- United States

- /

- Healthcare Services

- /

- NasdaqGS:PHLT

US Penny Stocks To Consider In February 2025

Reviewed by Simply Wall St

As February 2025 unfolds, major U.S. indices like the S&P 500 and Nasdaq Composite have been grappling with a downturn, primarily driven by declines in technology stocks. Despite the broader market challenges, penny stocks remain an intriguing area for investors due to their potential for significant growth when supported by strong financials. While the term "penny stocks" may seem outdated, it still captures attention as these smaller or newer companies can offer compelling value and growth opportunities that larger firms might overlook.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $127.54M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.86379 | $6.28M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.76 | $392.77M | ★★★★☆☆ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| North European Oil Royalty Trust (NYSE:NRT) | $4.47 | $42.83M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.60 | $82.81M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.42 | $47.52M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $4.00 | $155.17M | ★★★★★☆ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.36 | $24.65M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8491 | $77.35M | ★★★★★☆ |

Click here to see the full list of 726 stocks from our US Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Agape ATP (NasdaqCM:ATPC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Agape ATP Corporation is an investment holding company that provides health and wellness products and health solution advisory services in Malaysia, with a market cap of $3.73 million.

Operations: The company generates revenue primarily from its wholesale drug segment, totaling $1.35 million.

Market Cap: $3.73M

Agape ATP Corporation, with a market cap of US$3.73 million, is navigating the complexities typical of penny stocks. The company recently increased its authorized shares significantly, from 50 million to 500 million, which may imply future capital raising efforts. Despite being debt-free and having short-term assets exceeding liabilities, Agape ATP remains unprofitable with no meaningful revenue streams and a cash runway of less than a year. Its share price has been highly volatile recently, reflecting uncertainty in its financial stability and growth prospects amidst declining earnings over the past five years at a rate of 32.9% annually.

- Click to explore a detailed breakdown of our findings in Agape ATP's financial health report.

- Gain insights into Agape ATP's past trends and performance with our report on the company's historical track record.

Performant Healthcare (NasdaqGS:PHLT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Performant Healthcare, Inc. offers technology-enabled payment integrity, eligibility, and analytics services with a market cap of $185.55 million.

Operations: The company's revenue is derived from its Business Services segment, totaling $120.78 million.

Market Cap: $185.55M

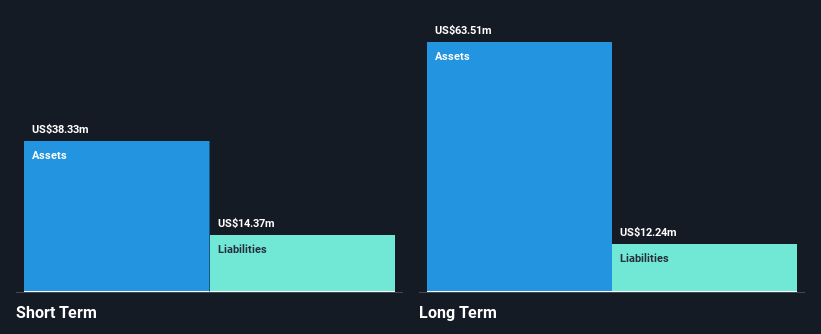

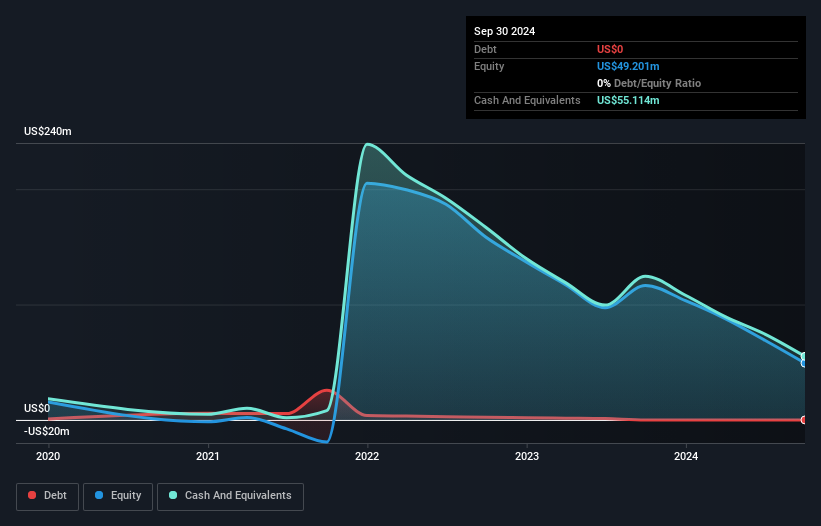

Performant Healthcare, Inc., with a market cap of US$185.55 million, is navigating the penny stock landscape with a focus on technology-enabled services. Despite being unprofitable and not expected to reach profitability in the next three years, it has reduced its debt significantly over five years and maintains a satisfactory net debt to equity ratio of 0.3%. The company forecasts revenue growth at 8.96% annually and has sufficient cash runway for over a year based on current free cash flow. Recent changes include rebranding from Performant Financial Corporation and adopting a new ticker symbol, PHLT, reflecting its strategic shift in focus.

- Get an in-depth perspective on Performant Healthcare's performance by reading our balance sheet health report here.

- Examine Performant Healthcare's earnings growth report to understand how analysts expect it to perform.

ESS Tech (NYSE:GWH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: ESS Tech, Inc. is an energy storage company that designs and produces iron flow batteries for commercial and utility-scale applications worldwide, with a market cap of $48.13 million.

Operations: The company's revenue is derived entirely from its Batteries / Battery Systems segment, amounting to $6.24 million.

Market Cap: $48.13M

ESS Tech, Inc., with a market cap of US$48.13 million, is advancing in the energy storage sector through its innovative iron flow batteries. Recent executive changes include the resignation of CEO Eric Dresselhuys, with Kelly Goodman stepping in as interim CEO. The company has celebrated initial commercial deliveries of its Energy Center™ systems and plans to ramp up production to meet growing demand. Despite being unprofitable and having less than a year of cash runway, ESS Tech's revenue is projected to grow at 46.45% annually. Its short-term assets exceed both short- and long-term liabilities, providing some financial stability amidst high share price volatility.

- Dive into the specifics of ESS Tech here with our thorough balance sheet health report.

- Gain insights into ESS Tech's outlook and expected performance with our report on the company's earnings estimates.

Summing It All Up

- Unlock more gems! Our US Penny Stocks screener has unearthed 723 more companies for you to explore.Click here to unveil our expertly curated list of 726 US Penny Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PHLT

Performant Healthcare

Provides audit, recovery, and analytics services in the United States.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives