- United States

- /

- Aerospace & Defense

- /

- NYSE:GD

Why General Dynamics (GD) Is Up 5.1% After Winning $1.25 Billion U.S. Army IT Contract

Reviewed by Sasha Jovanovic

- General Dynamics' information technology unit was recently awarded a US$1.25 billion task order to deliver enterprise IT, communications, and cybersecurity services to support the U.S. Army's operations across Europe and Africa, including a five-month base period and seven option years.

- This contract reflects General Dynamics' growing presence in defense digital infrastructure and highlights the increasing importance of advanced technology in modern military readiness.

- We'll now assess how this major U.S. Army IT award could alter General Dynamics' investment narrative and growth profile.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

General Dynamics Investment Narrative Recap

For shareholders, the core story behind General Dynamics is a belief in steady multi-year defense spending and recurring contract wins. The recent US$1.25 billion U.S. Army IT task order supports the bullish short-term catalyst of rising digital infrastructure demand, but the key risk, potential award delays or unpredictability in the Technologies segment, remains mostly unchanged by this news. This contract adds visibility, though the overall risk of revenue timing in the segment is still relevant for near-term performance.

Among recent announcements, the US$642 million contract modification for Virginia-class submarine production directly highlights General Dynamics’ resilience in securing large-scale, multi-year defense work, tying into the long-term sales growth catalyst from a record backlog and ongoing U.S. Navy program funding. The consistency of these defense wins reinforces current expectations for future revenue streams, while also underscoring how key contract timing can influence reported results in sensitive segments.

On the other hand, what investors should watch closely is the risk that even with a robust backlog and new tech-driven awards, the company still faces...

Read the full narrative on General Dynamics (it's free!)

General Dynamics is projected to reach $55.8 billion in revenue and $5.1 billion in earnings by 2028. This outlook is based on an expected 3.6% annual revenue growth rate and a $1.0 billion increase in earnings from the current $4.1 billion level.

Uncover how General Dynamics' forecasts yield a $337.94 fair value, in line with its current price.

Exploring Other Perspectives

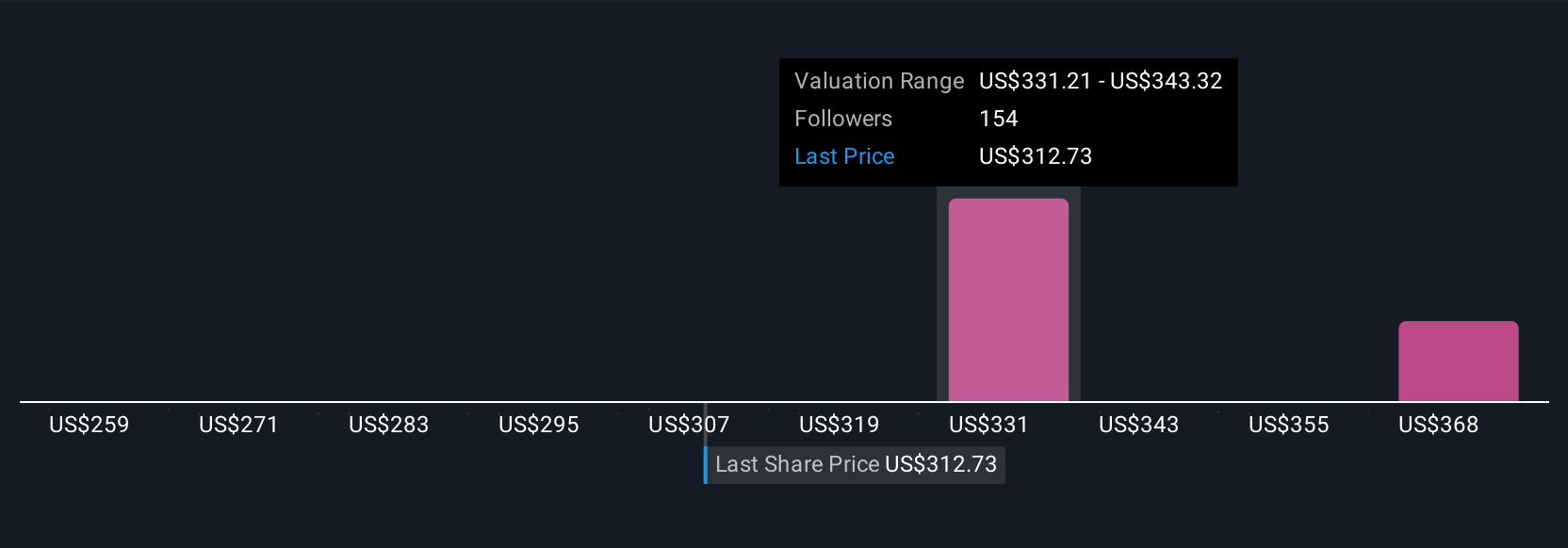

Eight Simply Wall St Community members provided fair value estimates ranging from US$260 to US$378.90 per share. Even as opinions vary, the unpredictability of Technologies segment contract awards can shape near-term performance, making it important to weigh multiple viewpoints before making decisions.

Explore 8 other fair value estimates on General Dynamics - why the stock might be worth as much as 11% more than the current price!

Build Your Own General Dynamics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your General Dynamics research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free General Dynamics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate General Dynamics' overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 32 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GD

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives