- United States

- /

- Building

- /

- NYSE:HAYW

Is the Labor Market Revision Shifting the Outlook for Hayward Holdings (HAYW)?

Reviewed by Simply Wall St

- Earlier this week, Hayward Holdings faced heightened attention after the U.S. Labor Department sharply revised job market data, indicating employers added 911,000 fewer jobs from April 2024 to March 2025 than initially estimated.

- This unexpected labor data revision has increased concerns about economic uncertainty, particularly for companies like Hayward Holdings that are closely tied to shifts in consumer sentiment and discretionary spending.

- Next, we'll examine how increased economic uncertainty could influence Hayward Holdings's outlook, given its reliance on consumer demand.

Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

Hayward Holdings Investment Narrative Recap

To be a shareholder in Hayward Holdings, you need to believe that ongoing consumer interest in outdoor living and demand for innovative pool technology will fuel stable replacement cycles and margin growth, even as economic swings occur. The recent sharp downgrade in US job growth data puts additional spotlight on the risk that weaker employment could slow discretionary spending, which remains the most significant short-term catalyst and risk for Hayward's aftermarket-heavy business. At this stage, the impact appears moderate, but continued economic weakness could test the company's resilience.

Hayward's latest earnings release in July 2025 is especially relevant in this context, showing both year-over-year sales and net income growth, and accompanied by slightly raised full-year revenue guidance. This demonstrates Hayward's ability to generate solid financial performance and maintain confidence in its outlook, even as economic signals grow more uncertain. By keeping investors informed through transparent earnings and guidance updates, Hayward signals its focus on...

Read the full narrative on Hayward Holdings (it's free!)

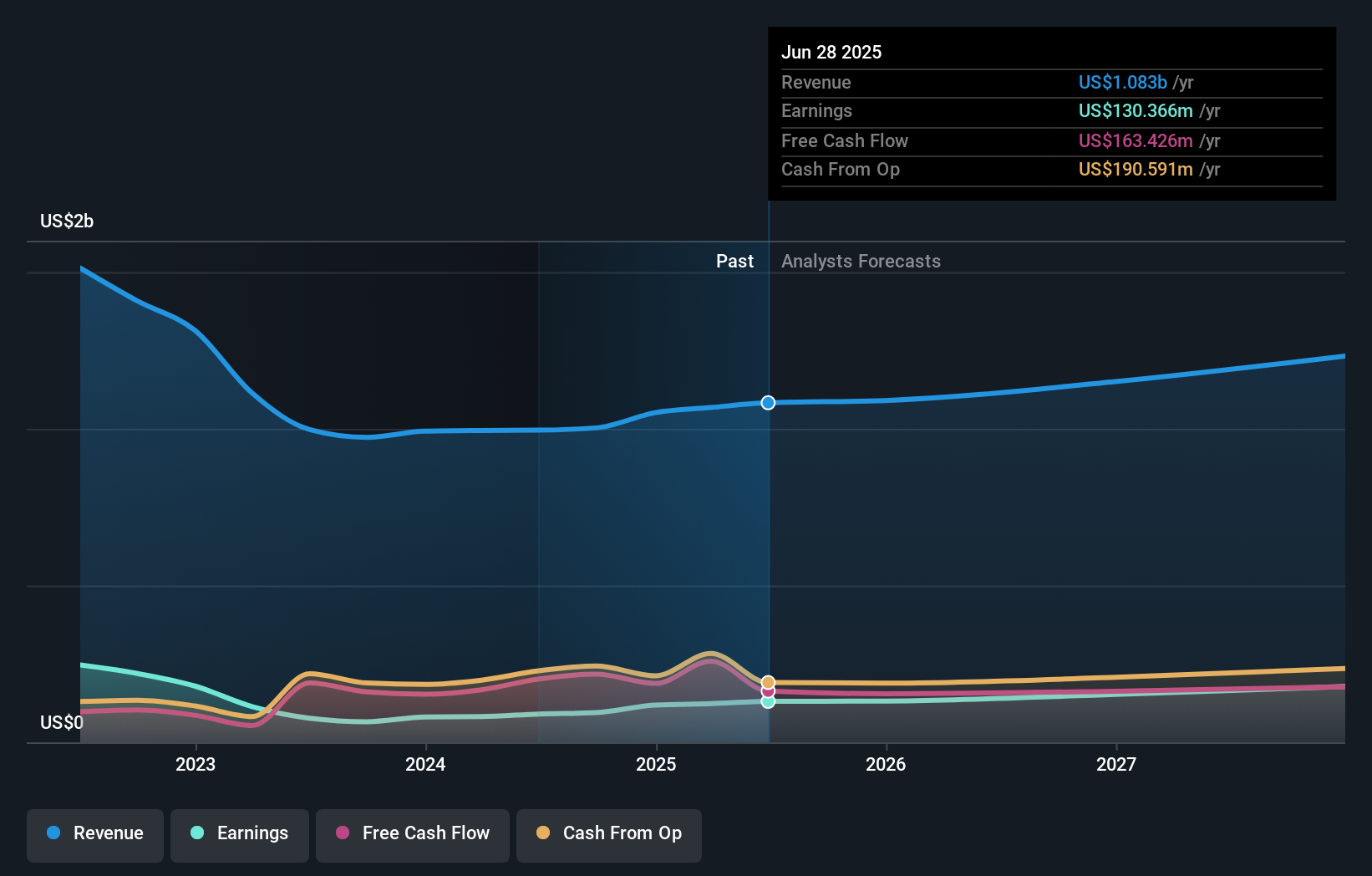

Hayward Holdings' narrative projects $1.3 billion revenue and $198.0 million earnings by 2028. This requires 5.8% yearly revenue growth and a $67.6 million earnings increase from $130.4 million currently.

Uncover how Hayward Holdings' forecasts yield a $16.64 fair value, a 7% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community provided a single fair value estimate for Hayward Holdings at US$16.64, with no variation among views. Against a backdrop of heightened concern about the company's sensitivity to consumer spending, the gap in independent perspectives highlights why assessing different outlooks is critical.

Explore another fair value estimate on Hayward Holdings - why the stock might be worth as much as 7% more than the current price!

Build Your Own Hayward Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hayward Holdings research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Hayward Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hayward Holdings' overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hayward Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HAYW

Hayward Holdings

Designs, manufactures, and markets a portfolio of pool equipment and associated automation systems in North America, Europe, and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives