- United States

- /

- Aerospace & Defense

- /

- NYSE:GD

General Dynamics (GD): Valuation Insights Following Major U.S. Army Contract and Submarine Partnerships

Reviewed by Kshitija Bhandaru

General Dynamics, a leading U.S. defense contractor, has been in the spotlight after landing a $1.25 billion contract to modernize IT and communications for the U.S. Army in Europe and Africa. Recent strategic partnerships in submarine production are also attracting market attention.

See our latest analysis for General Dynamics.

General Dynamics’ string of high-profile defense contracts and the rollout of its new Gulfstream jet have sharpened investor focus, with momentum building as positive earnings revisions come in and operational confidence grows. While the latest share price sits at $343.62, it is the company’s 1-year total shareholder return of 0.17% and impressive 3-year return of 0.63% that really highlight the steady advance, underscoring both short-term stability and long-term value.

If defense innovation is on your radar, now is the perfect moment to explore opportunities across the sector. See the full list for free with our aerospace and defense screener: See the full list for free.

With new contracts, analyst upgrades, and steady returns, the question for investors now is whether General Dynamics is trading at a bargain or if the market has already priced in the company’s future growth potential.

Most Popular Narrative: Fairly Valued

At $343.62, General Dynamics is trading just above what the most popular narrative suggests is fair value. This close gap puts the spotlight on the underlying growth drivers and sector dynamics powering the forecast.

Robust multi-year order intake and record backlog, driven largely by increased global defense spending and rising geopolitical instability, provide strong visibility into future revenue growth across key segments, especially Marine and Aerospace. Accelerating investment in secure communications, IT modernization, and cyber defense solutions is fueling growth in the Mission Systems and GDIT divisions. This aligns with increased government and enterprise focus on digital transformation and cyber resilience, which should support margin and earnings expansion as these mix shifts take hold.

Curious what projections underpin this conclusion? The forecast calls for solid growth in both revenue and profit margins. It also anticipates a powerful earnings surge in the next few years. Which financial moves will power this price and what could shake things up? Only the full narrative reveals the details.

Result: Fair Value of $337.94 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent supply chain disruptions and shifting technology demands could still unsettle the outlook. These factors may challenge growth and put pressure on future margins.

Find out about the key risks to this General Dynamics narrative.

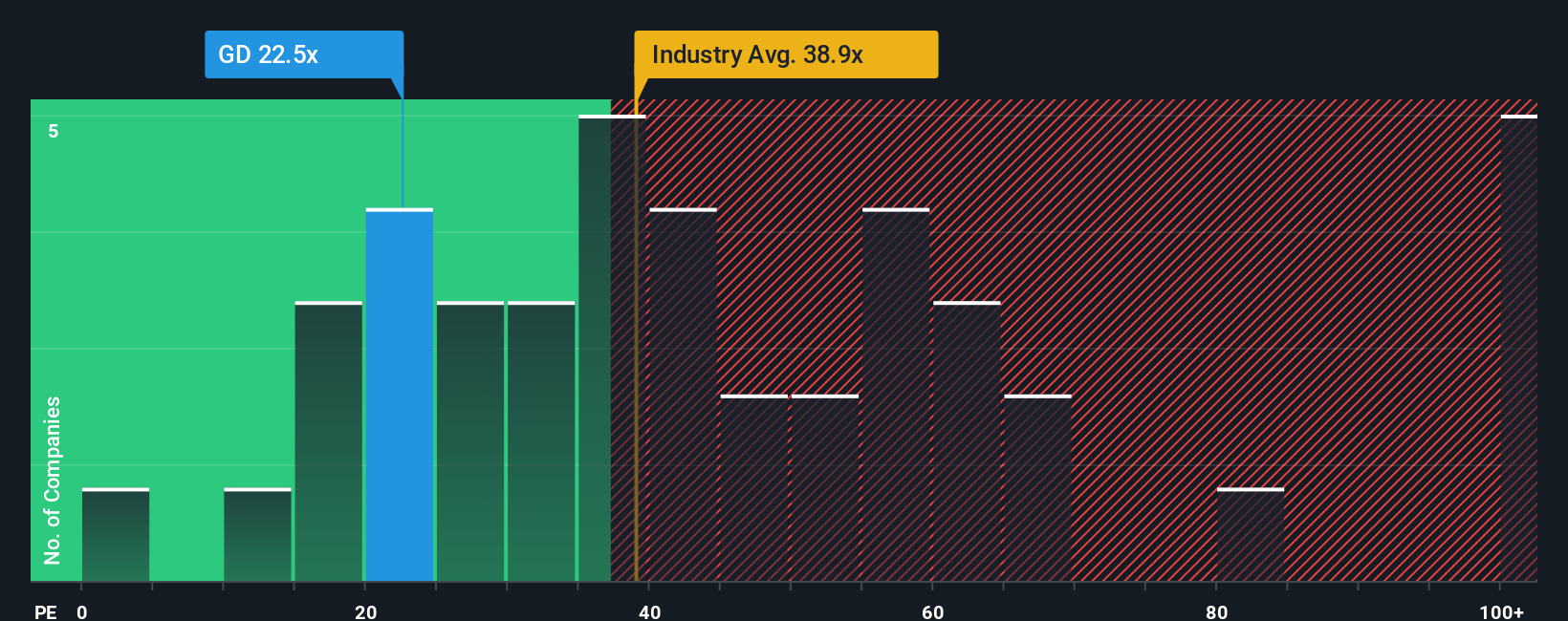

Another View: Market Valuation Ratios

While fair value estimates suggest General Dynamics is about fairly priced, its price-to-earnings ratio of 22.6x stands out as noticeably lower than the US Aerospace and Defense industry average of 39.1x and its peer group at 36.6x. The fair ratio is estimated at 26.1x, which the market could eventually move towards. This gap hints at a potential valuation opportunity or perhaps a sign that the market is cautious about future growth. Will this discount close, or is there something the market sees that broad comparisons miss?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own General Dynamics Narrative

If you see the story differently or prefer hands-on research, you can quickly craft your own analysis in under three minutes. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding General Dynamics.

Looking for More Investment Ideas?

Don’t settle for the obvious plays when fresh opportunities are just a click away. Stay ahead of the curve by acting on unique investment trends right now, before everyone else jumps in.

- Boost your income potential by checking out these 19 dividend stocks with yields > 3% with yields over 3 percent for a steady cash flow edge.

- Find emerging tech leaders today by tapping into these 26 quantum computing stocks, featuring trailblazers in quantum computing who are set to transform tomorrow’s industries.

- Uncover overlooked gems with strong fundamentals by exploring these 3566 penny stocks with strong financials and access fresh ideas beyond the mainstream tickers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GD

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives