- United States

- /

- Aerospace & Defense

- /

- NYSE:GE

How the Pentagon’s Missile Push Impacts General Electric’s Soaring Shares in 2025

Reviewed by Bailey Pemberton

Thinking about what to do with General Electric stock after such a run-up? You are not alone. The company is on a remarkable streak, and just holding the stock over the past few years would have made you look like a market genius. Year to date, GE shares have soared 78.0%, pulling off an eye-popping 592.4% gain in the last three years and 739.8% over five years. Even the last month shows some momentum, rising 6.5%, although last week saw a modest dip of -0.6%. This isn't just noise; there is real action and some compelling news behind the movement.

GE Aerospace has been in the headlines lately, with a major labor agreement ending a recent strike and fresh demand coming from overseas as India reportedly lines up a $1B order for fighter jet engines. In addition, the Pentagon is asking suppliers like GE to ramp up missile production, signaling confidence in ongoing defense contracts. Updates like these often give investors a sense that the future could be both profitable and uncertain, making it no surprise if higher growth (and sometimes risk perception) is getting priced in.

Now, if you are curious about whether GE stock is a bargain today, here is a surprising stat: out of six standard valuation checks, General Electric is undervalued in exactly zero. That represents a value score of 0, suggesting that based on conventional metrics, GE does not look cheap.

But are those the only ways to look at valuation? Next, let’s dig into the typical approaches investors use to value GE, and then I will share one way I think gets you even closer to the truth about what this company is really worth.

General Electric scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: General Electric Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and then discounting those amounts back to today’s dollars. This method aims to determine what General Electric is worth now, based on how much cash it is expected to generate in years to come.

For General Electric, the latest trailing twelve-month free cash flow sits at about $5.55 billion. Analysts forecast that this figure will grow steadily, with projections reaching $10.10 billion by the end of 2029. After five years, analyst-driven forecasts typically stop, so future numbers through 2035 are extrapolated using expected growth rates. These long-range projections help capture the company’s growth trajectory in the aerospace and defense market.

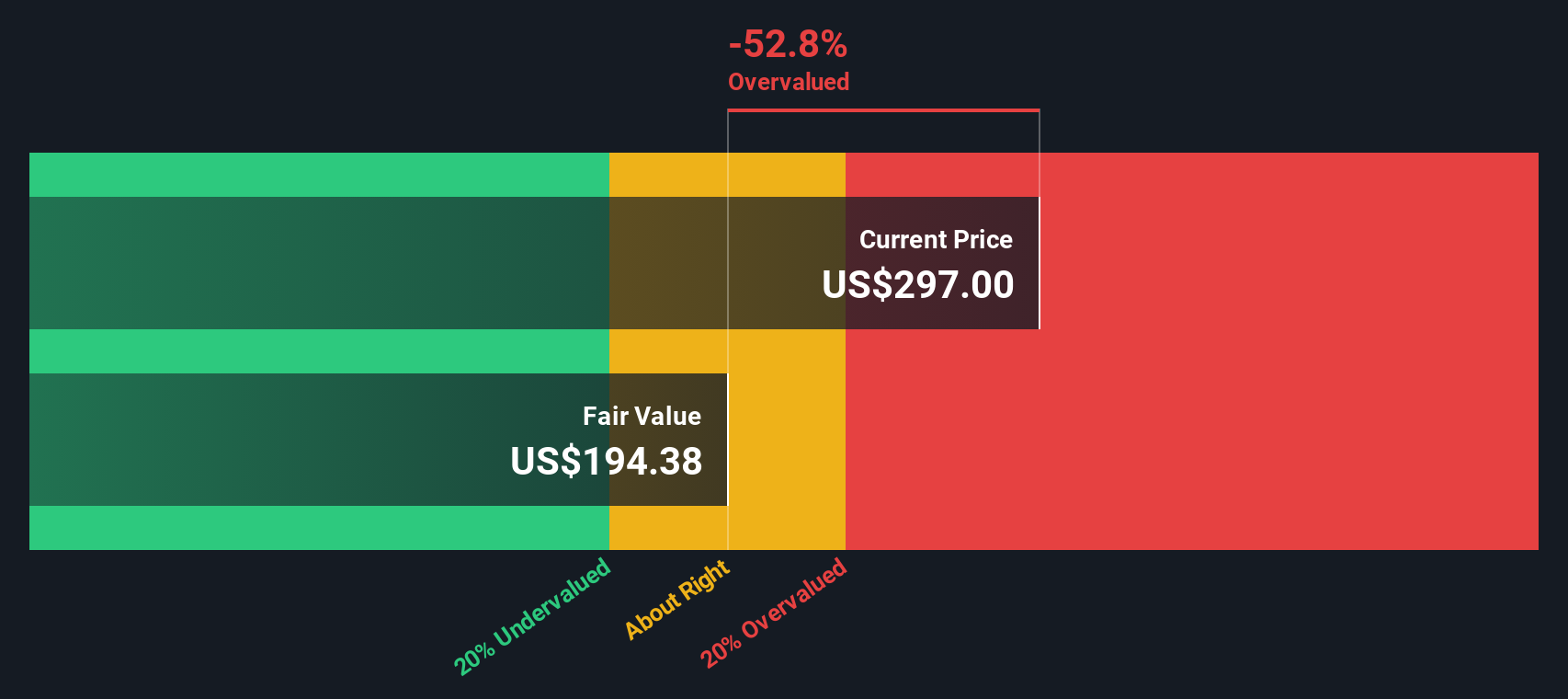

Using this approach, the DCF model estimates General Electric’s intrinsic value at $190.50 per share. However, when you compare this figure with the current share price, the model suggests the stock trades at a 57.5% premium to its fair value. In other words, the shares are significantly overvalued by the DCF’s math.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests General Electric may be overvalued by 57.5%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: General Electric Price vs Earnings

For companies that are consistently profitable, the Price-to-Earnings (PE) ratio is a widely accepted and intuitive valuation tool. It quickly tells you how much investors are paying for each dollar of earnings. Higher ratios can reflect future growth expectations or, on the flip side, increased risk or hype. A “normal” or “fair” PE ratio really depends on several factors, including how fast the company is growing and the level of uncertainty in its industry.

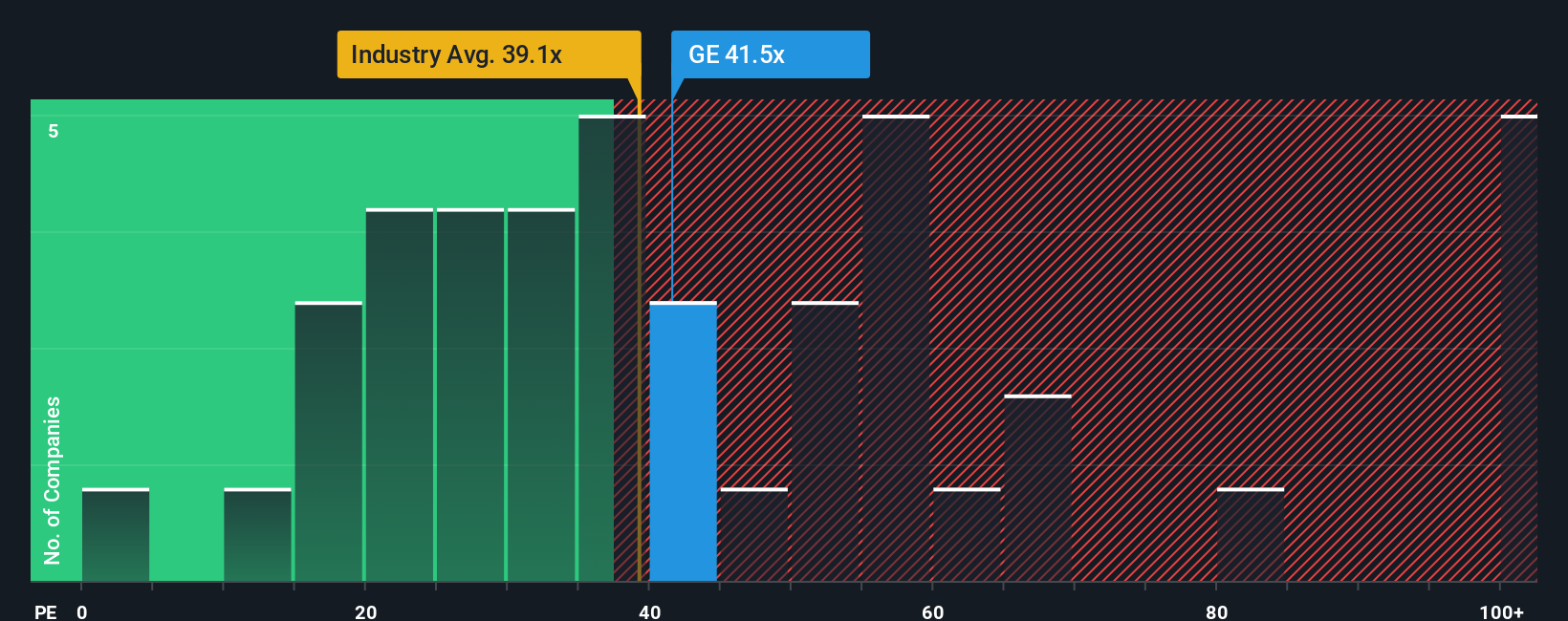

Currently, General Electric is trading at a PE ratio of 42x. That is higher than both the average for similar peers (27x) and the Aerospace and Defense sector average (40x). While a higher PE can sometimes be justified by stronger growth prospects or superior profitability, it can also signal that optimism about GE’s future is already baked into the price.

This is where the Simply Wall St Fair Ratio steps in. This proprietary metric calculates what a fair PE would look like for GE, taking into account not just how fast earnings are expected to grow, but also the company’s profit margins, market capitalization, industry trends, and the potential risks it faces. Unlike a straightforward peer or industry comparison, it delivers a more tailored valuation benchmark for today’s conditions. For GE, this fair ratio is 35.3x. Since the actual PE of 42x is noticeably higher than this fair ratio, GE stock currently looks overvalued when judged on price to earnings multiples.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your General Electric Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. Instead of relying solely on formulas and static metrics, a Narrative lets you tell the story behind the numbers with your perspective on a company's future, using your own fair value estimate and assumptions for things like future revenue, earnings, and margins.

A Narrative connects the dots between a company’s business outlook and a financial forecast, and then shows how it leads to a fair value today. On Simply Wall St’s Community page, Narratives are available to millions of investors as a straightforward, interactive tool. This makes it easy to map out your thinking and see how it stacks up against the current share price.

Narratives are updated dynamically as news and earnings come in, helping you make better buy or sell decisions as situations evolve. For General Electric, for example, some investors believe next-gen engine programs and global demand will drive the stock up toward $343 per share, while others see commercial aviation risks limiting gains to around $266. Building and sharing your Narrative helps you see exactly which assumptions move the needle and where you might agree or disagree with the market.

Do you think there's more to the story for General Electric? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GE

General Electric

General Electric Company, doing business as GE Aerospace, designs and produces commercial and defense aircraft engines, integrated engine components, electric power, and mechanical aircraft systems.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives