- United States

- /

- Construction

- /

- NYSE:GVA

Granite Construction (GVA): Assessing Valuation as Investor Optimism Grows

Reviewed by Kshitija Bhandaru

See our latest analysis for Granite Construction.

Granite Construction’s share price has pulled back slightly in the last month but remains firmly in positive territory for the year. Its 12.45% 90-day gain has contributed to a 29.64% total shareholder return over the past year. This strong momentum highlights growing investor confidence in the company’s longer-term prospects, particularly following recent performance beats and operational progress.

If you’re watching the rise of Granite Construction, now is a smart moment to expand your perspective and discover fast growing stocks with high insider ownership

Yet with Granite Construction stock still trading at a notable discount to analyst price targets, investors are left to consider whether the recent rally leaves more upside on the table or if future growth is already built in.

Most Popular Narrative: 18.5% Undervalued

Granite Construction’s most popular valuation narrative places its fair value at $129.33, roughly 18% above the last close. This suggests that analyst consensus sees considerable headroom for the stock, based on robust forecasts for growth, margins, and industry trends.

Vertical integration and technology adoption enhance margin stability, efficiency, and earnings quality by reducing input cost risks and boosting operational performance. Heavy reliance on acquisitions, rising debt, persistent cost inflation, and exposure to public funding cycles create significant financial and operational risks for future profitability and growth.

Want to see the full blueprint for this bullish outlook? There’s a bold set of financial assumptions focusing on future profit, margins, and even operational changes embedded in this narrative. The real surprise is how these projections build to a valuation many might find ambitious.

Result: Fair Value of $129.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Granite's heavy reliance on acquisitions and its exposure to shifts in public infrastructure funding could challenge the strength of the current bullish narrative.

Find out about the key risks to this Granite Construction narrative.

Another View: Looking at Price Ratios

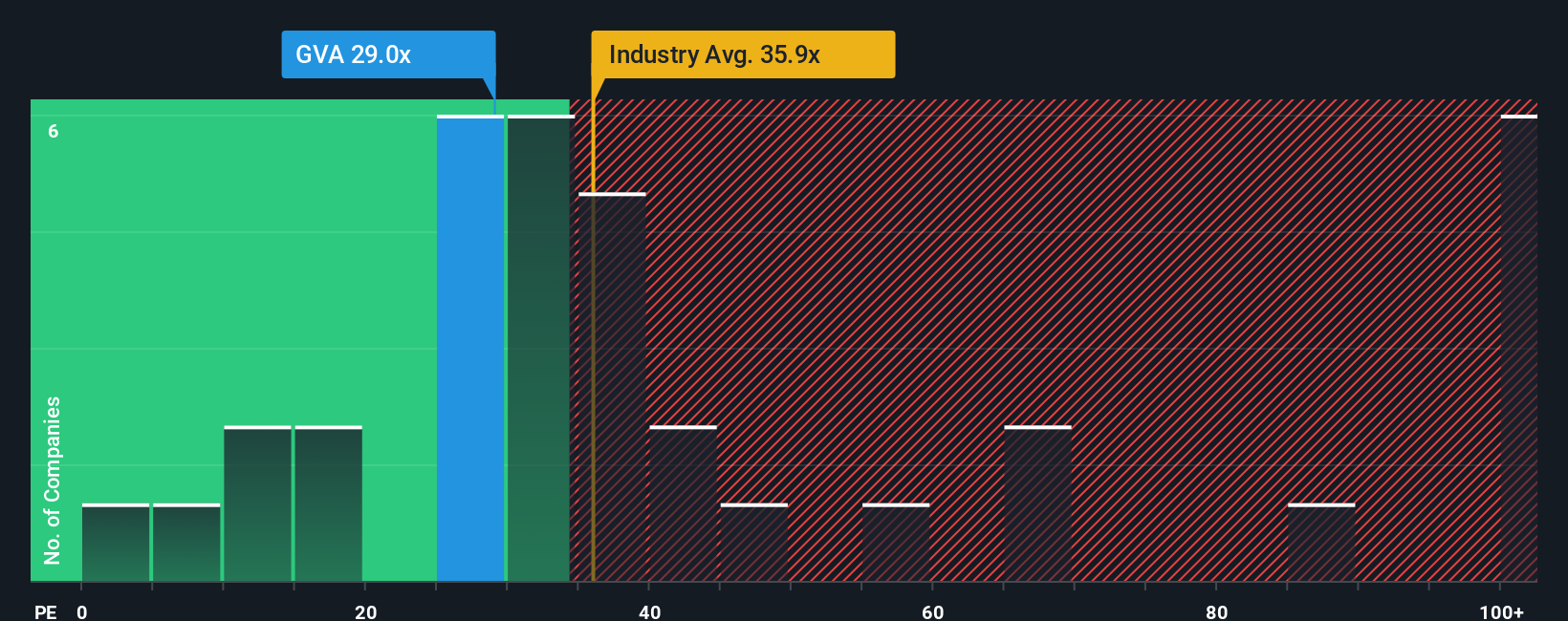

While the consensus narrative points to Granite Construction being undervalued, a look at its price-to-earnings ratio tells a different story. Shares are trading at 29.1 times earnings, making the stock pricier than its direct peers’ average of 27.6. However, it remains cheaper than the broader construction industry, which stands at 36.7. Compared to its fair ratio of 40.3, there is some room to run, but the premium versus peers could signal less upside than analysts forecast. Are investors paying up for quality, or just chasing recent momentum?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Granite Construction Narrative

If the current outlook does not match your perspective or you would rather dig into the numbers yourself, you can craft your own narrative in just a few minutes. Do it your way.

A great starting point for your Granite Construction research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t miss your chance to uncover fresh opportunities. Let’s make your next move count with three unique stock ideas ready for action right now.

- Tap into robust growth potential and see which companies made our shortlist of these 898 undervalued stocks based on cash flows for strong cash flow opportunities.

- Target reliable income streams by reviewing these 19 dividend stocks with yields > 3% with yields above 3%, a savvy addition to any portfolio.

- Step ahead of the curve in artificial intelligence by tracking these 24 AI penny stocks gaining traction in tomorrow’s key industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GVA

Granite Construction

Operates as an infrastructure contractor in the United States.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives