- United States

- /

- Electrical

- /

- NYSE:GNRC

A Look at Generac (GNRC)’s Valuation Following Its Strong Earnings Beat and Investor Rally

Reviewed by Simply Wall St

Generac Holdings (GNRC) just delivered another earnings beat, and investors wasted no time reacting. The stock surged nearly 20% in a single day after its Q2 results. The jump was driven by stronger-than-expected demand for home standby generators and ongoing momentum in the commercial and industrial segment. With a track record of outperforming expectations in each of the last four quarters, Generac’s quarterly performance is starting to look less like luck and more like a trend worth paying attention to.

This latest bump extends what has been a solid run for the stock this year. Shares are up almost 24% since January and show a similar gain over the past 12 months. While those returns put it well ahead of broader market averages recently, over a three-year period, Generac is still trading below where it started. This suggests the stock is recovering from tougher stretches. Momentum now seems to be building, supported by optimism around both near-term results and longer-term business drivers.

Given this backdrop, it is natural to ask if Generac is still undervalued based on its fundamentals after such a rapid climb, or if the market has already priced in all future growth.

Most Popular Narrative: 2.4% Undervalued

According to community narrative, Generac Holdings is currently seen as slightly undervalued, with a consensus analyst price target just above its current share price. The narrative points to a mix of strong growth catalysts and operational improvements as justification for this assessment.

Accelerating demand for backup power solutions in data centers, driven by AI adoption and global digitalization, has resulted in a structural supply deficit for large commercial generators. Generac's rapid entry and over $150 million backlog position it to capture significant revenue growth and operating leverage over the next several years. There is further potential upside as the company expands capacity to address demand in 2027 and beyond.

Curious what’s really fueling this bullish outlook? There is a detailed forecast inside, built on bold growth projections and margin improvements. Which financial assumptions are convincing enough to pull the price so close to the analysts’ target? The answer might challenge your view. See how Generac could reshape its growth story for years to come.

Result: Fair Value of $199.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, it is worth noting that a slowdown in residential solar or fewer severe outages could quickly dampen Generac’s projected growth trajectory.

Find out about the key risks to this Generac Holdings narrative.Another View: The SWS DCF Model Tells a Different Story

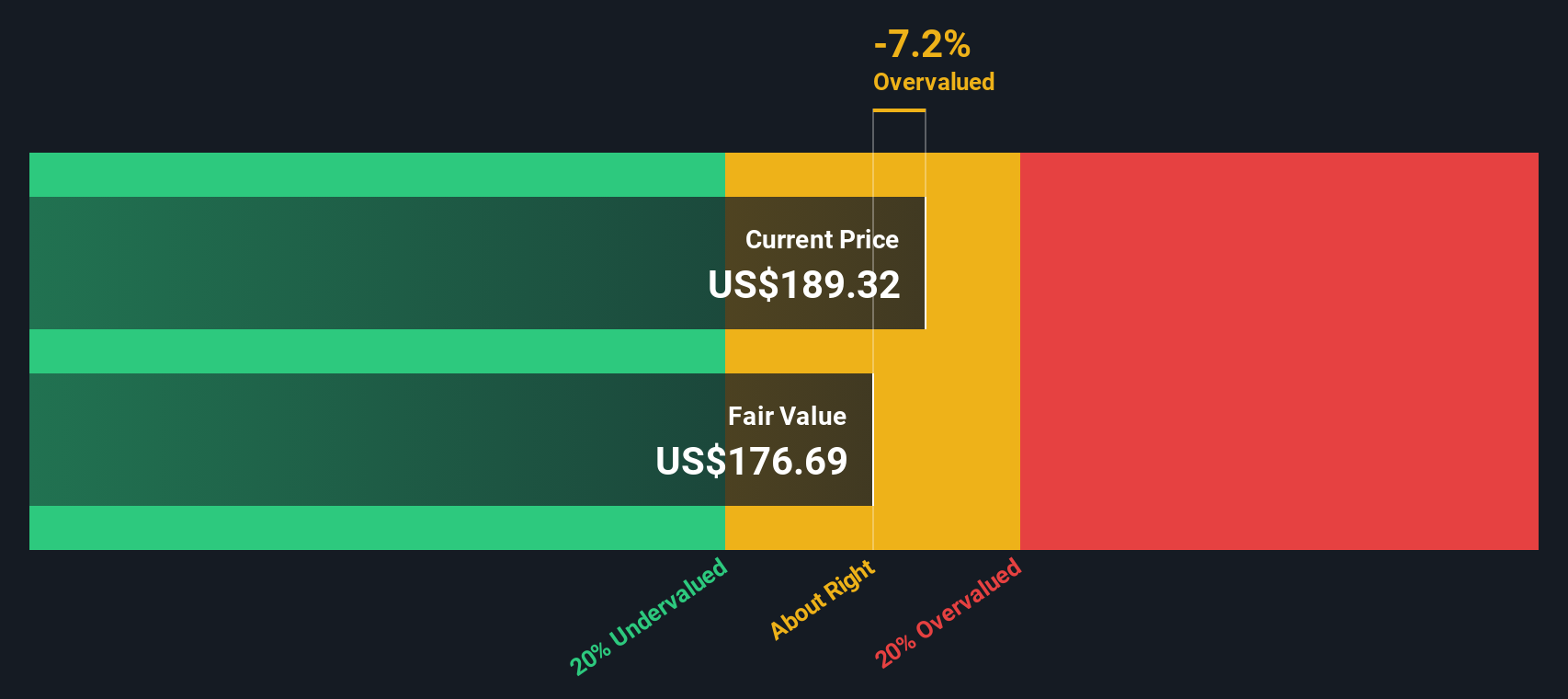

While multiples suggest Generac's shares are just slightly undervalued, our DCF model presents a less optimistic take and points to the stock being a bit expensive. Is one method missing what the other sees?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Generac Holdings Narrative

If these takes do not reflect your perspective, or you would rather dig into the numbers independently, you can put together your own story in under three minutes: do it your way.

A great starting point for your Generac Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Want Even More Investment Ideas?

Broaden your investing playbook by searching for stocks that could offer the growth, value, or specialization you are looking for. Powerful screening tools are ready to help you spot tomorrow’s winners. If you skip this, you could miss out while others move ahead. Start with these opportunities:

- Get a head start on tomorrow’s technology by focusing on companies leading the way in quantum computing. Check out quantum computing stocks for a lineup of innovators that are pushing digital boundaries.

- Find established businesses offering strong and steady income with dividend stocks with yields > 3%, featuring stocks that consistently deliver yields above 3%.

- Enhance your portfolio with healthcare’s next big breakthroughs by discovering top names in artificial intelligence transforming medicine. All of these are accessible through healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GNRC

Generac Holdings

Designs, manufactures, and distributes energy technology products and solution worldwide.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives