- United States

- /

- Trade Distributors

- /

- NYSE:GIC

Discovering US Undiscovered Gems With Potential In December 2025

Reviewed by Simply Wall St

In recent weeks, the U.S. stock market has shown mixed signals, with the S&P 500 and Dow Jones experiencing declines following an unexpected rise in unemployment rates, while the Nasdaq managed a slight uptick amid ongoing concerns about an AI bubble. Amid these fluctuations, investors are increasingly on the lookout for promising small-cap stocks that could offer growth potential despite broader economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 1.99% | 2.14% | 1.63% | ★★★★★★ |

| Sound Financial Bancorp | 34.24% | 1.40% | -12.55% | ★★★★★★ |

| Epsilon Energy | NA | 2.43% | -4.36% | ★★★★★★ |

| Franklin Financial Services | 127.01% | 5.48% | -4.56% | ★★★★★★ |

| Affinity Bancshares | 43.06% | 2.84% | 3.44% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.79% | 11.96% | ★★★★★★ |

| Seneca Foods | 41.64% | 2.31% | -23.77% | ★★★★★☆ |

| Pure Cycle | 4.76% | 6.42% | -1.58% | ★★★★★☆ |

| FRMO | 0.10% | 35.28% | 40.61% | ★★★★★☆ |

| Union Bankshares | 369.65% | 1.12% | -7.45% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

FVCBankcorp (FVCB)

Simply Wall St Value Rating: ★★★★★★

Overview: FVCBankcorp, Inc. is a bank holding company for FVCbank, offering a range of banking products and services to small and medium-sized businesses, professionals, non-profit organizations and associations, with a market cap of $253.05 million.

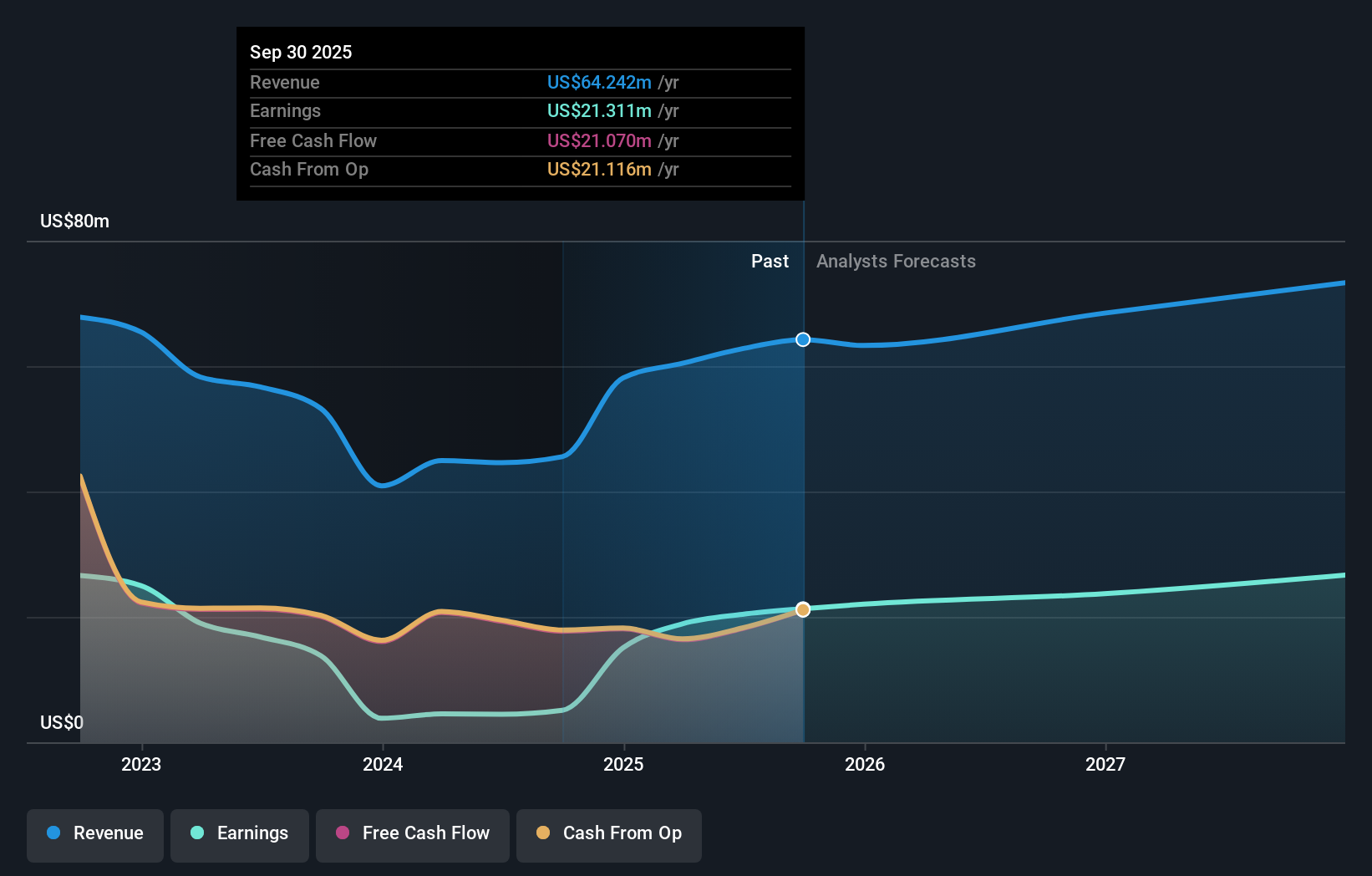

Operations: FVCBankcorp generates revenue primarily from its banking segment, which reported $64.24 million. The company focuses on providing financial services to a diverse clientele, including businesses and non-profit organizations.

FVCBankcorp, with total assets of US$2.3 billion and equity of US$249.8 million, shows strong financial health. The bank's total deposits stand at US$2 billion against loans of US$1.8 billion, ensuring a stable funding structure with 96% low-risk liabilities from customer deposits. Its allowance for bad loans is robust at 162%, while non-performing loans are just 0.6%. Earnings surged by an impressive 318% over the past year, outpacing the industry growth rate of 18%. Trading at a discount to its estimated fair value by about 22%, FVCB appears undervalued in the current market context.

- Dive into the specifics of FVCBankcorp here with our thorough health report.

Gain insights into FVCBankcorp's historical performance by reviewing our past performance report.

C&F Financial (CFFI)

Simply Wall St Value Rating: ★★★★★★

Overview: C&F Financial Corporation is a bank holding company for Citizens and Farmers Bank, offering banking services to individuals and businesses, with a market cap of $250.09 million.

Operations: C&F Financial Corporation generates revenue primarily through its Community Banking segment, contributing $97.12 million, and is supplemented by the Consumer Finance and Mortgage Banking segments at $15.14 million and $14.79 million respectively.

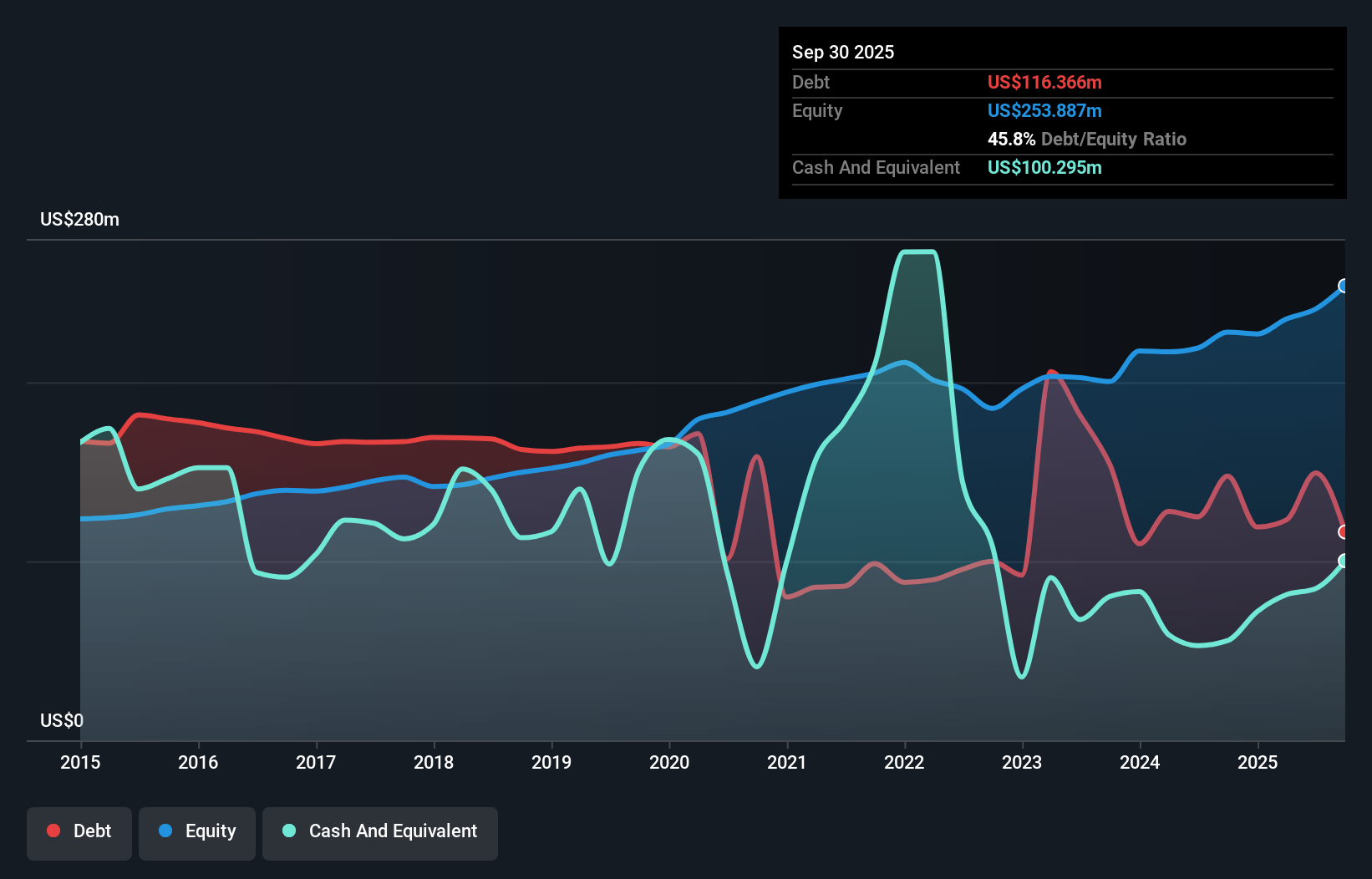

With total assets of US$2.7 billion and equity of US$253.9 million, C&F Financial stands out with its solid financial health. The bank's net interest margin is 4.1%, and it has a robust allowance for bad loans at 0.1% of total loans, indicating prudent risk management practices. Earnings growth over the past year was impressive at 38.7%, outpacing the industry average of 18.2%. Trading at a discount, it's valued at 27% below fair value estimates, making it an attractive prospect for investors seeking undervalued opportunities in the financial sector with strong fundamentals and growth potential.

- Unlock comprehensive insights into our analysis of C&F Financial stock in this health report.

Examine C&F Financial's past performance report to understand how it has performed in the past.

Global Industrial (GIC)

Simply Wall St Value Rating: ★★★★★★

Overview: Global Industrial Company operates as an industrial distributor of MRO products in the United States and Canada, with a market cap of approximately $1.16 billion.

Operations: Global Industrial generates revenue primarily through its Industrial Products Group, which reported $1.34 billion in sales. The company's cost structure and operational efficiency impact its profitability, with a focus on optimizing margins to enhance financial performance.

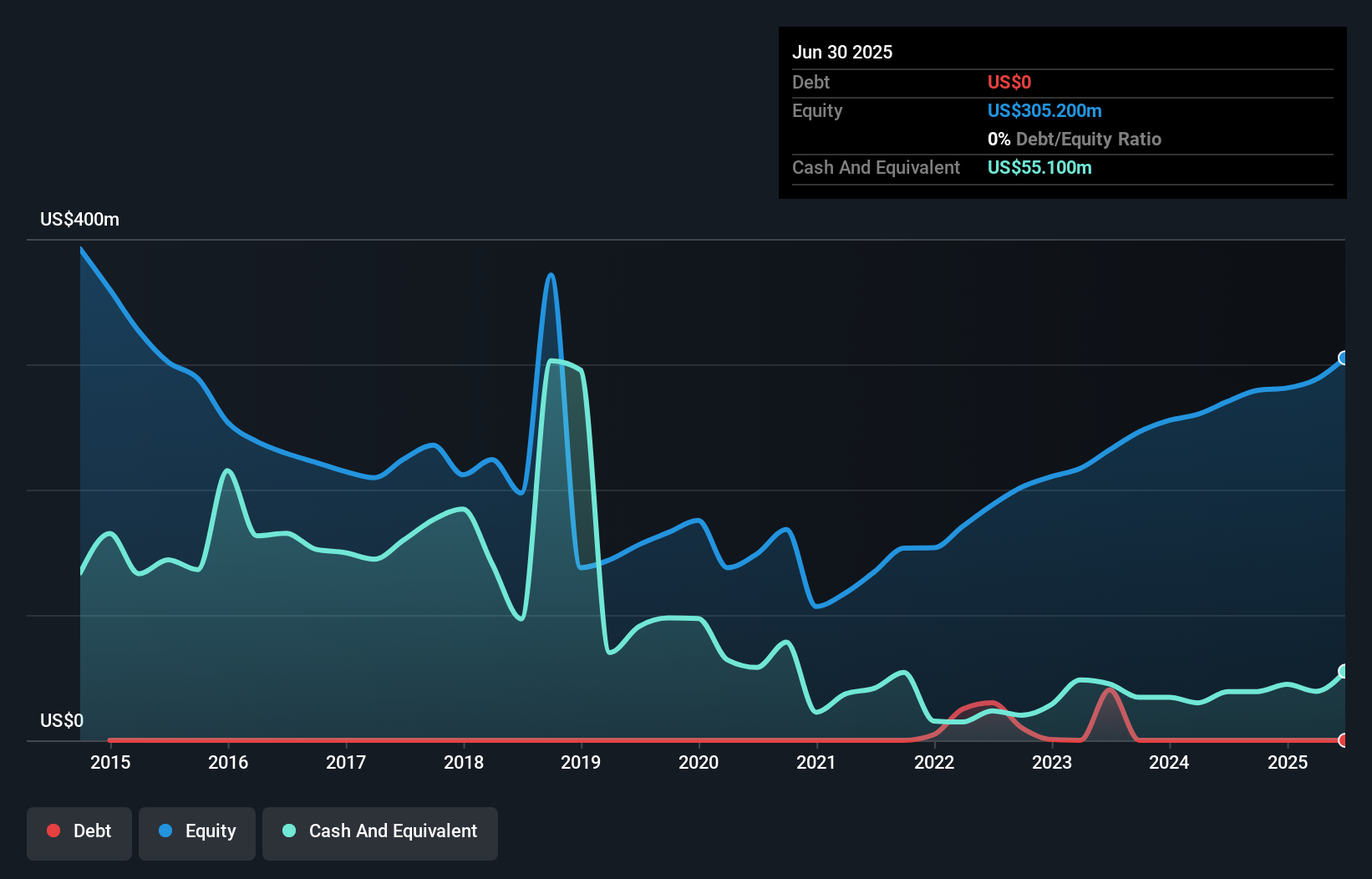

Global Industrial, a nimble player in the trade distribution sector, has been making waves with its impressive financial health. Over the past year, earnings shot up by 3.5%, outpacing the industry average of -1.1%. With no debt on its books for five years, it operates without concerns over interest payments. The company reported third-quarter sales of US$353.6 million and net income of US$18.8 million, both higher than last year's figures. Trading at nearly 40% below estimated fair value, Global Industrial seems poised for continued growth with earnings forecasted to rise by 11% annually.

- Navigate through the intricacies of Global Industrial with our comprehensive health report here.

Assess Global Industrial's past performance with our detailed historical performance reports.

Next Steps

- Explore the 298 names from our US Undiscovered Gems With Strong Fundamentals screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GIC

Global Industrial

Through its subsidiaries, operates as an industrial distributor of various industrial and maintenance, repair, and operation (MRO) products in the United States and Canada.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion