- United States

- /

- Electrical

- /

- NYSE:GEV

GE Vernova (NYSE:GEV) Focuses On Texas Energy Project With RWE After 5% Monthly Price Dip

Reviewed by Simply Wall St

GE Vernova (NYSE:GEV) recently experienced a 5% price decline, potentially influenced by market trends and recent collaborations. The decline aligns with broader market challenges, including inflation concerns and weaker consumer sentiment impacting major indexes. During this period, GE Vernova's involvement with RWE in Texas energy projects and its partnership with PyroGenesis reflected a focus on sustainability and emission reduction in the energy sector. These developments indicate GE Vernova's continued commitment to innovative energy solutions, yet market conditions and external economic factors might have played a role in last month's overall stock performance.

Buy, Hold or Sell GE Vernova? View our complete analysis and fair value estimate and you decide.

Rare earth metals are the new gold rush. Find out which 20 stocks are leading the charge.

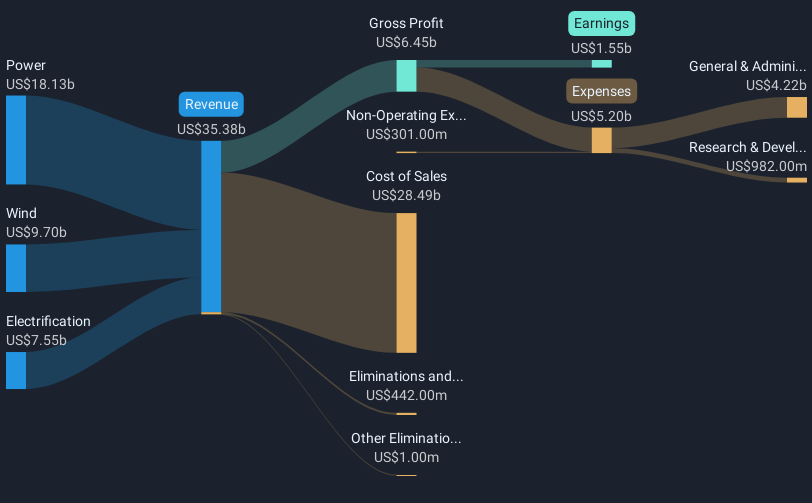

Over the past year, GE Vernova achieved a total shareholder return of 121.74%, significantly surpassing both the US Electrical industry, which saw a 0.5% return, and the broader US market, which returned 7.8%. This impressive performance came amid a series of key developments. The company reported an increase in full-year revenue and net income for 2024, highlighted by a net income of US$1.55 billion compared to a net loss the previous year. Additionally, GE Vernova announced a new cash dividend and completed a share buyback, which likely contributed to investor confidence and overall returns.

Further enhancing its market position, GE Vernova actively engaged in projects aligned with sustainability, demonstrated in its agreement with Tosyali for a solar power project and a collaboration with Technip Energies on the Net Zero Teesside Power project. Following its spin-off from General Electric, GE Vernova began trading on major indexes, potentially increasing its visibility and attractiveness to investors. These factors collectively played a substantial role in the company's notable stock performance over the past year.

Explore GE Vernova's analyst forecasts in our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GEV

GE Vernova

An energy company, engages in the provision of various products and services that generate, transfer, orchestrate, convert, and store electricity in the United States, Europe, Asia, the Americas, the Middle East, and Africa.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives