- United States

- /

- Machinery

- /

- NYSE:GTLS

Not Many Are Piling Into Chart Industries, Inc. (NYSE:GTLS) Just Yet

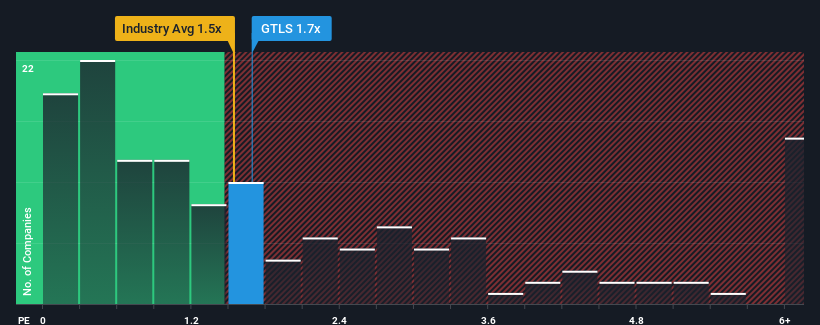

There wouldn't be many who think Chart Industries, Inc.'s (NYSE:GTLS) price-to-sales (or "P/S") ratio of 1.7x is worth a mention when the median P/S for the Machinery industry in the United States is similar at about 1.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Chart Industries

What Does Chart Industries' P/S Mean For Shareholders?

Recent times have been advantageous for Chart Industries as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Keen to find out how analysts think Chart Industries' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Chart Industries' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 111% gain to the company's top line. The latest three year period has also seen an excellent 224% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 16% per annum as estimated by the analysts watching the company. That's shaping up to be materially higher than the 4.3% per annum growth forecast for the broader industry.

In light of this, it's curious that Chart Industries' P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Chart Industries' P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Looking at Chart Industries' analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Before you take the next step, you should know about the 3 warning signs for Chart Industries (1 shouldn't be ignored!) that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GTLS

Chart Industries

Engages in the designing, engineering, and manufacturing of process technologies and equipment for the gas and liquid molecules in the United States and internationally.

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives