- United States

- /

- Electrical

- /

- NYSE:GEV

Assessing GE Vernova’s Valuation as Taiwan Repower Deal Expands Its Asian Renewables Footprint

Reviewed by Simply Wall St

GE Vernova (GEV) and Taiwan Power Company just struck a deal for 25 onshore wind repower upgrade kits, plus five years of services, signaling a clear push to scale GE Vernova's renewables footprint in Asia.

See our latest analysis for GE Vernova.

The deal lands while GE Vernova's share price has climbed to $601.97, with a strong year to date share price return hinting that investors see building momentum behind its renewables and broader energy transition story rather than fading enthusiasm.

If this Taiwan expansion has you thinking more broadly about the energy and infrastructure theme, it could be worth exploring other aerospace and defense stocks that are shaping the next decade of industrial growth.

With the stock already up more than 75 percent year to date and trading only modestly below analyst targets, is GE Vernova still mispriced as its renewables pipeline builds, or is the market already discounting years of growth?

Most Popular Narrative Narrative: 11.7% Undervalued

With the narrative fair value sitting meaningfully above GE Vernova's last close, the Taiwan deal becomes one proof point in a much bigger growth math.

Strong momentum in power generation and grid infrastructure orders, driven by rising demand for electrification and global decarbonization initiatives, is expanding GE Vernova's backlog at higher margins; this supports sustained revenue growth and future earnings visibility.

Want to see the playbook behind that optimism? Revenue compounding, margin expansion, and a bold earnings step change all come together in this valuation story. Curious how?

Result: Fair Value of $681.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, uneven European demand and ongoing wind segment losses could quickly challenge today’s optimism if projects are delayed or tariffs have a greater impact than expected.

Find out about the key risks to this GE Vernova narrative.

Another Lens on Valuation

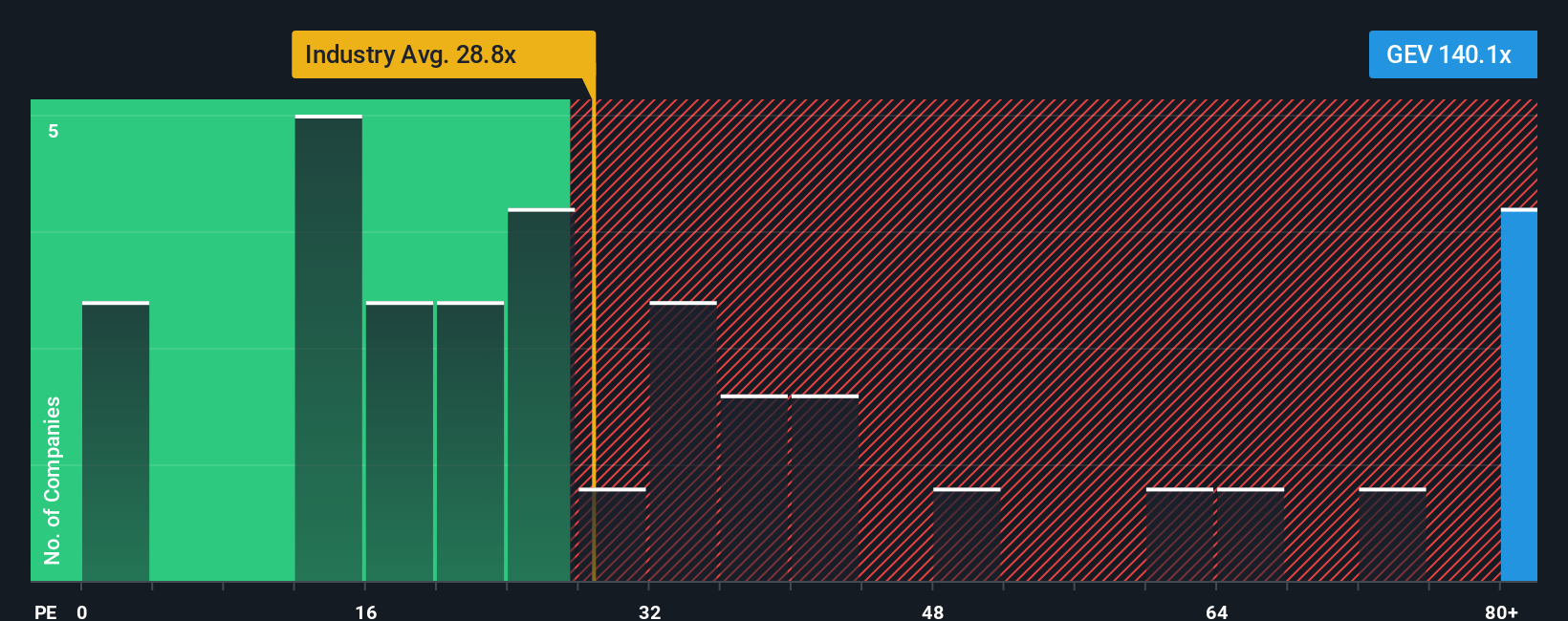

Those optimistic fair value estimates sit awkwardly beside current pricing. On earnings, GE Vernova trades at about 95.8 times, well above its 74.2 times fair ratio, the 30.9 times industry average, and 38.1 times peer average, which leans more toward overvaluation than hidden bargain. What if sentiment cools faster than earnings catch up?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own GE Vernova Narrative

If you are not fully convinced by this view or simply want to dive into the numbers yourself, you can build a complete narrative in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding GE Vernova.

Ready for your next investing move?

Before markets shift again, use Simply Wall Street to scan targeted stock ideas that match your style, risk appetite, and return expectations.

- Look for potential multi-baggers early by scanning these 3571 penny stocks with strong financials with resilient balance sheets and real, measurable business traction.

- Position your portfolio for the next productivity wave by targeting these 30 healthcare AI stocks involved in diagnostics, treatment pathways, and hospital efficiency.

- Explore quality income streams as rates move by focusing on these 14 dividend stocks with yields > 3% with reliable, above-market yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GEV

GE Vernova

An energy company, engages in the provision of various products and services that generate, transfer, orchestrate, convert, and store electricity in the United States, Europe, Asia, the Americas, the Middle East, and Africa.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026