- United States

- /

- Aerospace & Defense

- /

- NYSE:HEI

HEICO (NYSE:HEI) Sees 15% Stock Surge As Strong Q1 2025 Earnings Impress Investors

Reviewed by Simply Wall St

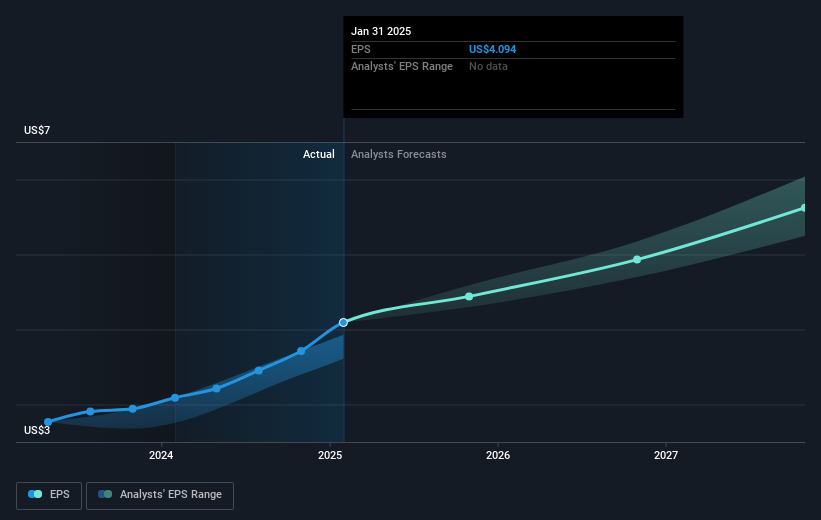

HEICO (NYSE:HEI) experienced a notable 15% increase in its share price over the last week, driven by the strong Q1 2025 earnings report. The company announced sales of $1,030 million and net income of $168 million, both up significantly from the previous year. Basic and diluted earnings per share also showed considerable growth, reflecting HEICO's ongoing financial health. Meanwhile, external market conditions were generally unfavorable, with major indices such as the Dow Jones and S&P 500 experiencing slight declines amid economic concerns. Despite this, HEICO's strong earnings report seems to have overshadowed broader market trends and contributed positively to its stock performance. Additionally, executive changes in the accounting department, where Bradley K. Rowen took over as Chief Accounting Officer, may have reinforced investor confidence in the company's leadership. These factors collectively suggest investor optimism regarding HEICO's recent performance and future prospects.

Dig deeper into the specifics of HEICO here with our thorough analysis report.

Over the past five years, HEICO's shares have returned a significant 175.47%, combining both share price growth and dividends. This impressive performance contrasts with its Price-To-Earnings Ratio, which remains high compared to the aerospace and defense industry average. Despite this premium valuation, HEICO has consistently exceeded both market and industry returns over the past year, signaling its shareholder appeal.

Key factors contributing to its long-term performance include robust earnings growth, with Q3 2024 earnings showing a large year-over-year increase in sales to US$992.25 million. The company's dedication to rewarding investors is evidenced by its 93rd consecutive semiannual cash dividend, with a 10% rise announced in June 2024. Leadership transitions, like Bradley K. Rowen's appointment as Chief Accounting Officer, also reflected stability, supporting investor confidence. Such developments and continued profitability have kept HEICO's shares attractive to investors over the years.

- Unlock the insights behind HEICO's valuation and discover its true investment potential

- Understand the uncertainties surrounding HEICO's market positioning with our detailed risk analysis report.

- Already own HEICO? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HEICO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HEI

HEICO

Through its subsidiaries, designs, manufactures, and sells aerospace, defense, and electronic related products and services in the United States and internationally.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives