- United States

- /

- Electrical

- /

- NYSE:GNRC

Does Generac's Fourth Straight Earnings Beat Signal a Stronger Long-Term Demand Story for GNRC?

Reviewed by Simply Wall St

- Generac Holdings recently reported second quarter 2025 results that exceeded expectations, with strong demand highlighted in both home standby generators and its commercial and industrial business.

- Notably, Generac has now surpassed analyst earnings forecasts for four consecutive quarters, signaling a consistent positive trend in performance surprise.

- We'll explore how Generac's sustained demand for home standby generators could shape its broader investment outlook going forward.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Generac Holdings Investment Narrative Recap

To be a shareholder in Generac Holdings, you need to believe that rising demand for backup power, driven by increased grid outages and a growing commercial and industrial segment, can offset challenges facing the company's clean energy business. The recent earnings surprise reaffirms short-term confidence, but the primary risk remains the unpredictable nature of power outages influencing generator sales. This news may boost sentiment but doesn't eliminate the need for attention to the clean energy segment's lagging growth. Among recent announcements, Generac's Q2 2025 earnings delivered significant revenue and net income growth, outpacing analyst expectations and supporting the main catalyst: stronger demand for home standby generators. While this headline result brings optimism for core products, investors should keep in mind the continued earnings drag and slow adoption in the clean energy segment as the company aims for greater profit stability. On the other hand, there is a material risk investors should be aware of if residential solar and battery markets continue to weaken...

Read the full narrative on Generac Holdings (it's free!)

Generac Holdings is projected to achieve $5.4 billion in revenue and $593.3 million in earnings by 2028. This assumes a 7.3% annual revenue growth rate and an increase in earnings of $232.8 million from the current $360.5 million.

Uncover how Generac Holdings' forecasts yield a $199.44 fair value, in line with its current price.

Exploring Other Perspectives

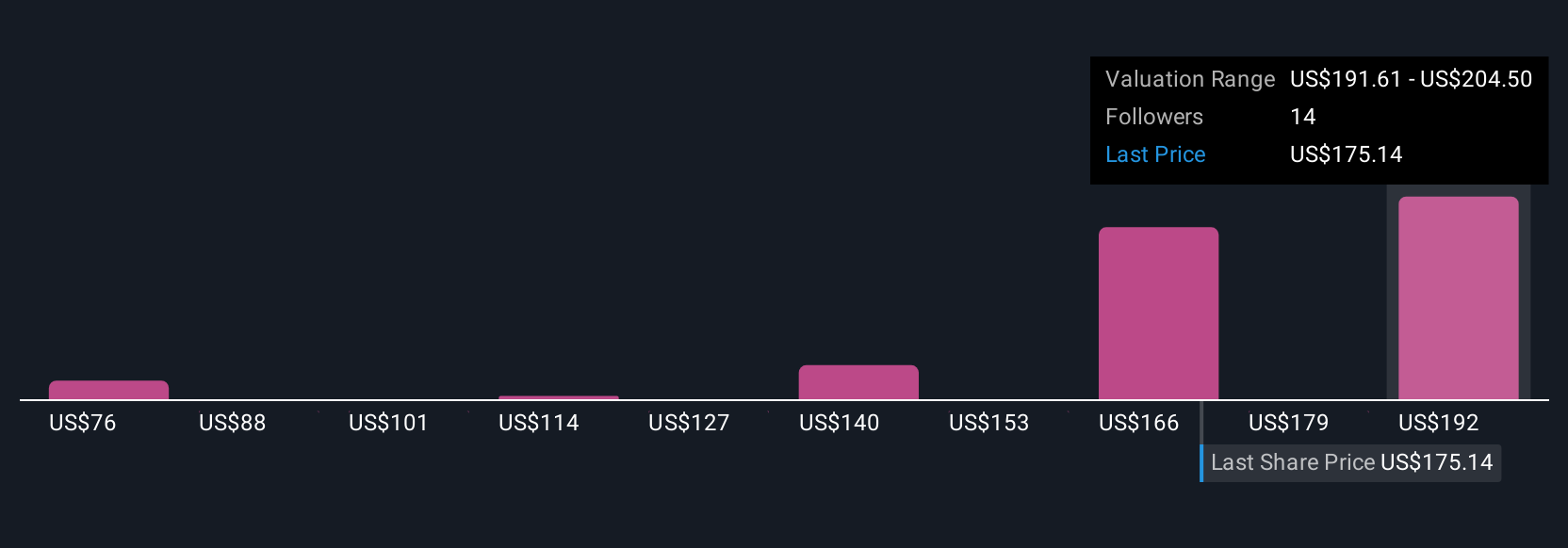

Eight members of the Simply Wall St Community estimate Generac’s fair value between US$75.60 and US$199.44. While optimism focuses on backup power demand, concerns about the clean energy segment highlight the importance of weighing different views before making decisions.

Explore 8 other fair value estimates on Generac Holdings - why the stock might be worth as much as $199.44!

Build Your Own Generac Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Generac Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Generac Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Generac Holdings' overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GNRC

Generac Holdings

Designs, manufactures, and distributes energy technology products and solution worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives