- United States

- /

- Aerospace & Defense

- /

- NYSE:HII

Is Huntington Ingalls Industries, Inc.'s (NYSE:HII) Recent Stock Performance Influenced By Its Fundamentals In Any Way?

Huntington Ingalls Industries' (NYSE:HII) stock is up by a considerable 16% over the past month. We wonder if and what role the company's financials play in that price change as a company's long-term fundamentals usually dictate market outcomes. Specifically, we decided to study Huntington Ingalls Industries' ROE in this article.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

See our latest analysis for Huntington Ingalls Industries

How Do You Calculate Return On Equity?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Huntington Ingalls Industries is:

12% = US$550m ÷ US$4.7b (Based on the trailing twelve months to December 2024).

The 'return' is the yearly profit. So, this means that for every $1 of its shareholder's investments, the company generates a profit of $0.12.

What Has ROE Got To Do With Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Huntington Ingalls Industries' Earnings Growth And 12% ROE

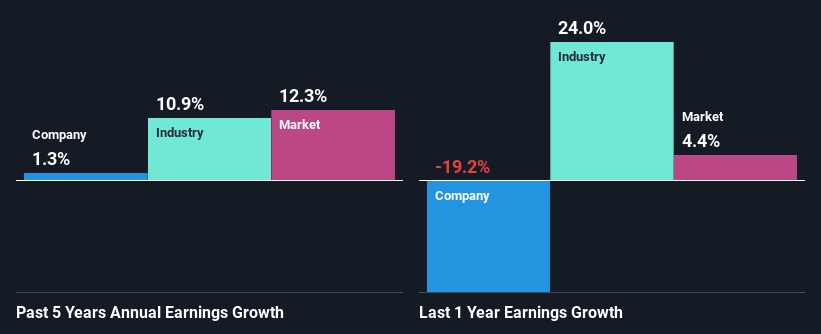

To start with, Huntington Ingalls Industries' ROE looks acceptable. And on comparing with the industry, we found that the the average industry ROE is similar at 12%. However, we are curious as to how Huntington Ingalls Industries' decent returns still resulted in flat growth for Huntington Ingalls Industries in the past five years. Based on this, we feel that there might be other reasons which haven't been discussed so far in this article that could be hampering the company's growth. These include low earnings retention or poor allocation of capital.

We then compared Huntington Ingalls Industries' net income growth with the industry and found that the company's growth figure is lower than the average industry growth rate of 11% in the same 5-year period, which is a bit concerning.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. Doing so will help them establish if the stock's future looks promising or ominous. What is HII worth today? The intrinsic value infographic in our free research report helps visualize whether HII is currently mispriced by the market.

Is Huntington Ingalls Industries Making Efficient Use Of Its Profits?

Despite having a normal three-year median payout ratio of 33% (implying that the company keeps 67% of its income) over the last three years, Huntington Ingalls Industries has seen a negligible amount of growth in earnings as we saw above. Therefore, there might be some other reasons to explain the lack in that respect. For example, the business could be in decline.

In addition, Huntington Ingalls Industries has been paying dividends over a period of at least ten years suggesting that keeping up dividend payments is way more important to the management even if it comes at the cost of business growth. Based on the latest analysts' estimates, we found that the company's future payout ratio over the next three years is expected to hold steady at 36%. Therefore, the company's future ROE is also not expected to change by much with analysts predicting an ROE of 13%.

Conclusion

In total, it does look like Huntington Ingalls Industries has some positive aspects to its business. However, given the high ROE and high profit retention, we would expect the company to be delivering strong earnings growth, but that isn't the case here. This suggests that there might be some external threat to the business, that's hampering its growth. With that said, the latest industry analyst forecasts reveal that the company's earnings are expected to accelerate. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

If you're looking to trade Huntington Ingalls Industries, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Huntington Ingalls Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:HII

Huntington Ingalls Industries

Designs, builds, overhauls, and repairs military ships in the United States.

Undervalued average dividend payer.