- United States

- /

- Trade Distributors

- /

- NYSE:GWW

W.W. Grainger (GWW): Exploring Valuation After Recent Earnings and Share Price Dip

Reviewed by Kshitija Bhandaru

W.W. Grainger (GWW) stock gained 3% Tuesday after its quarterly earnings release. Investors are digesting steady revenue growth and annual net income improvements. The figures suggest consistent performance despite a competitive distribution landscape this year.

See our latest analysis for W.W. Grainger.

Over the past year, W.W. Grainger's share price momentum has faded somewhat, with a year-to-date price return of -7.87% and a one-year total shareholder return of -10.86%, despite the company’s continued profit growth and operational resilience. Still, Grainger’s robust long-term track record stands out, with total shareholder returns of 85.6% over three years and an impressive 170.3% over five years.

If Grainger’s steady climb until recently has you rethinking your next move, now is a smart time to broaden your outlook and discover fast growing stocks with high insider ownership

With the stock trading below analyst price targets yet showing only modest valuation discounts, investors must consider whether Grainger’s recent dip is a rare chance to buy value in an industrial leader or if future growth is already reflected in the price.

Most Popular Narrative: 7.9% Undervalued

With W.W. Grainger’s last close at $959.74 and a widely followed narrative fair value of $1,041.77, the gap signals that analysts see renewed upside potential for the stock, despite its muted recent returns. As investor attention turns to long-term drivers, the assumptions behind this target become central to the outlook.

As ongoing upgrades to aging U.S. infrastructure necessitate steady MRO demand, Grainger's entrenched relationships and supply chain scale uniquely position it to capture incremental high-touch and digital revenue growth as customers prioritize reliability and efficiency.

Digging deeper into this valuation, you’ll find bold assumptions underneath—expectations of persistent structural tailwinds, digital dominance, and sector leadership set against a backdrop of margin pressure. Which of these factors truly powers the optimistic fair value? Read on to discover the numbers shaping this call.

Result: Fair Value of $1,041.77 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressure from tariffs and a sluggish recovery in MRO demand could challenge Grainger’s positive outlook in the coming quarters.

Find out about the key risks to this W.W. Grainger narrative.

Another View: Is Grainger Actually Expensive?

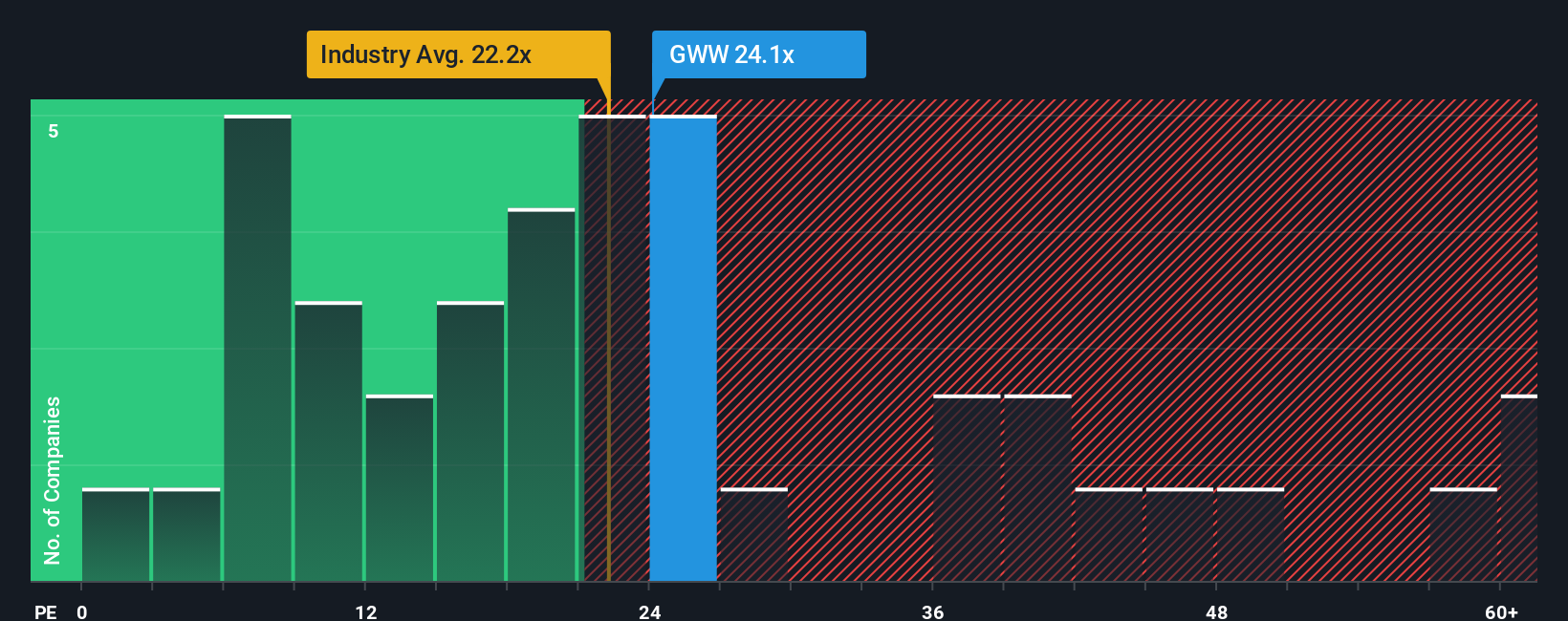

Switching perspective and comparing Grainger's price-to-earnings ratio to peers, we see GWW trading at 23.9x, which is higher than the Trade Distributors industry average of 21.8x and above its own fair ratio of 23.8x. This hints at limited relative value and exposes buyers to potential valuation risk if growth disappoints. Could there be less upside than it seems?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own W.W. Grainger Narrative

If you see things differently or want to dive into the details on your own terms, you can craft your own perspective with just a few clicks: Do it your way

A great starting point for your W.W. Grainger research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunity pass you by. There’s a world of other promising stocks waiting just beyond Grainger. The right picks could be the boost your strategy needs.

- Unlock growth potential by scanning these 881 undervalued stocks based on cash flows, packed with solid companies trading below their intrinsic worth.

- Power up your portfolio as AI innovations accelerate when you review these 25 AI penny stocks, targeting the next frontier in intelligent automation.

- Secure steady returns in any market by checking out these 18 dividend stocks with yields > 3%, featuring companies with yields above 3% and proven payout records.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if W.W. Grainger might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GWW

W.W. Grainger

Distributes maintenance, repair, and operating products and services primarily in North America, Japan, and the United Kingdom.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives