- United States

- /

- Trade Distributors

- /

- NYSE:GATX

GATX (GATX) Valuation Breakdown After Revenue Beat and Upgraded Earnings Outlook

Reviewed by Kshitija Bhandaru

GATX (GATX) caught attention after delivering an 11% jump in revenue for the quarter, surpassing expectations. The company also offered a slightly more upbeat full-year earnings outlook, which contributed to a 10% rise in its stock price.

See our latest analysis for GATX.

GATX’s upbeat revenue and earnings outlook comes amid a powerful stretch for shareholders, with total returns climbing 32% over the past year and an impressive 175% over five years. After its latest quarterly update, momentum appears to be building as the market takes a more optimistic view of the company’s growth prospects and resilience.

If you’re looking to widen your investing lens beyond GATX’s latest surge, now is a great time to seek out other fast growers with market-moving insider conviction. Start your search with fast growing stocks with high insider ownership

After such a strong run, the key question is whether GATX remains undervalued in light of its steady growth or if the market has already priced in all of its future potential, leaving little room for upside.

Most Popular Narrative: 7.8% Undervalued

GATX shares last closed at $173.94, while the most followed narrative calculates a fair value of $188.75. That leaves a notable margin and sets the stage for a discussion centered on the strong strategic drivers shaping this price target.

Strategic deployment of new railcars via committed supply agreements and selective international expansion, particularly in India, position GATX to capitalize on long-term growth in commodity flows and diversified revenue streams. This is likely to improve future revenue and operating margins. Robust secondary market demand for both railcars and spare aircraft engines, underpinned by investor appetite for yield and tangible assets, is enabling strong remarketing gains and supplemental income. This, in turn, enhances net earnings.

What is fueling the bullish narrative? A rarely-seen combination of growth levers, shifting end markets, and ambitious profit margin projections. Under the surface, there is a set of bold financial assumptions most investors would never guess. Want the specifics? Click through and see the numbers that drive this valuation.

Result: Fair Value of $188.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, muted lease renewal rates in North America and customer delays in Europe could limit GATX’s near-term revenue growth if these trends persist.

Find out about the key risks to this GATX narrative.

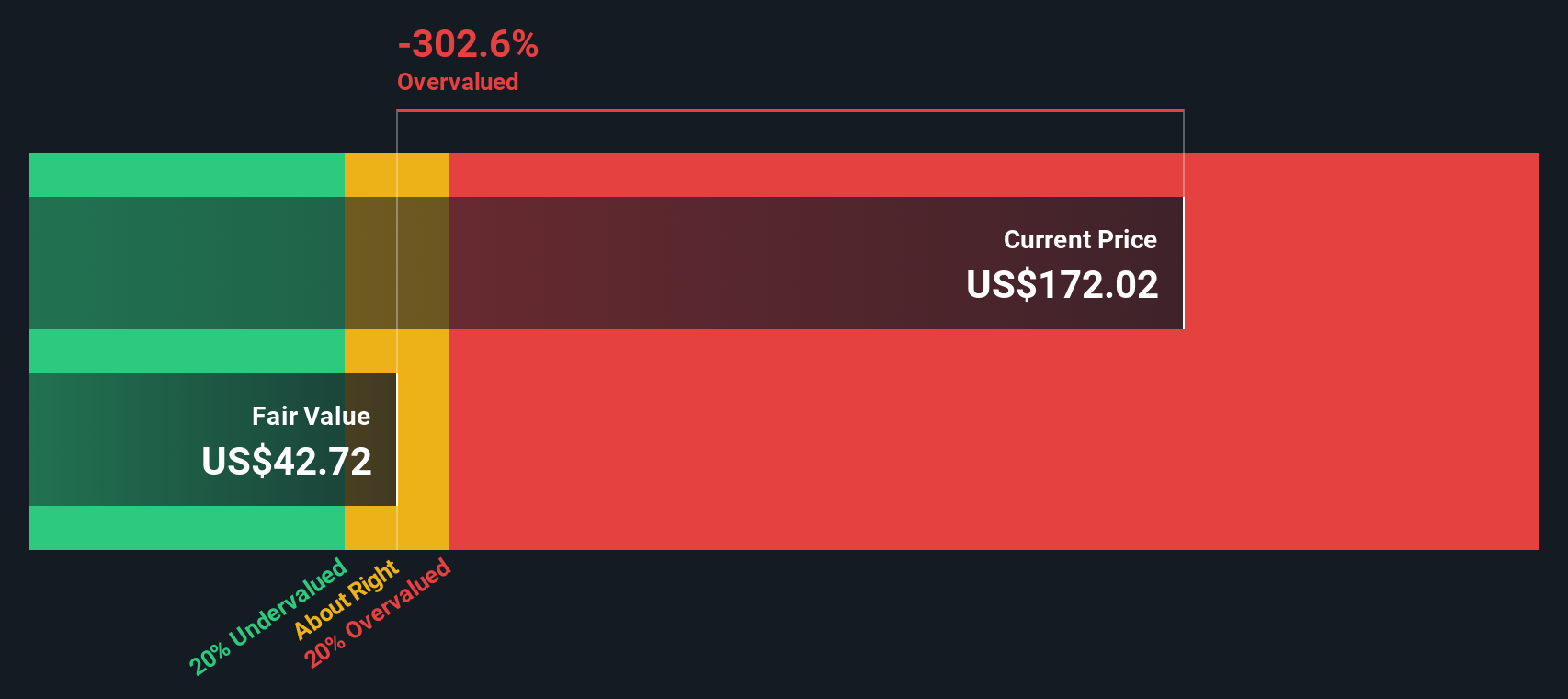

Another View: DCF Model Raises Questions

While analyst consensus views GATX as undervalued, our SWS DCF model tells a very different story. Based on this approach, GATX appears significantly overvalued, with its current price far above the model's fair value estimate. Is the market overlooking risk, or do analysts know something the models do not?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out GATX for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own GATX Narrative

If you see things differently or want to dig into the numbers on your own terms, you can build your own story with just a few clicks, in under three minutes. Do it your way

A great starting point for your GATX research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Winning Opportunities?

Serious investors do not wait for another headline to make their move. The SWS Screener is packed with fresh, high-potential ideas across every trend.

- Capture powerful income streams instantly by reviewing these 18 dividend stocks with yields > 3% offering yields above 3% and solid financial backbones.

- Seize your edge in cutting-edge medicine by checking out these 33 healthcare AI stocks that are driving breakthroughs in healthcare through advanced artificial intelligence solutions.

- Position your portfolio for tomorrow by tapping into these 79 cryptocurrency and blockchain stocks at the forefront of blockchain innovation and digital finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GATX

GATX

Together its subsidiaries, operates as railcar leasing company in the United States, Canada, Mexico, Europe, and India.

Proven track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives