- United States

- /

- Electrical

- /

- NYSE:GEV

Should You Reassess GE Vernova After Its 78% YTD Rally in 2025?

Reviewed by Bailey Pemberton

If you find yourself wondering what to do with GE Vernova right now, you are not alone. Investors who have watched this stock soar over the last year are asking the same question: is it too late to get in, or is there more room to run? With the share price closing recently at $603.22, it is hard to ignore the numbers. The stock has rattled off a 130.2% gain over the last twelve months and is up an impressive 78.0% year-to-date. Even in just the last month, it returned 3.6%, barely pausing after each move higher.

What is driving this momentum? For GE Vernova, much of the story is tied to growing demand for clean energy and a shift in market sentiment toward companies positioned to benefit from decarbonization trends. While there have been general sector tailwinds across renewables, GE Vernova's moves also reflect changing investor attitudes about the company’s risk profile. The recent string of positive gains shows renewed confidence and also raises the stakes for accurately assessing value at these levels.

So how does the company look on paper? If we break down its valuation, GE Vernova scores just a 1 on a simple 6-point undervaluation check, meaning it is only considered undervalued by one metric at this time. That does not mean it is overvalued, but it does tell us to look closer before assuming the recent rally is justified.

Up next, I will walk through the main valuation approaches investors use to analyze stocks like GE Vernova, and later, reveal a perspective on value that goes beyond the standard checklist.

GE Vernova scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: GE Vernova Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. For GE Vernova, this approach starts with last year’s Free Cash Flow of $2.74 billion and looks ahead at both analyst and extrapolated forecasts for future growth. According to the data, analysts expect cash flows to rise steadily, with projections reaching $7.92 billion by 2029. Longer-range estimates, extrapolated to 2035, show further increases.

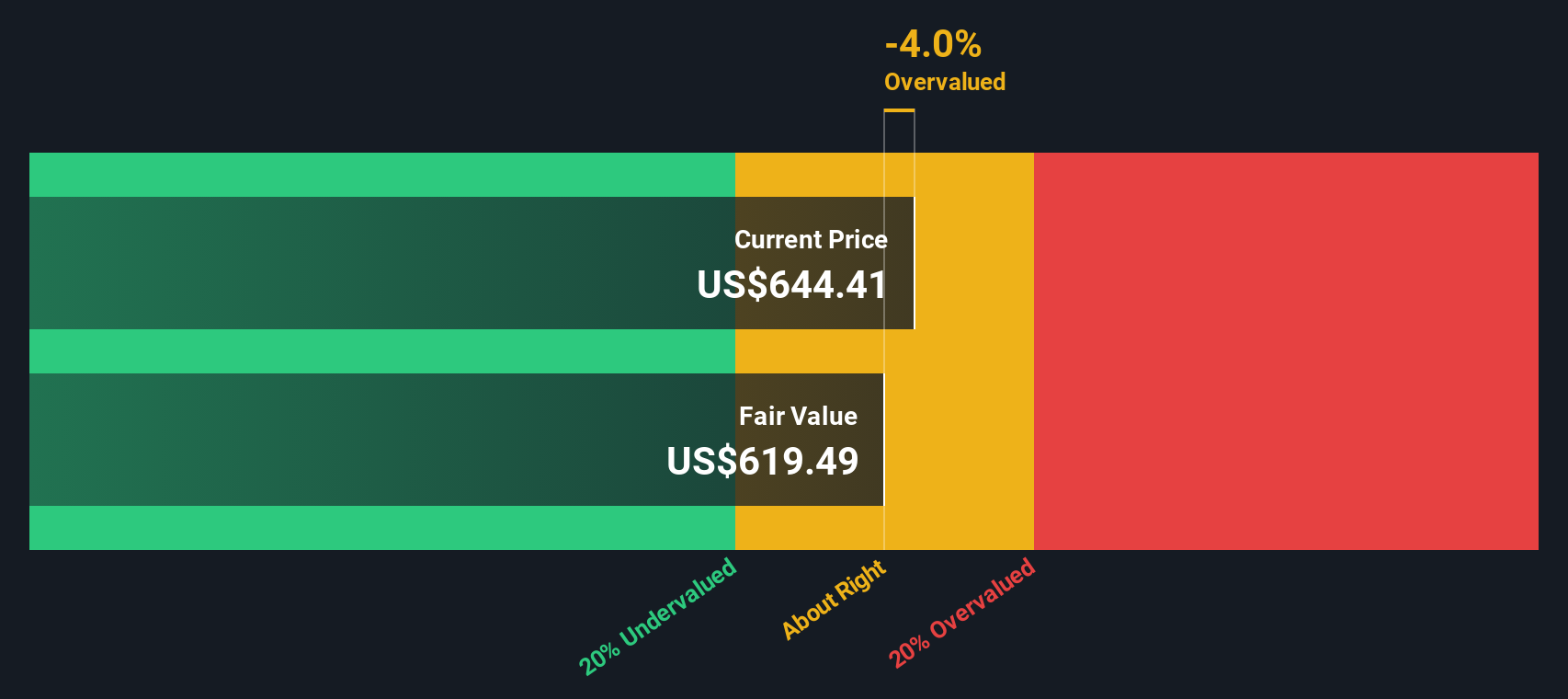

Simply Wall St’s DCF analysis uses a 2 Stage Free Cash Flow to Equity model and factors in analyst forecasts for the next five years, then extrapolates expected performance out to ten years. This model produces an estimated fair value of $613.80 per share. With GE Vernova currently trading at $603.22, this implies the stock is about 1.7% below its calculated intrinsic value.

Given that the DCF discount is less than 10%, the model suggests that GE Vernova is priced very close to its fair value at this time.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out GE Vernova's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: GE Vernova Price vs Earnings

For established and profitable companies, the price-to-earnings (PE) ratio is often the go-to metric because it directly links a company’s share price to its actual earnings. This makes it easy for investors to see what they are paying for each dollar of profit and to set a baseline for comparisons. However, determining what counts as a “normal” or “fair” PE ratio can vary widely depending on the company’s growth prospects and risk profile. Stocks with faster growth and lower risk tend to justify higher PE multiples, while slower growers or riskier businesses typically trade more cheaply.

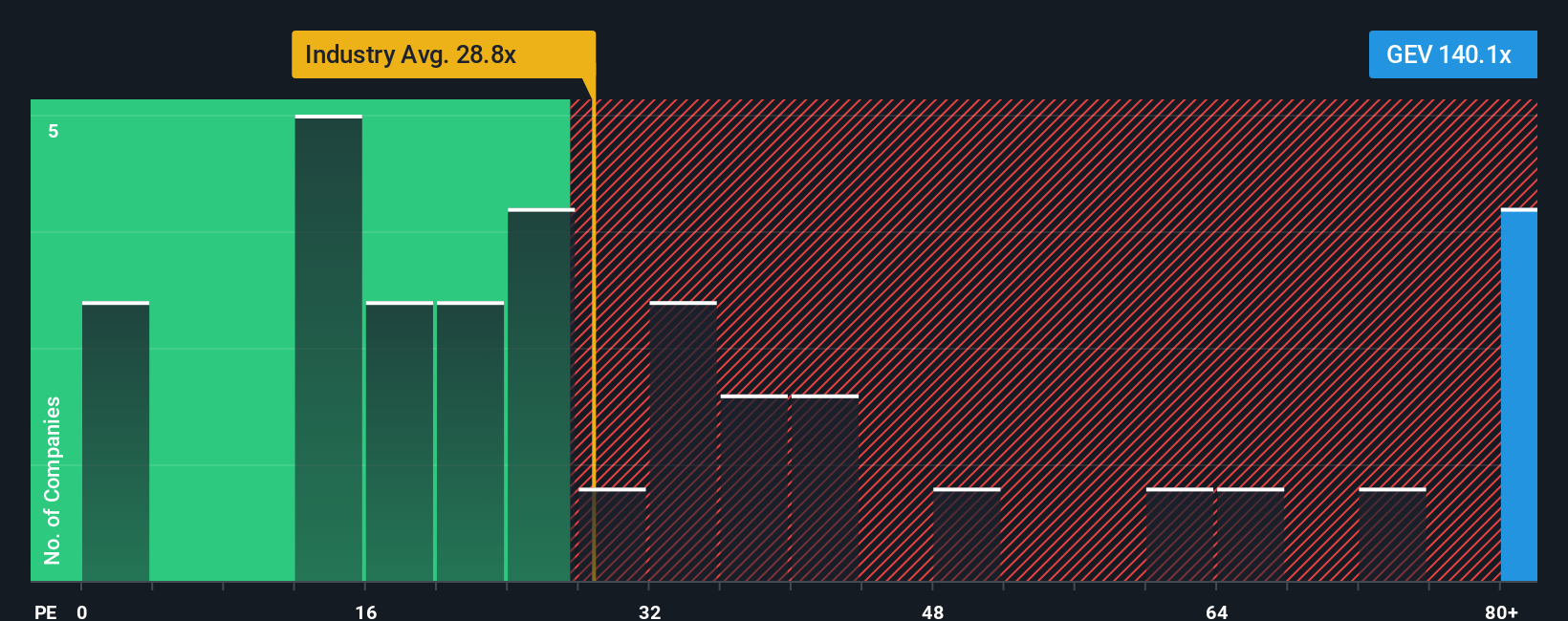

GE Vernova currently trades at a lofty 142.1x PE ratio. To put that in context, the average among peers is 41.5x, and the broader Electrical industry sits at 28.4x. Even so, headline multiples only tell part of the story. Simply Wall St’s proprietary “Fair Ratio,” which factors in expected earnings growth, margins, risk, market cap, and industry context, provides a more tailored benchmark. For GE Vernova, the Fair Ratio is calculated at 78.5x, meaning that, given its outlook and business profile, this is the multiple the stock should command under normal circumstances.

By comparing the actual PE of 142.1x to the Fair Ratio of 78.5x, it becomes clear that the shares are currently priced well above what would be considered fair on a fundamentals-adjusted basis. This suggests GE Vernova is trading at a significant premium relative to what its growth and risk profile would warrant.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your GE Vernova Narrative

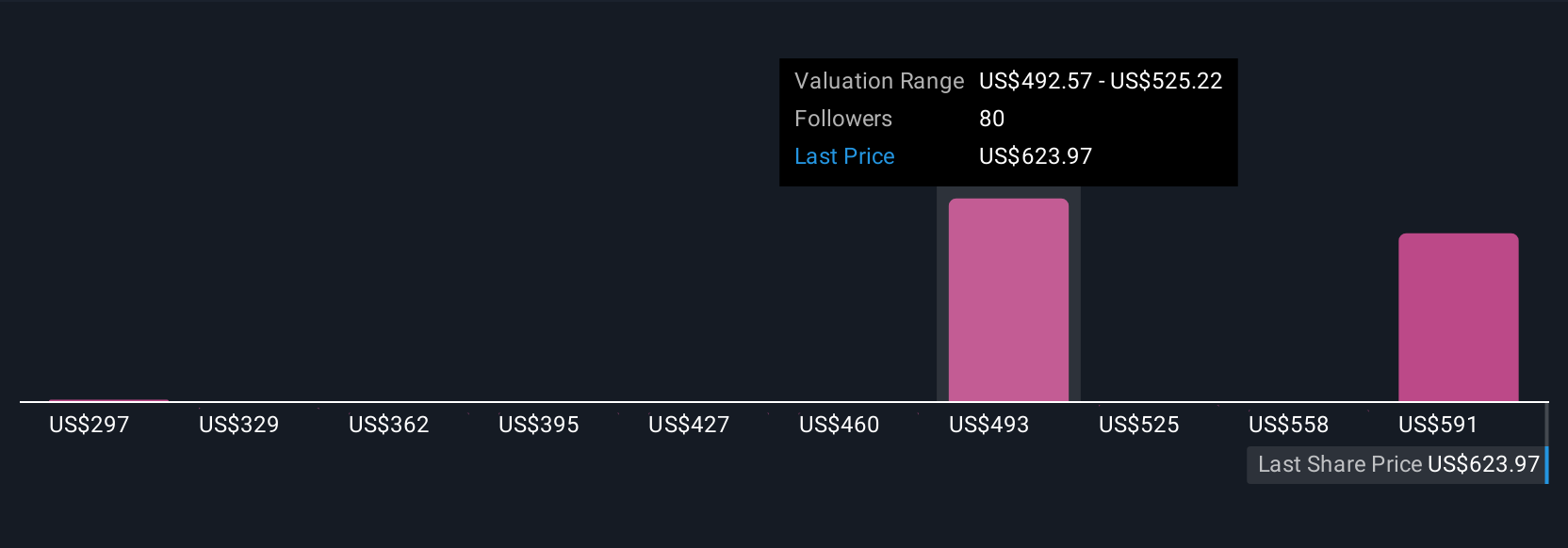

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is simply your story about a company, bringing together your perspective on what drives its future, such as revenue growth, profit margins, and market shifts. Then you can translate those beliefs into a financial forecast and fair value.

Narratives let you connect the dots from a company’s real-world story to a numbers-based estimate, making it easy for anyone to create their own view and instantly compare it to the market price. This tool is available to everyone on Simply Wall St’s platform through the Community page, and it is used by millions of investors worldwide.

With Narratives, you can decide when to buy or sell GE Vernova by checking how your fair value stacks up against today’s price. Your outlook responds automatically as new news or results emerge. For example, some investors are highly optimistic, projecting future earnings that could justify a fair value as high as $760.0 per share. Others are more cautious, estimating a fair value closer to $280.0 based on slower revenue and margin progress.

Do you think there's more to the story for GE Vernova? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GEV

GE Vernova

An energy company, engages in the provision of various products and services that generate, transfer, orchestrate, convert, and store electricity in the United States, Europe, Asia, the Americas, the Middle East, and Africa.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives