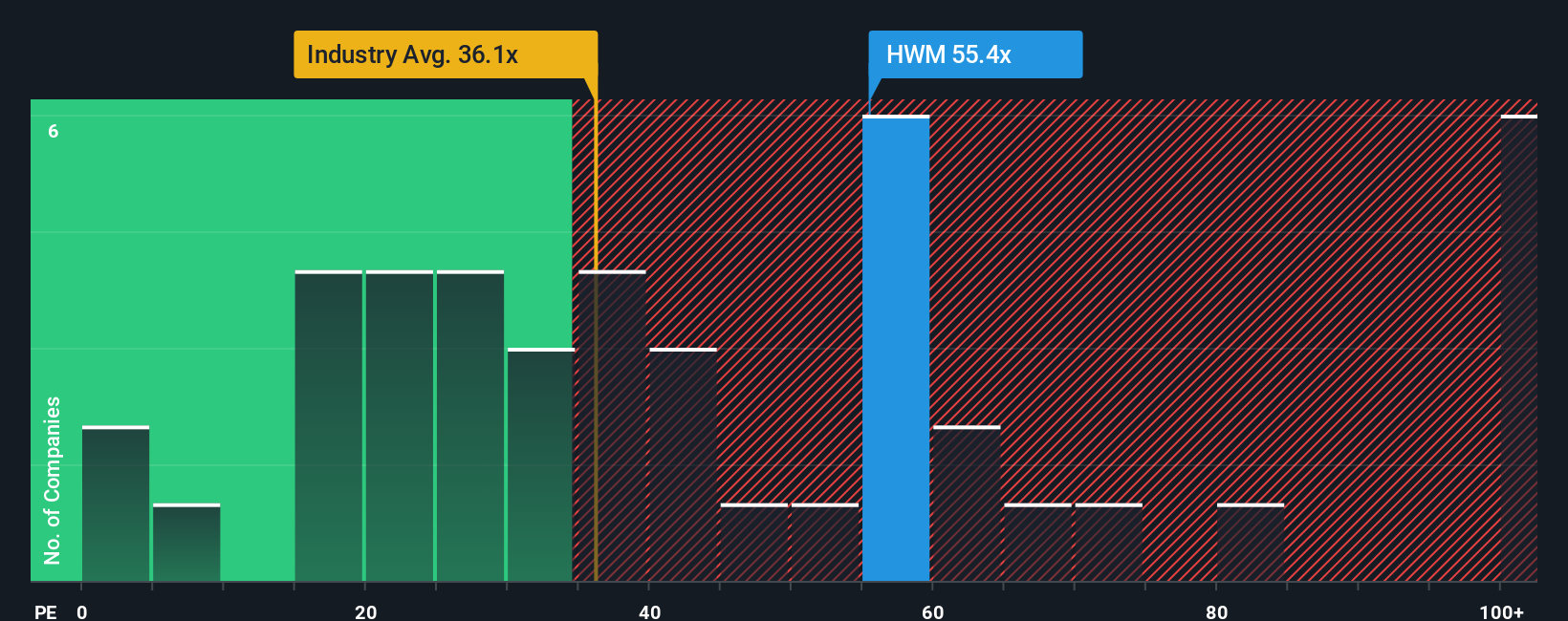

While the fair value target based on bullish growth assumptions suggests Howmet Aerospace is undervalued, a look at market valuation signals more caution. The company’s price-to-earnings ratio is currently 55.8x, which is well above both its industry average of 40x and the fair ratio of 35.6x. This premium signals that investors are paying up for future potential, but it also raises the bar for continued outperformance. Does this leave less margin for error if growth expectations falter?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Howmet Aerospace Narrative

Of course, if you see things differently or would rather dig into the numbers personally, you can shape your own narrative in just a few minutes. Do it your way

A great starting point for your Howmet Aerospace research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your portfolio to a single story. Take the next step by tapping into smart opportunities, built from data and community insights for investors who want an edge.

- Unlock steady growth prospects when you scan for income potential with these 18 dividend stocks with yields > 3%, offering yields greater than 3% from financially resilient companies.

- Catch tomorrow’s market leaders by tracking innovation with these 25 AI penny stocks, focusing on firms advancing artificial intelligence across vital industries.

- Target value before the crowd by scouring these 879 undervalued stocks based on cash flows, highlighting investments overlooked by the broader market but supported by robust fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Howmet Aerospace might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HWM

Howmet Aerospace

Provides advanced engineered solutions for the aerospace and transportation industries in the United States, Japan, France, Germany, the United Kingdom, Mexico, Italy, Canada, Poland, China, and internationally.

Outstanding track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives