- United States

- /

- Electrical

- /

- NYSE:HUBB

Hubbell (HUBB): Exploring Valuation and Upside Potential After Recent Share Price Recovery

Reviewed by Kshitija Bhandaru

See our latest analysis for Hubbell.

After a small rally this week, Hubbell’s share price seems to be regaining some momentum. Its 1-year total shareholder return still sits just below break-even. Investors who held for the last three or five years are looking at total returns of 94% and 216%, which signals longer-term value creation.

If you're interested in how other companies are building on consistent performance, now’s a perfect chance to discover fast growing stocks with high insider ownership

With Hubbell showing steady, if unspectacular, gains and sitting just shy of analyst price targets, the real question is whether there is unrecognized value left for investors or if future growth is already fully reflected in the current price.

Most Popular Narrative: 6% Undervalued

Hubbell’s last close of $427.43 is a touch below the most followed narrative’s fair value estimate of $456.73. This view turns the spotlight on a small margin of potential upside and hints that current consensus expects a little more growth ahead.

Hubbell's segments are experiencing strong organic growth and improving margins supported by demand in data centers and grid modernization. Actions tackling cost inflation are anticipated to stabilize earnings, while investments in acquisitions should sustain revenue growth and EPS expansion.

Curious what drives the optimism? The story behind this price target is built on accelerating operating margins, a cash-generating business model, and future numbers that might surprise you. Want to see the full financial playbook and the bold assumptions built into this fair value? Click to unveil the details.

Result: Fair Value of $456.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing cost inflation and potential tariffs could still pressure Hubbell’s future margins if pricing actions are insufficient.

Find out about the key risks to this Hubbell narrative.

Another View: What Do the Multiples Say?

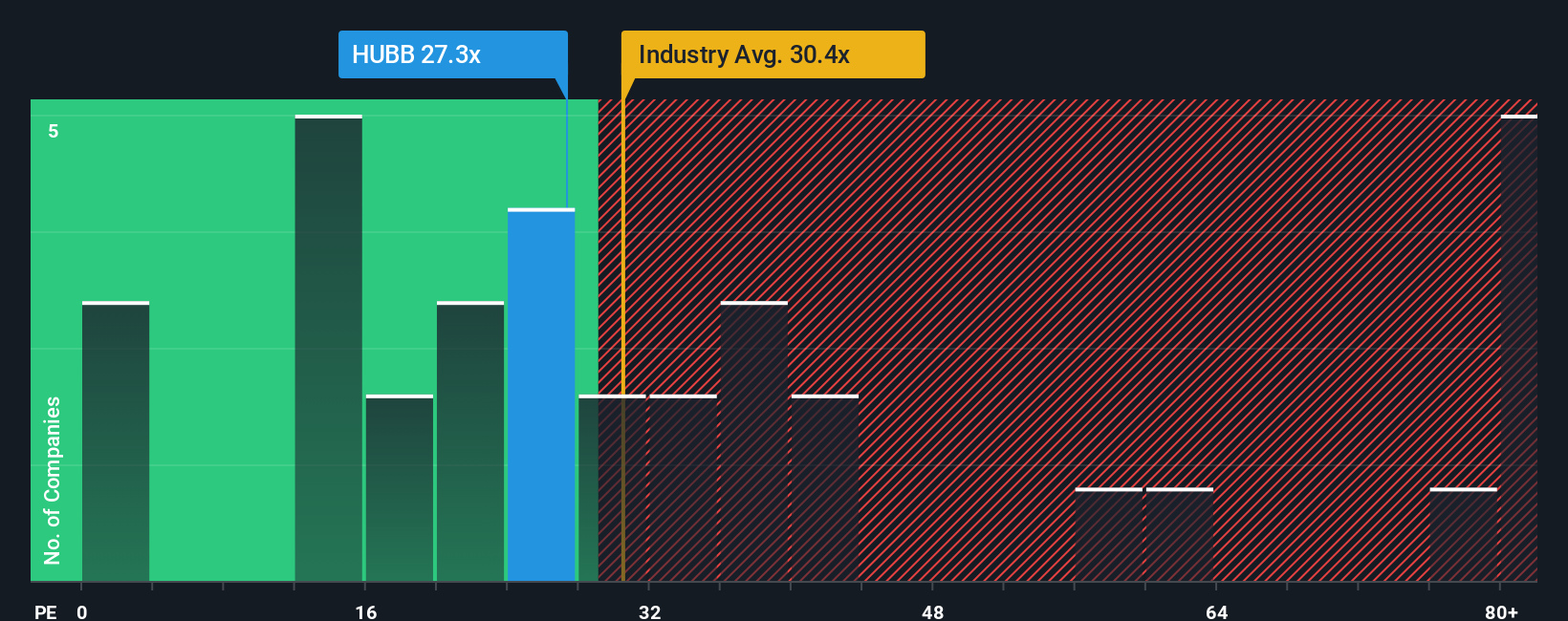

Our market multiples approach tells a slightly different story than the consensus price target. Hubbell's price-to-earnings ratio of 27.4x is below the peer average of 40x and the industry average of 28.8x, but it is notably above its fair ratio of 24.7x. This gap means the stock could be expensive unless future growth outpaces expectations. Could the market be too optimistic, or does Hubbell have hidden upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hubbell Narrative

If you think the story here could look different or want to put your own research to the test, you can craft a personal narrative in just minutes. Do it your way.

A great starting point for your Hubbell research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Your next winning portfolio move could be hiding in plain sight. Give yourself an edge by checking out these standout stock themes curated by Simply Wall Street:

- Identify future industry leaders when you check out these 25 AI penny stocks. These companies are harnessing artificial intelligence breakthroughs and reshaping how modern businesses compete.

- Capture reliable income by following these 18 dividend stocks with yields > 3%, which features companies with robust yields and strong histories of regular payouts.

- Capitalize on disruptive innovation and track the pioneers powering tomorrow’s computing with these 26 quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hubbell might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HUBB

Hubbell

Designs, manufactures, and sells electrical and utility solutions in the United States and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives