- United States

- /

- Building

- /

- NYSE:GFF

Evaluating Griffon's (GFF) Valuation After Recent Share Price Pullback

Reviewed by Kshitija Bhandaru

See our latest analysis for Griffon.

Griffon's recent pullback follows a solid stretch over the past year, with the share price experiencing some short-term pressure while longer-term total shareholder returns remain strong. After gaining 7.12% over the past year on a total return basis and 166% over three years, the current momentum appears to be pausing as investors reassess growth prospects and risks at current valuations.

If you’re weighing new opportunities after Griffon’s slide, now is the perfect time to broaden your horizons and discover fast growing stocks with high insider ownership.

With shares now trading at a notable discount to analyst price targets and solid long-term gains in the rear-view mirror, investors face a key question: is Griffon's recent weakness a compelling entry point, or has the market already factored in its growth prospects?

Most Popular Narrative: 27% Undervalued

Despite the latest share price weakness, the most closely watched narrative suggests Griffon’s fair value sits well above today’s closing price. The narrative valuation puts Griffon at a substantial discount, heightening interest in the factors driving this outlook.

Resilience in high-end home products, modernization, and innovation in premium offerings set the stage for strong margins and future revenue growth.

Flexible sourcing models, cost controls, and disciplined capital allocation are positioned to boost margins, EPS, and shareholder returns when demand recovers.

Want to know which bold earnings and margin forecasts underpin this valuation gap? The narrative leans on ambitious profit growth and a future valuation multiple that even seasoned industry watchers might find surprising. Unlock the hidden drivers and see what analysts are betting on.

Result: Fair Value of $100.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent soft consumer demand or further tariff hikes remain key risks that could undermine Griffon's rebound and dampen future earnings growth.

Find out about the key risks to this Griffon narrative.

Another View: What Do Market Multiples Say?

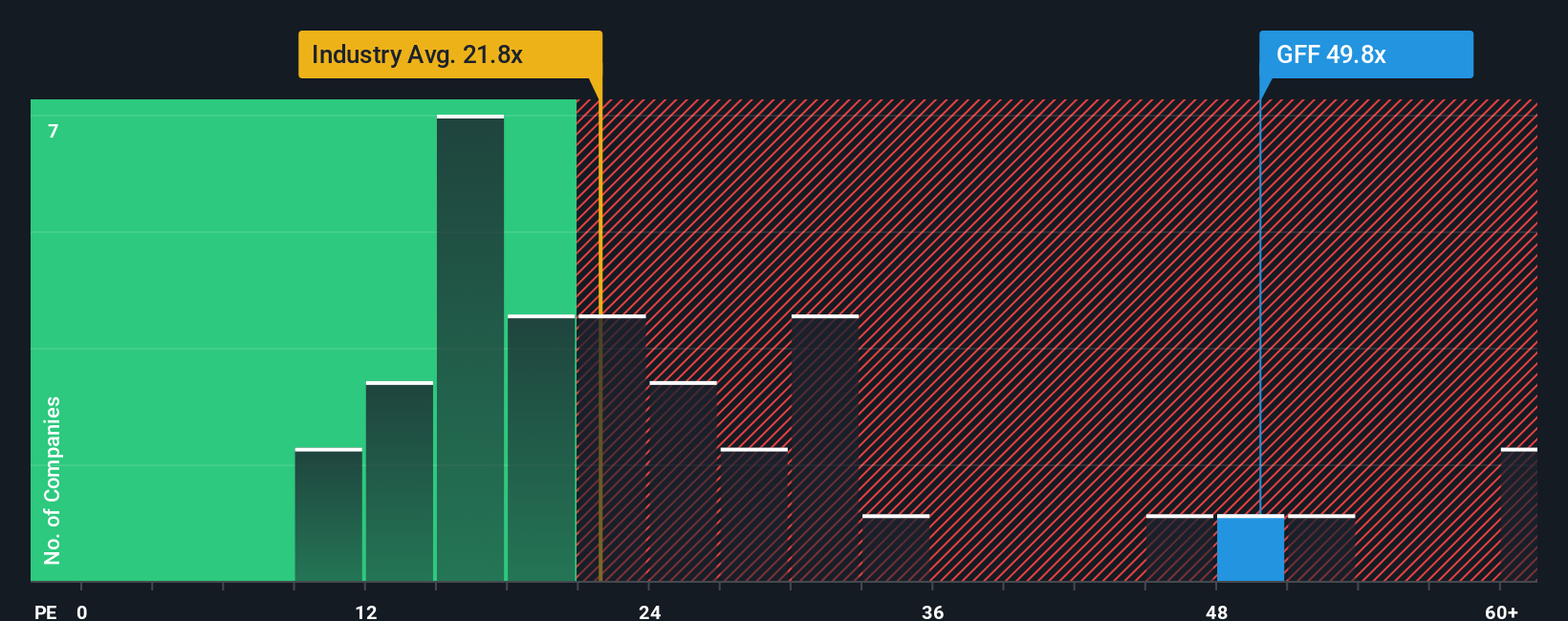

While fair value models suggest Griffon's shares are undervalued, a closer look at its price-to-earnings ratio tells a different story. Griffon trades at 48.5 times earnings, which is much higher than both its industry peers (averaging 19.8x) and the broader building sector (21.5x). Even when compared to the fair ratio estimate of 80.7x, the current multiple appears stretched, raising caution about how much growth is already reflected in the price. Could this indicate a higher valuation risk than initially believed?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Griffon Narrative

Whether you see the story differently or want to dig into the numbers on your own terms, it only takes a few minutes to build your own perspective. Do it your way

A great starting point for your Griffon research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

If you want to stay ahead of market trends and secure future opportunities, don’t limit your search to just one company. Simply Wall St’s screener helps you spot winners across the market.

- Tap into a wave of innovation by checking out these 25 AI penny stocks, which are pushing boundaries in artificial intelligence and redefining what’s possible in tech.

- Lock in stable returns and recurring income streams with these 18 dividend stocks with yields > 3%, which offers above-average yields and strong payout records.

- Capitalize on breakthroughs in medical technology through these 33 healthcare AI stocks, where healthcare and artificial intelligence converge for significant long-term growth potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GFF

Griffon

Through its subsidiaries, provides consumer and professional, and home and building products in the United States, Europe, Canada, Australia, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives