- United States

- /

- Construction

- /

- NYSE:GVA

The Bull Case For Granite Construction (GVA) Could Change Following $24 Million Route 66 Bridge Contract Win

Reviewed by Sasha Jovanovic

- Granite Construction announced in the past week that it secured a US$24 million contract from San Bernardino County to replace aging bridges along Route 66 in Amboy, California, with the project funded by state and federal sources and scheduled for construction between December 2025 and April 2027.

- This contract enhances Granite's project portfolio in California's High Desert and highlights the company's role in improving critical transportation links like the route connecting 29 Palms and Las Vegas.

- To assess the impact of this new bridge replacement contract on Granite's outlook, we will explore how adding high-profile public infrastructure work could affect its long-term investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

Granite Construction Investment Narrative Recap

Granite Construction’s long-term thesis rests on capturing sustained infrastructure investment and executing profitably in high-growth U.S. regions. The latest Route 66 bridge contract highlights Granite’s competitive positioning but is unlikely to materially shift near-term catalysts, which remain rooted in the successful integration of recent acquisitions and managing exposure to public sector funding cycles. Any material impact to the investment case would depend more on large, transformative wins or evidence of margin stability, rather than incremental contract additions like this one.

Among recent announcements, Granite’s $39 million Pajaro River Flood Risk Management Project award is closely tied to its ability to execute multi-year, government-funded projects. Like the Amboy bridges, it reinforces Granite’s depth in federally and state-backed civil works, underscoring the importance of consistent backlog growth as a key driver for earnings and cash flow progress over the next several quarters. Sustaining this momentum will require careful management of execution risk, especially as project complexity increases.

Yet, despite backlogs and visible growth, investors should be mindful of the risk that comes with ramping up acquisition activity and expanding into new geographies which could expose the company to...

Read the full narrative on Granite Construction (it's free!)

Granite Construction's outlook anticipates $5.6 billion in revenue and $533.1 million in earnings by 2028. This scenario is based on an annual revenue growth rate of 10.8% and a $374.6 million increase in earnings from the current $158.5 million level.

Uncover how Granite Construction's forecasts yield a $129.33 fair value, a 21% upside to its current price.

Exploring Other Perspectives

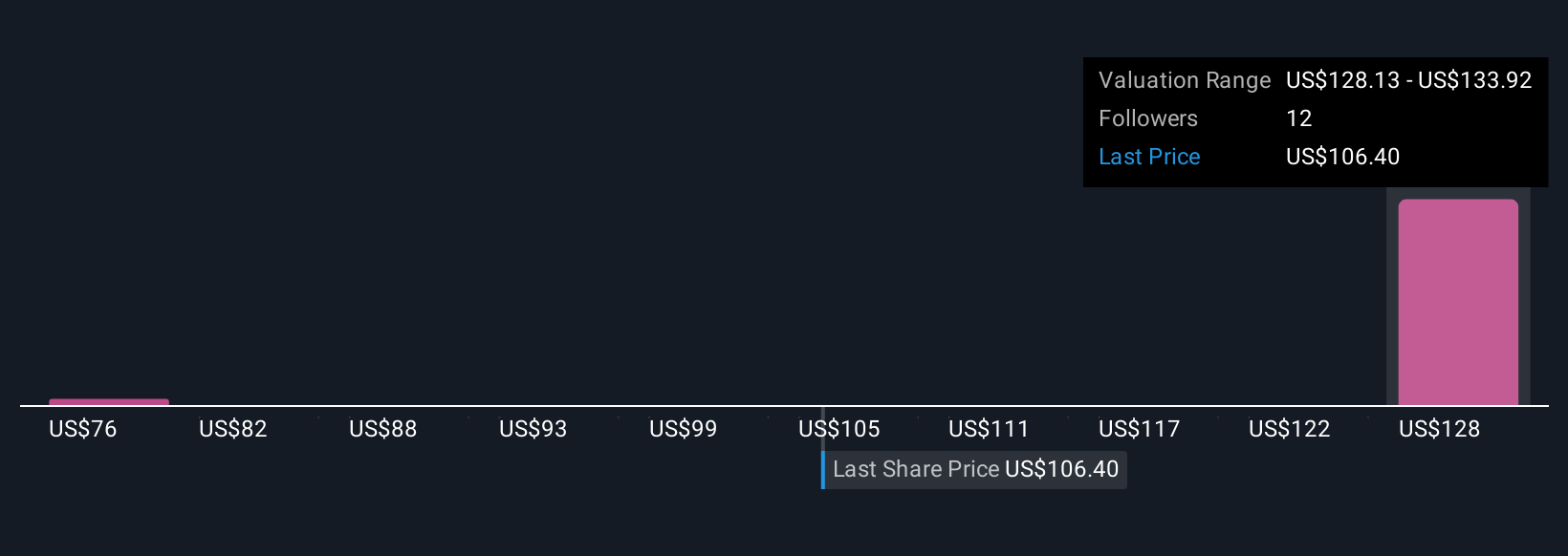

Three Simply Wall St Community fair value opinions for Granite Construction range widely from US$76 to US$137.94 per share. While some see clear upside, others flag the company’s ongoing acquisition risk as a concern for earnings quality and margin performance; you may want to check out several independent perspectives before making up your mind.

Explore 3 other fair value estimates on Granite Construction - why the stock might be worth 29% less than the current price!

Build Your Own Granite Construction Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Granite Construction research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Granite Construction research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Granite Construction's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GVA

Granite Construction

Operates as an infrastructure contractor in the United States.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives