- United States

- /

- Machinery

- /

- NYSE:HLIO

Helios Technologies (HLIO): Assessing Valuation After Recent Weak Share Performance

Reviewed by Kshitija Bhandaru

See our latest analysis for Helios Technologies.

While Helios Technologies has staged a notable rebound over the past quarter with a 29.96% share price return, recent weeks have seen that momentum fade. The stock is down 14.08% in just the past month. Putting it all in perspective, Helios’s latest share price sits at $47.11. Despite some short-term volatility, the company’s one-year total shareholder return is down 1.94%, suggesting the long-term trend is still finding its footing rather than gaining meaningful traction.

If today’s reversal has you wondering where else opportunity may be building, now is an ideal moment to broaden your scope and discover fast growing stocks with high insider ownership

With shares lagging despite a past quarter rally and trading nearly 31% below intrinsic value estimates, investors may wonder whether Helios Technologies is a hidden bargain primed for recovery or if today’s prices already reflect all the expected growth ahead.

Most Popular Narrative: 22.3% Undervalued

Compared to the previous closing price of $47.11, Helios Technologies' widely followed narrative places its fair value significantly higher. The stage is set for a deeper investigation into why some analysts see big upside from current levels.

The shift in the industry towards electrification of mobile and industrial equipment is driving OEM demand for sophisticated electro-hydraulic and electronic control solutions. These are areas where Helios is actively innovating (e.g., Enovation Controls, Cygnus Reach), supporting both top-line growth and margin expansion over the medium to long term.

Want to know what’s powering this bullish outlook? Intricate forecasts for Helios’s sales, profits, and future margins could help the company command a market premium. The real twist? The fair value is based on estimates that would surprise even seasoned investors. See which critical financial inflection point underpins this narrative’s confidence.

Result: Fair Value of $60.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent end-market volatility and slow adoption of new technologies could challenge Helios’s growth story and cast doubt on the current bullish narrative.

Find out about the key risks to this Helios Technologies narrative.

Another View: Pricing In The Realities

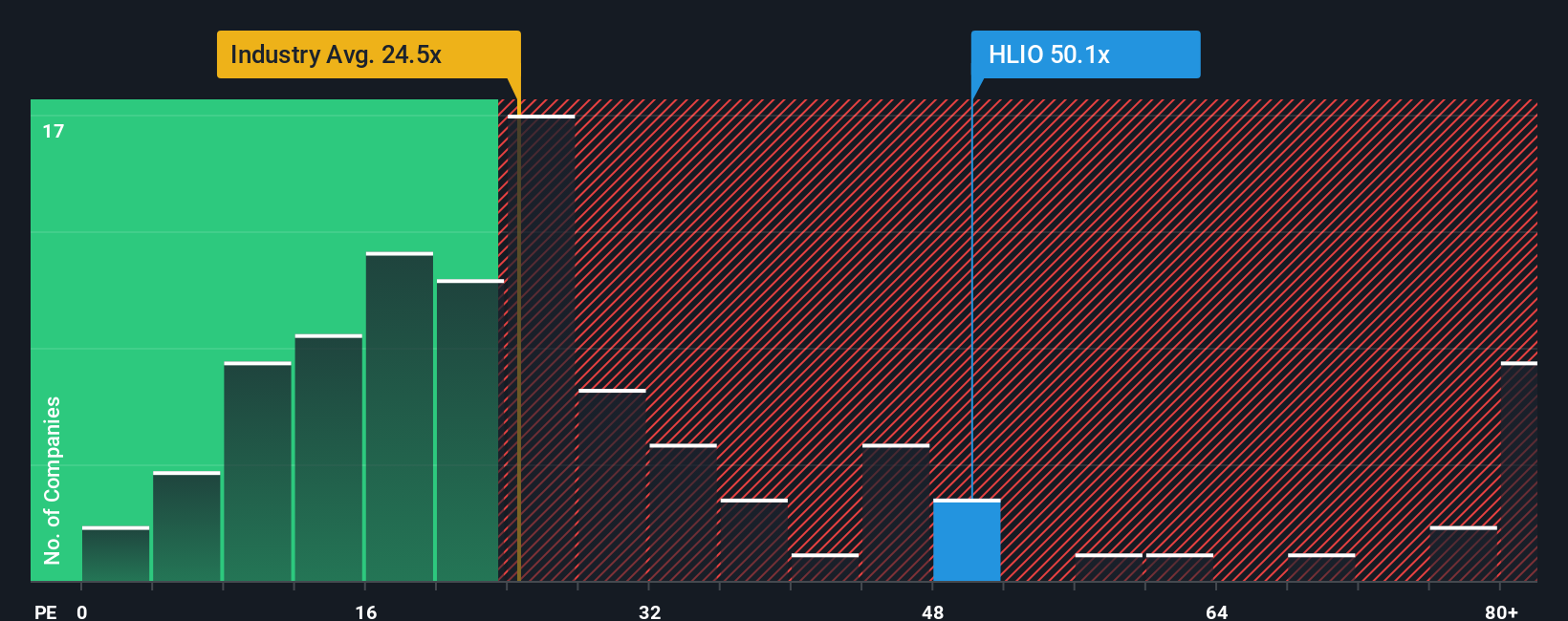

Looking from a market perspective, Helios Technologies trades at a price-to-earnings ratio of 44.8x, which is notably higher than both its industry average (23.8x) and its immediate peers (37.5x). The fair ratio, based on our regression analysis, stands at 40.5x. That premium signals either strong future belief or increased valuation risk. Is the current optimism getting ahead of fundamentals, or is the market spot on?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Helios Technologies Narrative

If your take on Helios Technologies differs or you prefer to chart your own course, crafting a personal narrative is quick and straightforward. Do it your way

A great starting point for your Helios Technologies research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Why settle for just one opportunity? Seize your chance to uncover profitable stocks aligned with your goals by using the Simply Wall Street screener.

- Unlock the potential of digital finance and monitor market innovators by following these 79 cryptocurrency and blockchain stocks making waves in the cryptocurrency space.

- Target regular income streams with these 19 dividend stocks with yields > 3% that consistently deliver yields above 3%. This can be an essential addition to any watchlist.

- Get ahead of mega trends in medicine by finding these 32 healthcare AI stocks leading advances at the intersection of healthcare and artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Helios Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HLIO

Helios Technologies

Provides engineered motion control and electronic controls technology solutions in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives